- Japan

- /

- Consumer Durables

- /

- TSE:6809

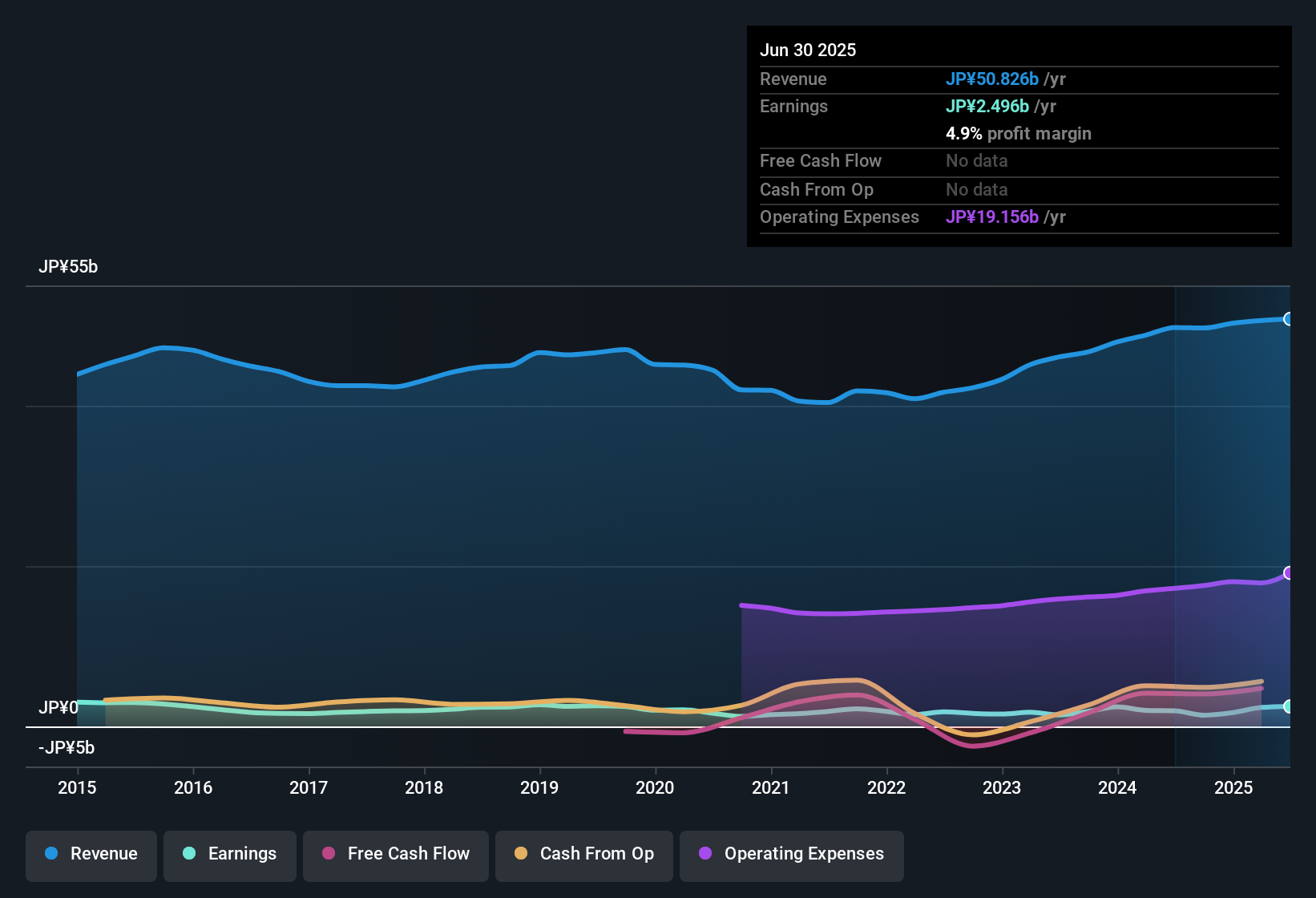

TOA (TSE:6809) Net Profit Margin Jumps to 4.9%, Reinforcing Positive Investor Narratives

Reviewed by Simply Wall St

TOA (TSE:6809) delivered net profit margins of 4.9%, up from 3.9% previously, reflecting improved profitability. EPS growth for the year came in at 28.1%, far surpassing the five-year average annual growth rate of 6.5%. Over a five-year compound basis, earnings climbed at a 6.5% annual rate, pointing to a steady, positive long-term trend. With a current share price of ¥1,613, trading well below the estimated fair value of ¥2,692.99, and a price-to-earnings ratio of 19.4x when compared with peer and industry benchmarks, investors are likely to view these results positively, especially with no material risks identified and several key rewards present.

See our full analysis for TOA.Next, we will see how these headline results compare to the broader market narratives, highlighting where current sentiment matches up and where it might take a sharp turn.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Reach 4.9% Milestone

- Net profit margins climbed to 4.9%, up from 3.9% previously, underscoring stronger operating efficiency and a notable move away from the company’s five-year compound annual earnings growth trend of 6.5%.

- What is surprising is how this margin expansion heavily supports the bullish case. A 1 percentage point margin improvement builds off high-quality earnings and exceeds the steady long-term trajectory, even as many peers experience margin squeeze.

- Bulls emphasize that sustained margin gains provide resilience, especially as no material risks were flagged in the current filings.

- Improvement in core profitability gives investors tangible evidence that recent performance is not just a blip but signals underlying momentum.

Dividend and Value Stand Out

- The stock trades at a price-to-earnings ratio of 19.4x, which is well below the estimated DCF fair value of ¥2,692.99 and at a discount to peer averages of 21.9x. However, it remains higher than the JP Consumer Durables industry at 11.5x, while also gaining recognition for offering an attractive dividend.

- Consensus narrative notes that, with the current share price of ¥1,613 sitting below DCF fair value and no major risks present, the combination of value and income appeals to both growth and income-focused investors.

- Relative to peers, the stock’s valuation offers room for upside, giving extra reassurance to investors considering sector momentum.

- The lack of flagged risks allows the narrative to focus squarely on reward potential, instead of downside scenarios.

Earnings Quality Drives Confidence

- The most recent year’s earnings grew 28.1%, which significantly outpaces the company’s five-year average annual growth of 6.5%. This highlights that current results are not just steady but are robustly accelerating.

- The prevailing market view is that this outsized earnings growth, paired with margin improvement, supports the case for further positive sentiment as the company demonstrates an ability to deliver at a pace beyond historical trends.

- Skeptics may note sector-wide macro headwinds, but both the single-year and long-term growth rates provide concrete signals of earnings quality and trajectory.

- The durability shown across these growth metrics builds confidence that recent performance is not merely temporary, or a function of external factors alone.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TOA's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong recent growth, TOA’s valuation is still higher than its industry average. This raises concerns for investors focused on better value opportunities.

If you want to focus on stocks that offer more compelling valuations with upside potential, see what you can discover with these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6809

TOA

Manufactures and sells broadcasting, communications, and transmission equipment in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives