The Market Lifts Daidoh Limited (TSE:3205) Shares 27% But It Can Do More

Daidoh Limited (TSE:3205) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The annual gain comes to 193% following the latest surge, making investors sit up and take notice.

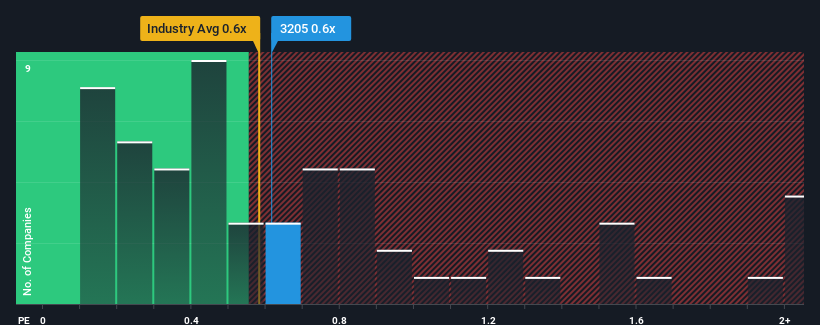

Even after such a large jump in price, it's still not a stretch to say that Daidoh's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Luxury industry in Japan, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Daidoh

How Has Daidoh Performed Recently?

For example, consider that Daidoh's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Daidoh's earnings, revenue and cash flow.How Is Daidoh's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Daidoh's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 66% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

When compared to the industry's one-year growth forecast of 7.2%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Daidoh is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Daidoh's P/S Mean For Investors?

Daidoh's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We didn't quite envision Daidoh's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Daidoh has 4 warning signs (and 3 which are a bit unpleasant) we think you should know about.

If these risks are making you reconsider your opinion on Daidoh, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3205

Daidoh

Manufactures and sells ready-made men's and women’s clothing and accessories in Japan.

Second-rate dividend payer and slightly overvalued.

Market Insights

Community Narratives