Fujibo Holdings (TSE:3104) Margin Surge Reinforces "Safe Haven" Narrative Despite Valuation Debate

Reviewed by Simply Wall St

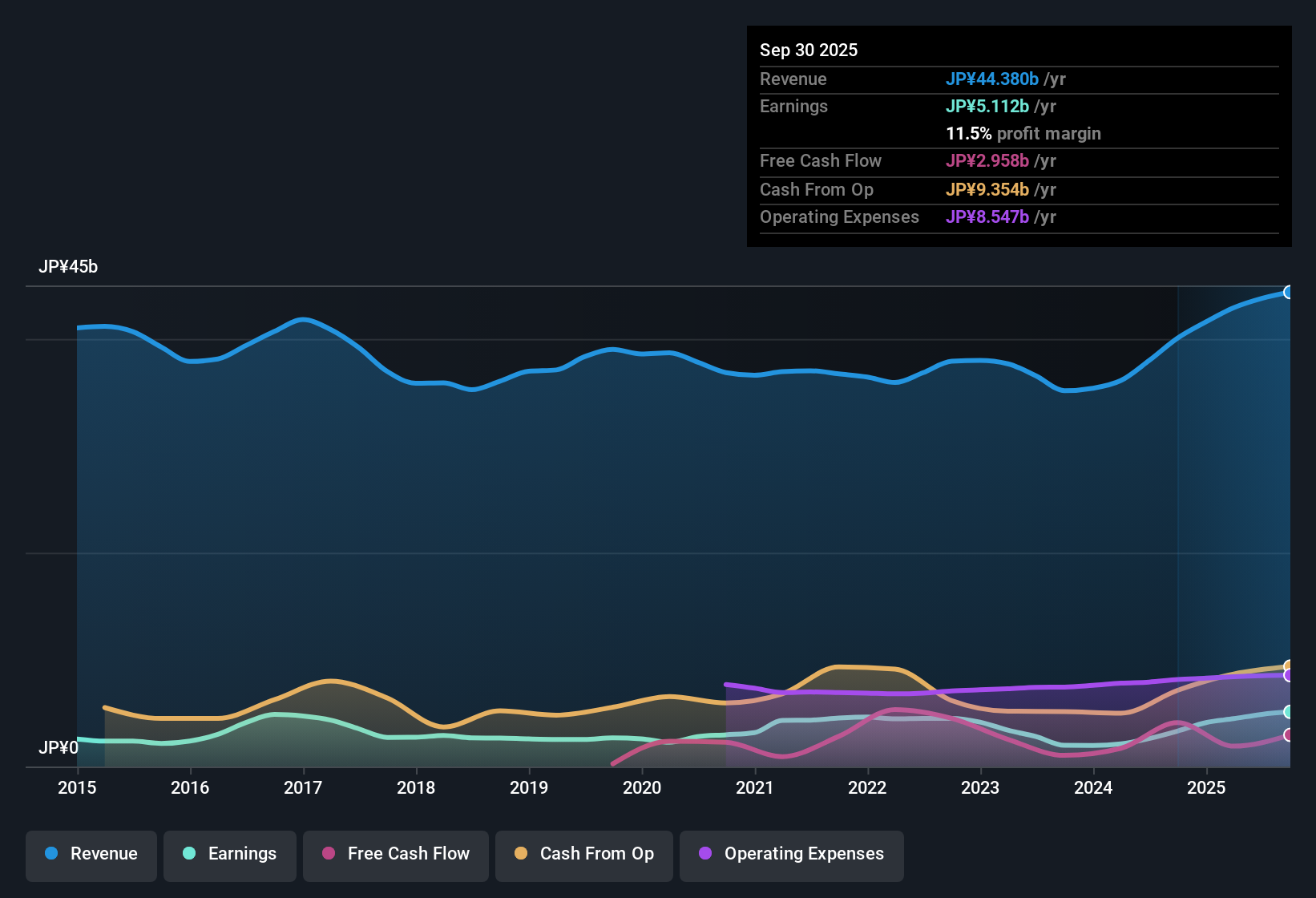

Fujibo Holdings (TSE:3104) reported annual earnings growth of 54.2%, with net profit margins rising to 11.5% from last year’s 8.3%. Revenue is forecast to climb 7.9% per year going forward, which is faster than the Japanese market’s average of 4.5%. Investors will note these figures come alongside solid profit trends and growth expectations for both earnings and revenue that are above the market average.

See our full analysis for Fujibo Holdings.The real test is how these numbers compare to prevailing market narratives, so let’s see which views hold up and which might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Stretch Beyond Their Recent Range

- Net profit margins have reached 11.5%, a jump from last year’s 8.3% and notably above the company's five-year trend, which showed a decrease of 0.6% per year on average.

- One of the most striking takeaways is how the recent margin expansion strongly supports the case for stronger underlying profitability, even as the broader sector often faces flat or contracting margins.

- What is surprising is the durability of the margin gain, which suggests cost discipline and improved operational execution rather than just a one-off boost.

- This supports the prevailing view that stability and moderate gains in fundamental performance reinforce Fujibo's reputation as a "safe haven" within its sector.

Growth Pace Now Outruns the Market

- Fujibo’s 7.9% annual revenue growth outlook outpaces the Japanese market average of 4.5%. Projected earnings growth sits at 11.8% per year, faster than the country’s 7.8% norm.

- The main tension is that, while some investors may look for blockbuster results, the market view notes that consistent above-market growth—even if not extraordinarily rapid—can build confidence that the company is moving in the right direction.

- The consensus narrative points out that incremental improvements and stable trends are viewed as positives in an otherwise low-growth sector.

- This forward momentum might not generate excitement among aggressive growth investors, but it positions the business well for income-focused and defensive strategies.

Valuation Discount Despite Peer Premium

- The latest share price of ¥6,840 trades below the DCF fair value estimate of ¥11,159.84. The current price-to-earnings ratio of 15.1x is slightly above both its peer set (14.4x) and luxury industry average (14.2x).

- What stands out is that, even as valuation multiples have risen above peers, the share still sits at a sizable discount to modeled fair value. This leaves room for both value and quality-driven investors to debate next steps.

- This pricing gap raises questions about whether the market is underestimating recent earnings quality or if caution is driving a premium on sector stability.

- Bears may argue that unless growth or margins continue to expand, the stock could struggle to justify a valuation premium, but the fair value gap remains difficult to ignore for long-term holders.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Fujibo Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust recent earnings and margin expansion, Fujibo’s valuation premium remains tough to justify if profit growth or margins do not continue progressing.

If you prefer stocks where share prices better reflect company fundamentals, discover more potential in these 831 undervalued stocks based on cash flows and sidestep these valuation disconnects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3104

Fujibo Holdings

Manufactures and sells polishing pads, industrial chemical products, and apparel products in Japan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives