- Japan

- /

- Consumer Durables

- /

- TSE:6752

A Fresh Look at Panasonic Holdings (TSE:6752) Valuation Following Lowered Earnings Guidance

Reviewed by Simply Wall St

Panasonic Holdings (TSE:6752) lowered its full-year earnings guidance, signaling softer expectations for net sales and profits through March 2026. The new forecast comes as the company adjusts to shifting market dynamics.

See our latest analysis for Panasonic Holdings.

Shares of Panasonic Holdings recently pulled back after the company's revised earnings outlook, with the one-week share price return slipping -4.34%. Still, momentum over the longer haul remains strong, as evidenced by a 28% total shareholder return over the past year and an impressive 85% total return over five years. This suggests that, while short-term sentiment may be cooling on softer guidance, investors who took a longer-term view have been well rewarded.

If this dip in sentiment has you rethinking your watchlist, now could be the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

The latest update leaves investors debating the real value behind Panasonic Holdings, with its price still trading at a meaningful discount to analyst targets. Is the recent pullback a genuine buying opportunity, or could markets already be factoring in what lies ahead?

Most Popular Narrative: 16.6% Undervalued

With Panasonic Holdings trading at ¥1,720.5 compared to the narrative fair value of ¥2,063, there is a significant gap between market sentiment and what the most widely followed analysis sees as justified. This sets the stage for a closer look at what might be powering these expectations.

The company's emphasis on cost optimization through workforce streamlining, portfolio restructuring, and increased production automation is expected to enhance operational efficiency and drive operating margin improvement, supporting stronger long-term earnings.

Curious what is driving such a bold outlook? There is a quantitative blueprint behind this forecast, with factors such as stronger margins, higher recurring profits, and some surprising targets for future earnings. Click through to unpack the catalyst that could reshape Panasonic’s valuation narrative.

Result: Fair Value of ¥2,063 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing policy shifts in the EV sector and execution delays in key restructurings could quickly challenge even the most optimistic forecasts.

Find out about the key risks to this Panasonic Holdings narrative.

Another View: Market Ratios Tell a Mixed Story

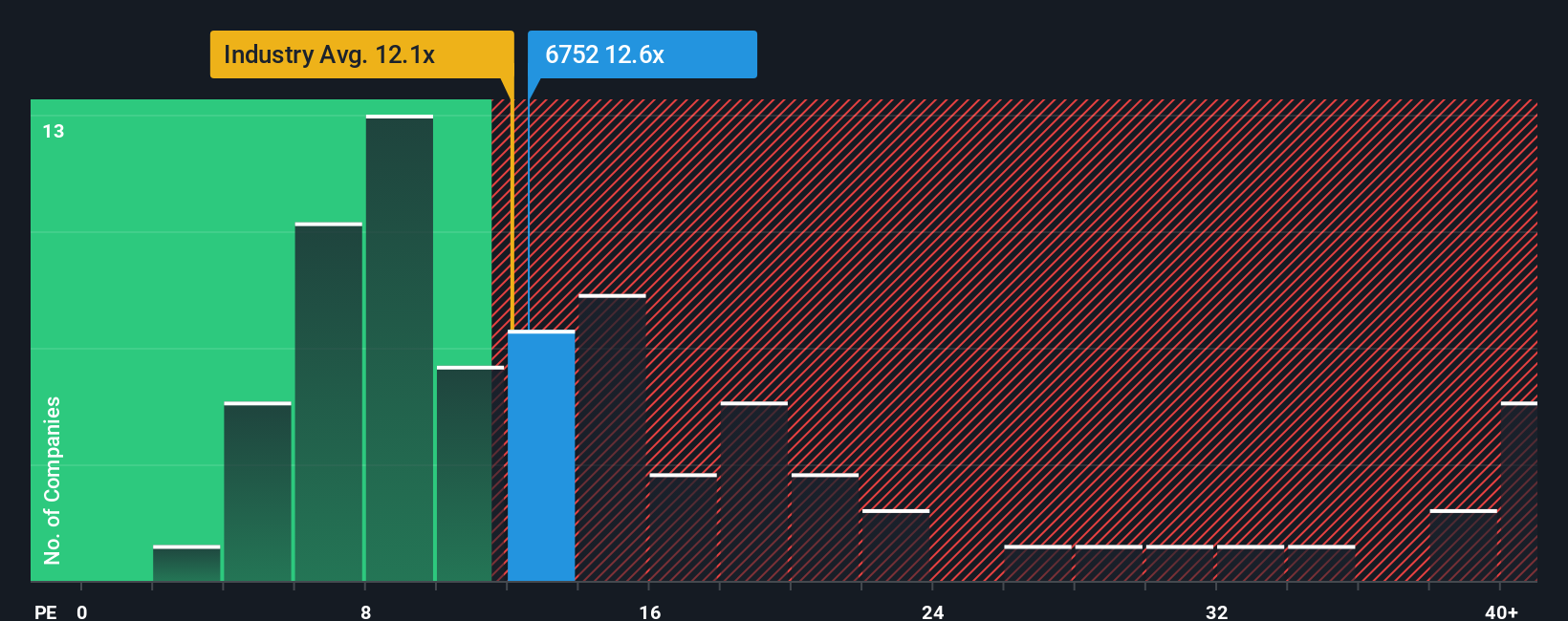

While the fair value estimate shows Panasonic Holdings as undervalued, its price-to-earnings ratio of 12.6 times is slightly higher than the Consumer Durables industry average of 12.5 times. This suggests the market is already pricing in optimism. However, compared to the average of similar peers at 36.9 times, it appears modest and it trades well below the fair ratio of 27.8 times, which the market could move toward if sentiment shifts. Is this a sign of untapped upside, or could the premium to the sector limit near-term gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Panasonic Holdings Narrative

If you see the story playing out differently or want to dig into the numbers and draw your own conclusions, you can craft a narrative in just a few minutes, your way. Do it your way

A great starting point for your Panasonic Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to make your next move? Powerful market shifts can happen quickly, so don't wait to spot trends that could work in your favor. Get ahead of the curve with these curated investment ideas:

- Capture the momentum by targeting high-yield opportunities with these 16 dividend stocks with yields > 3%, which offers consistent payouts above 3%.

- Seize early-stage growth by reviewing these 3590 penny stocks with strong financials, combining robust financials and the potential for outsized returns.

- Find untapped value through these 870 undervalued stocks based on cash flows, poised for gains based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6752

Panasonic Holdings

Research, develops, manufactures, sells, and services various electrical and electronic products in Japan, the United States, Europe, Asia, China, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives