- Japan

- /

- Electrical

- /

- TSE:6643

3 Japanese Dividend Stocks With At Least 3% Yield

Reviewed by Simply Wall St

Japan’s stock markets have shown modest gains recently, with the Nikkei 225 Index rising 0.8% and the broader TOPIX Index up 0.2%. Amid speculation about interest rate hikes and a stable inflation outlook, investors are increasingly looking for reliable income sources. In this context, dividend stocks offering at least a 3% yield can be particularly attractive as they provide steady income while potentially benefiting from Japan's economic stability.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.02% | ★★★★★★ |

| Globeride (TSE:7990) | 4.13% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.77% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.84% | ★★★★★★ |

| Innotech (TSE:9880) | 4.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.09% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

Click here to see the full list of 455 stocks from our Top Japanese Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Envipro Holdings (TSE:5698)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Envipro Holdings Inc. operates in resource circulation, global trading, and lithium-ion battery recycling businesses both in Japan and internationally, with a market cap of ¥15.01 billion.

Operations: Envipro Holdings Inc.'s revenue segments include ¥34.96 billion from global trading (including used cars), ¥21.25 billion from resource circulation (excluding lithium-ion batteries recycling), and ¥1.57 billion from lithium-ion battery recycling.

Dividend Yield: 3%

Envipro Holdings has a mixed dividend track record, with recent volatility in payments, including a significant drop to ¥6.00 per share for the fiscal year ending June 30, 2024, down from ¥14.00 the previous year. However, dividends are well-covered by earnings (33.6% payout ratio) and cash flows (35% cash payout ratio). The company forecasts net sales of ¥53.50 billion and operating profit of ¥1.50 billion for FY2025, indicating potential stability ahead despite past inconsistencies.

- Take a closer look at Envipro Holdings' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Envipro Holdings is priced higher than what may be justified by its financials.

Togami Electric Mfg (TSE:6643)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Togami Electric Mfg. Co., Ltd. manufactures and sells power distribution and control equipment in Japan, with a market cap of ¥15.75 billion.

Operations: Togami Electric Mfg. Co., Ltd.'s revenue segments include Metal Processing (¥2.98 billion), Plastic Molding Business (¥3.36 billion), and Industrial Power Distribution Equipment (¥22.02 billion).

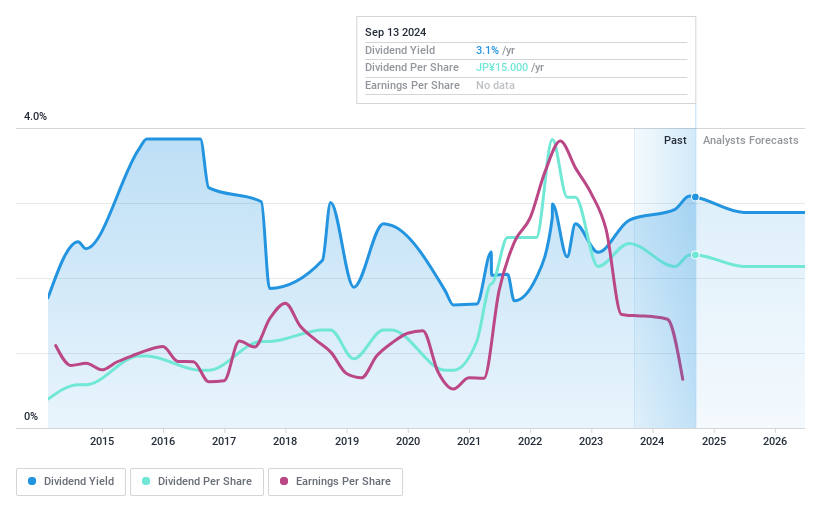

Dividend Yield: 3.1%

Togami Electric Mfg. has a history of volatile dividend payments over the past decade, but recent earnings growth of 45.8% and a low payout ratio of 26.1% suggest dividends are well-covered by earnings. The company’s dividends are also supported by cash flows with a cash payout ratio of 76.7%. Although its dividend yield (3.13%) is below the top quartile in Japan, Togami's share repurchase program aims to enhance shareholder returns and improve capital efficiency.

- Get an in-depth perspective on Togami Electric Mfg's performance by reading our dividend report here.

- The analysis detailed in our Togami Electric Mfg valuation report hints at an deflated share price compared to its estimated value.

Funai Soken Holdings (TSE:9757)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Funai Soken Holdings Incorporated offers consulting services to manufacturing and retail businesses in Japan and has a market cap of approximately ¥107.76 billion.

Operations: Funai Soken Holdings Incorporated generates revenue primarily through its consulting services for the manufacturing and retail sectors in Japan.

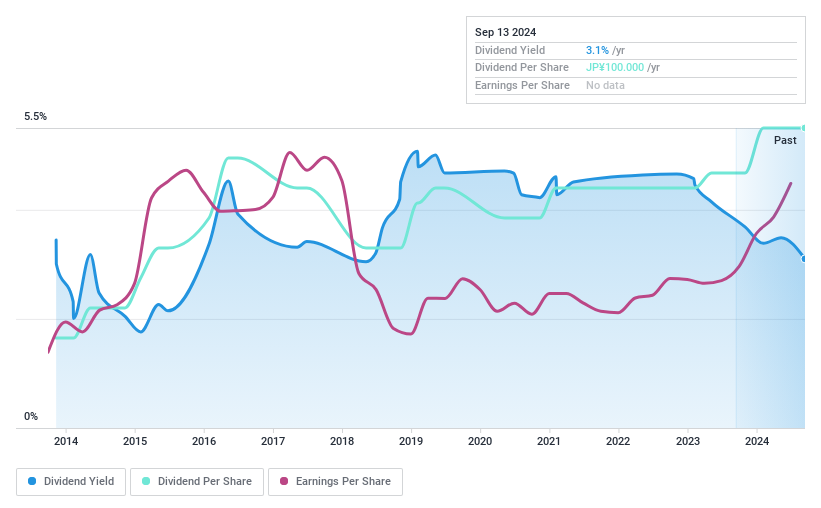

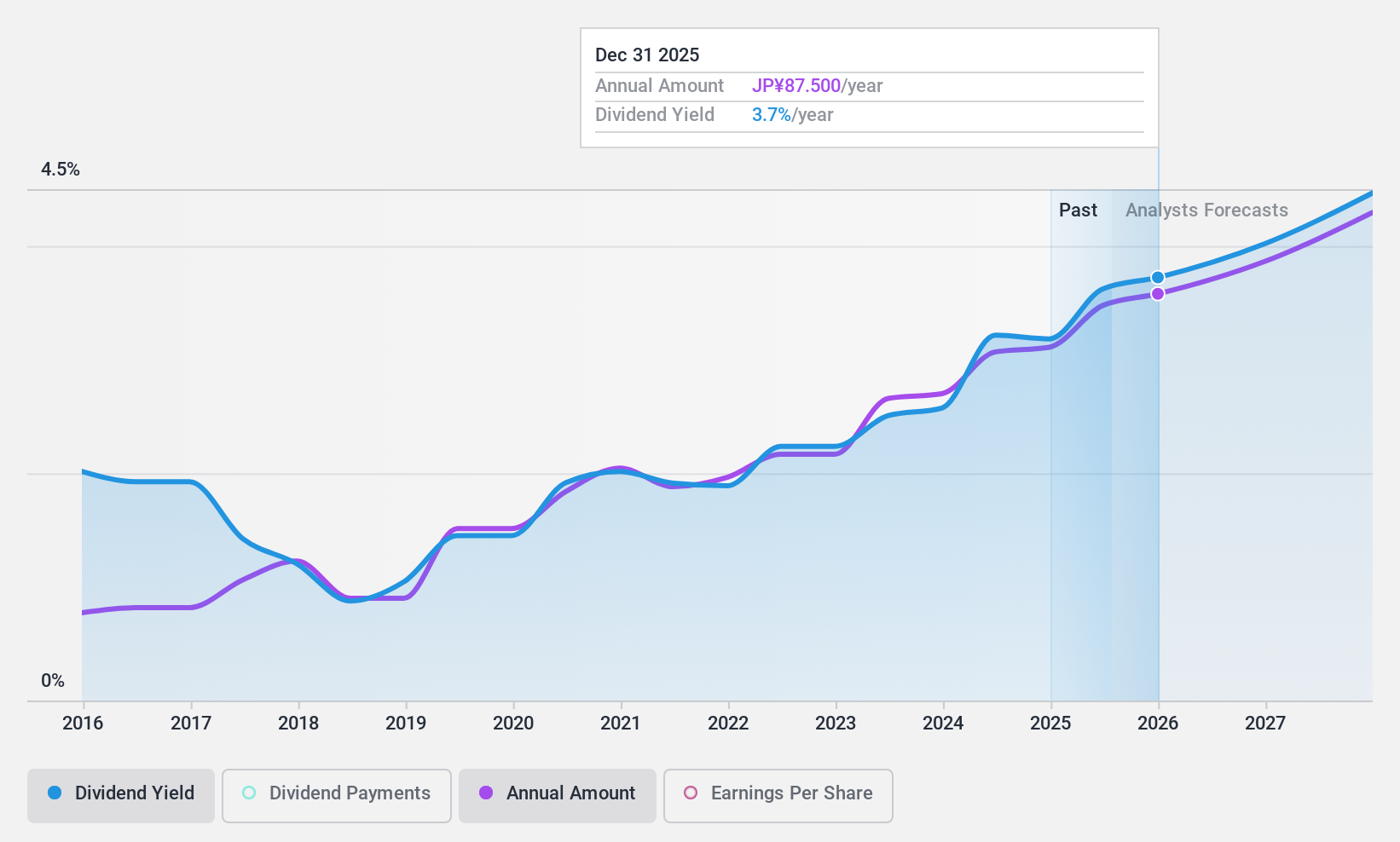

Dividend Yield: 3.3%

Funai Soken Holdings' dividend payments have been volatile over the past decade, but recent earnings growth of 25.9% and a low payout ratio of 26.9% indicate dividends are well-covered by earnings. The company announced a dividend increase to ¥37 per share for Q2 FY2024, payable on August 30, 2024. Despite a relatively low dividend yield (3.3%), ongoing share repurchases aim to enhance shareholder value and capital efficiency.

- Dive into the specifics of Funai Soken Holdings here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Funai Soken Holdings is priced lower than what may be justified by its financials.

Summing It All Up

- Embark on your investment journey to our 455 Top Japanese Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Togami Electric Mfg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6643

Togami Electric Mfg

Engages in manufacturing and sale of power distribution and control equipment in Japan.

Flawless balance sheet with solid track record and pays a dividend.