Komatsu Materia (TSE:3580) Margin Miss Raises Questions Over Premium Valuation

Reviewed by Simply Wall St

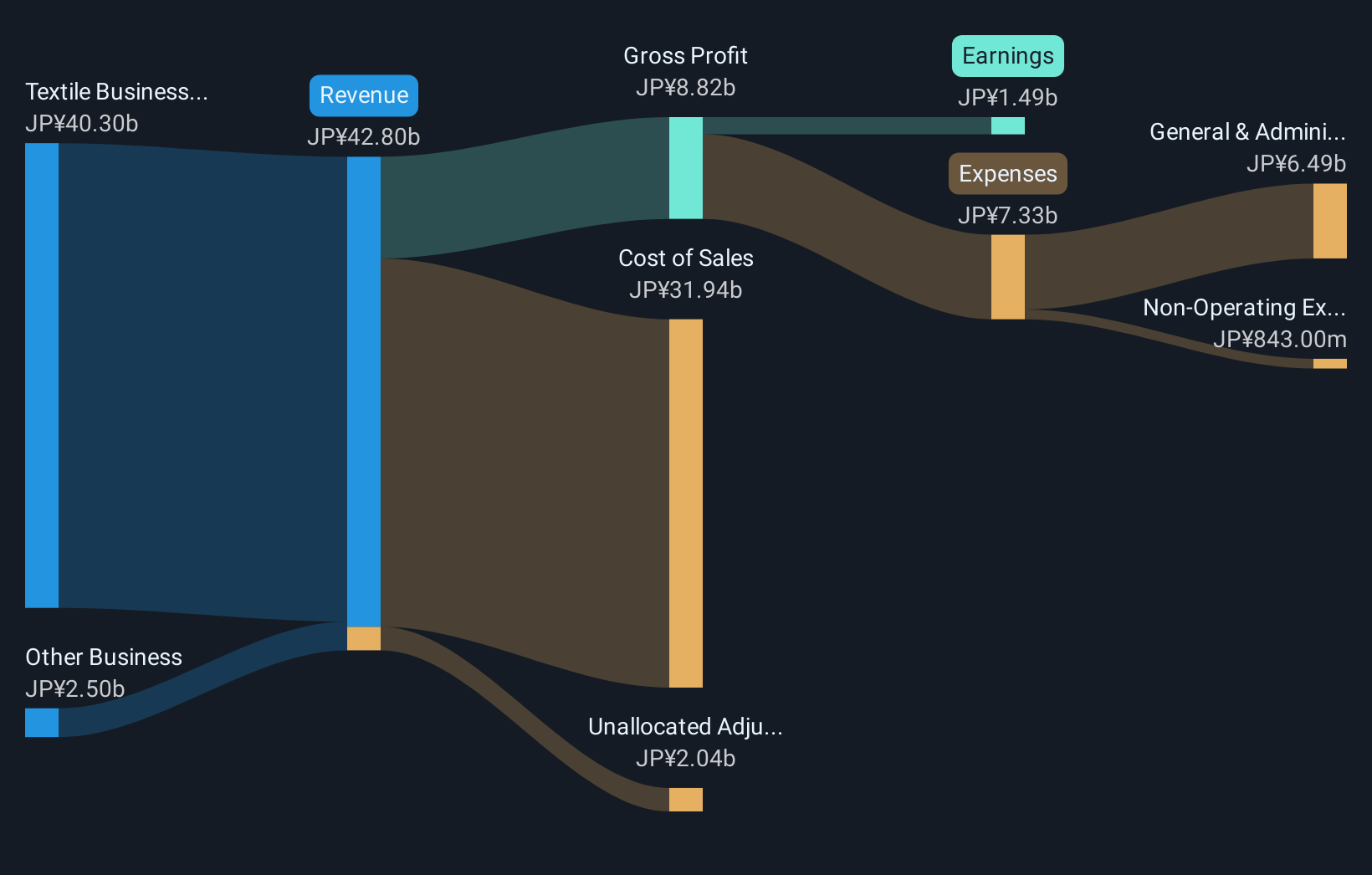

Komatsu Materia (TSE:3580) reported net profit margins of 3.7% over the past twelve months, down from 6.8% a year ago. The results reflected the impact of a notable one-off loss of ¥706.0 million. While the company’s average earnings have grown by 7.9% per year over the past five years, earnings declined in the most recent period, making direct comparisons with previous years less meaningful. Investors now face a mixed picture, as weakened profitability and narrower margins shape expectations heading into the next reporting cycle.

See our full analysis for KOMATSU MATERELtd.Now that we have set out the headline results, let us see how these numbers stack up against the most widely followed narratives and expectations for Komatsu Materia.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Loss Weighs on Margins

- The company recorded a notable one-off loss of ¥706.0 million, which played a key role in pushing net profit margins down to 3.7% from last year's 6.8%.

- What’s notable is that throughout the past five years, average annual earnings growth was a healthy 7.9%. However, the recent drop in profit margins stands in contrast to that longer-term trend.

- This recent setback highlights a tension with the otherwise steady track record of expanding profits.

- The isolated nature of the loss means investors may be weighing whether this disruption signals deeper operational issues or is a one-off blip.

Premium Valuation Versus Peers

- Komatsu Materia’s price-to-earnings ratio is 22.5x, meaning it trades at a clear premium to both the sector average (15x) and industry average (13.3x), even though profitability is currently under pressure.

- Bulls might argue the higher valuation reflects investors' confidence in the company’s ability to return to growth. Yet the margin contraction puts pressure on that premium.

- Despite trading below the DCF fair value estimate of ¥1,322.35, the heightened P/E ratio suggests the market is already baking in a rebound.

- If margins do not recover, the company risks remaining more expensive than its sector without delivering the earnings outperformance that would justify the price.

Dividend Sustainability in Question

- The filing notes uncertainty around the durability of Komatsu Materia’s dividend, especially as profit quality and margin trends have weakened alongside the recent one-off loss.

- What’s surprising is that a strong multi-year earnings record hasn’t translated into clearer stability for dividends going forward.

- With net profit margins falling and no clear signals of a quick recovery, even a solid long-term track record leaves the dividend outlook clouded.

- Investors who look to the company for income will need to closely watch if operational stability returns before relying on future payouts.

To see how the latest findings fit into the wider market outlook and uncover more investor perspectives, dive into the full narrative on the company’s story. See what the community is saying about KOMATSU MATERELtd

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on KOMATSU MATERELtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Komatsu Materia’s shrinking profit margins, premium valuation, and uncertain dividend outlook depict weaker earnings quality and elevated risk for income-focused investors.

If reliable payout potential matters to you, check out these 2007 dividend stocks with yields > 3% to discover companies delivering consistent yields and stronger confidence in future dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KOMATSU MATERELtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3580

KOMATSU MATERELtd

Engages in the planning, development, manufacturing, and sale of synthetic fabrics and thin film fabrics in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives