- Japan

- /

- Commercial Services

- /

- TSE:9307

Sugimura Warehouse (TSE:9307) Undervaluation Challenges Cautious Narrative Despite Flat Growth and Margins

Reviewed by Simply Wall St

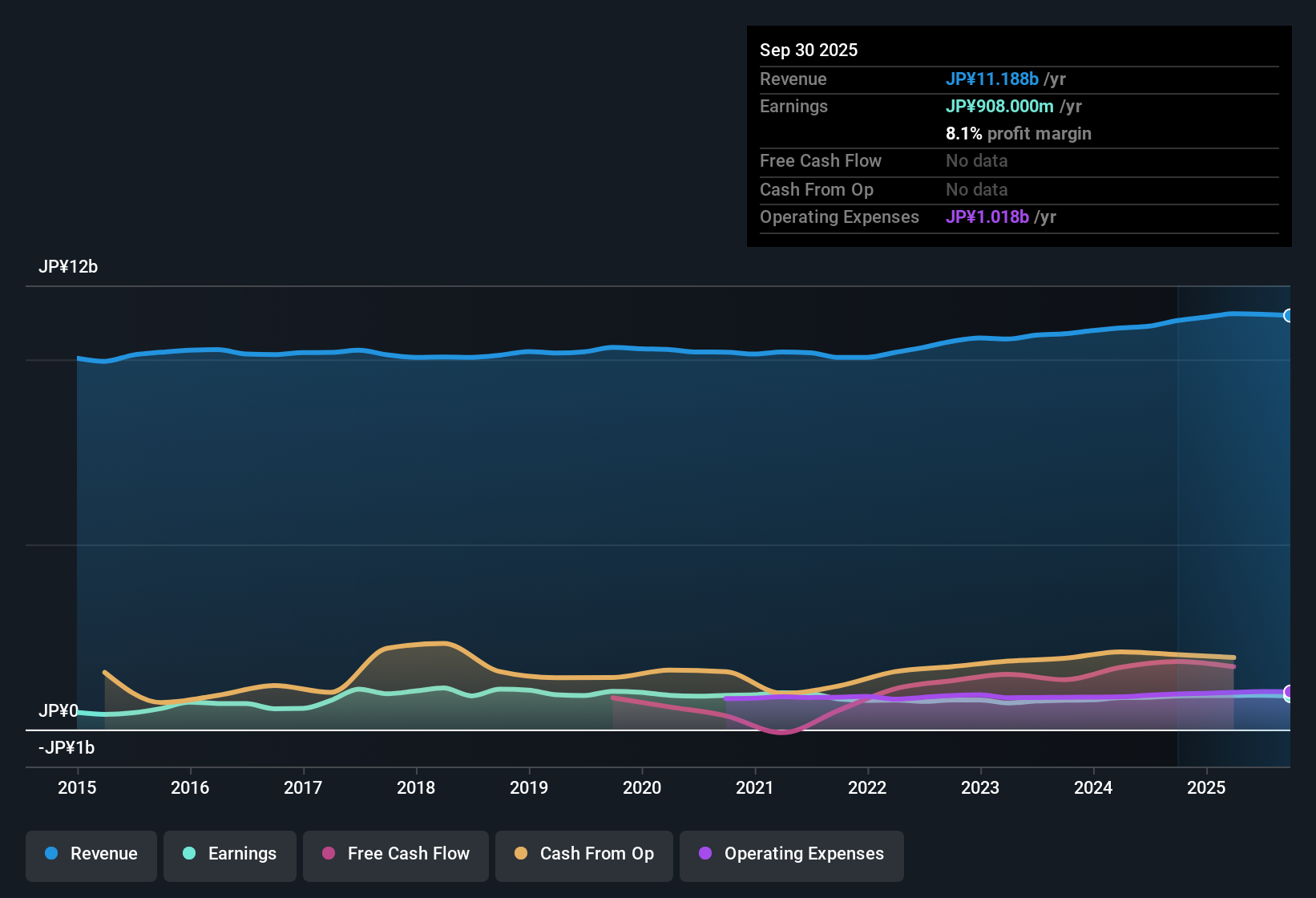

Sugimura Warehouse (TSE:9307) reported net profit margins of 8.1%, just below last year’s 8.2%, with EPS growth of 0.2% over the past year. This result outpaces the company’s five-year average annual earnings change of -0.03%. However, the longer-term trend still points to earnings declining by 0.03% per year on average. Shares currently trade at a Price-To-Earnings Ratio of 17.7x, above both peer and industry averages. At ¥988 per share, the company is priced below an estimated fair value of ¥2,323.10, drawing attention to possible undervaluation for investors.

See our full analysis for Sugimura Warehouse.Next up, we’ll see how these headline numbers compare to the narratives that drive market sentiment, whether they confirm the story or force a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Resilience Despite Sector Pressure

- Net profit margins of 8.1% remained nearly unchanged from last year, signaling that Sugimura Warehouse has been able to withstand sector challenges without significant erosion to profitability.

- While longer-term earnings are down by an average of 0.03% per year, ongoing margin stability supports the thesis that the company's defensive qualities appeal to investors seeking steady cash flow in turbulent markets.

- The prevailing analysis points to Sugimura’s capacity to sustain operations and deliver reliable results, backed by a continued demand for logistics services.

- This steady margin performance, in the absence of headline growth, still positions the company as a “safe harbor” for those prioritizing consistency over aggressive expansion.

Trading Below DCF Fair Value

- Shares are currently priced at ¥988, well below the DCF fair value estimate of ¥2,323.10. The stock’s Price-To-Earnings Ratio of 17.7x remains a premium over peers (10.5x) and the industry (13.1x).

- The considerable gap between market price and intrinsic value highlights tension for investors weighing the appeal of potential undervaluation against the company’s slower earnings momentum.

- This discount suggests investors may perceive risk in the lack of evident earnings growth, despite the quantitative value opportunity on paper.

- Steep undervaluation, coupled with high quality historical earnings, makes the stock intriguing for value-oriented buyers. At the same time, the higher P/E prompts caution relative to sector norms.

Share Price Stability Remains a Concern

- The share price has not demonstrated stability over the last three months, making the stock less attractive to those prioritizing smooth performance and price consistency.

- Cautious analysis spotlights this volatility as a primary risk for investors in defensive sectors, especially since Sugimura Warehouse lacks visible near-term growth drivers to offset these price swings.

- This lack of stability tempers the traditional defensive appeal, reminding investors to weigh the absence of predictable price movements alongside the company's otherwise steady fundamentals.

- Persistent share price instability, even with attractive margins and valuation, may be an important signal for those building portfolios focused on low volatility holdings.

See what the community is saying about Sugimura Warehouse

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sugimura Warehouse's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Sugimura Warehouse’s lack of consistent earnings growth and ongoing share price volatility make it a less reliable pick for stability-focused investors.

If you seek companies with steadier revenue and earnings, consider our stable growth stocks screener (2087 results) for stocks that consistently deliver through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9307

Sugimura Warehouse

Engages in the warehousing, customs clearance, port transport and freight forwarding, and real estate rental businesses in Japan.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives