- Japan

- /

- Consumer Durables

- /

- TSE:1808

Why HASEKO (TSE:1808) Is Up 5.6% After Raising Profit Forecasts and Boosting Dividends

Reviewed by Sasha Jovanovic

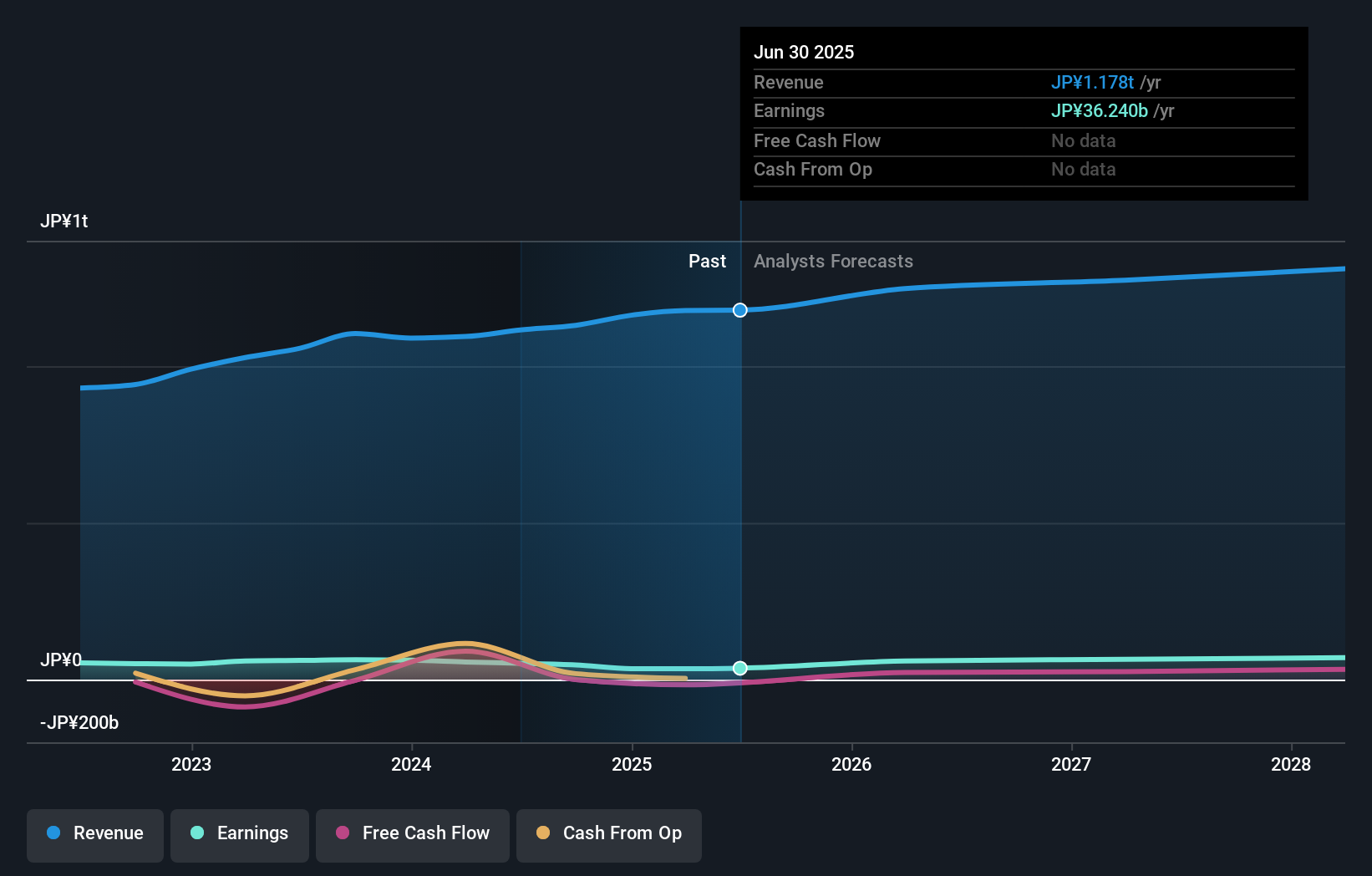

- Earlier this month, HASEKO Corporation raised its full-year consolidated and non-consolidated earnings guidance for the fiscal year ending March 31, 2026, citing stronger-than-expected profitability in condominium construction contracts, and declared a higher interim dividend of ¥45 per share for the second quarter ended September 30, 2025.

- This combination of upwardly revised profit expectations and a boosted dividend highlights management's increased confidence in both near-term performance and shareholder returns.

- We'll explore how the improved earnings outlook shapes HASEKO's investment narrative, with particular focus on the company’s enhanced profitability in construction contracts.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is HASEKO's Investment Narrative?

For anyone considering HASEKO as an investment, the big-picture belief is centered on the company's ability to consistently capitalize on strong condominium construction demand while effectively returning value to shareholders through buybacks and dividends. The recent upward revision in earnings guidance and the completion of a sizeable share repurchase signal new confidence from management and provide near-term catalysts, potentially shifting the focus away from previous concerns about profit volatility and capital efficiency. However, the company still faces ongoing risks, such as a relatively high valuation compared to industry peers, a track record of unstable dividends, and the lack of board independence that could limit strong governance. This combination of improved earnings visibility and capital management could reduce some uncertainty, yet it's important not to lose sight of the business’s exposure to construction cycle swings and execution risks that remain front of mind for many investors.

But with board independence still low, there are governance risks investors should keep in mind. HASEKO's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on HASEKO - why the stock might be worth as much as ¥1020!

Build Your Own HASEKO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HASEKO research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free HASEKO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HASEKO's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HASEKO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1808

HASEKO

Engages in the real estate, construction, and engineering businesses in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives