- Japan

- /

- Commercial Services

- /

- TSE:7912

Does Recent Share Rally Signal an Opportunity in Dai Nippon Printing for 2025?

Reviewed by Bailey Pemberton

If you are weighing what to do with Dai Nippon Printing stock, you are certainly not alone. With the shares closing last at 2,544.5, this is a company that turns heads regardless of market mood. Just take a look at those long-term numbers: an impressive 167.2% gain over the last five years and 82.6% over three years, showing plenty of staying power for long-haul investors. Even so, the past year saw the stock dip slightly, down 3.0%, hinting at some shifting market views around risk and potential.

Anyone tracking the recent action will have noticed a modest rally in the last month, with a 3.2% climb, while the past week came in at plus 1.1%. These moves have come as investors have reconsidered the broader potential of established firms like Dai Nippon Printing, especially given ongoing shifts in demand for specialty printing technologies and supply chain resilience. The result has been a renewed momentum that reflects growing optimism about the company’s place in new and evolving markets.

With all this in mind, how should you think about Dai Nippon Printing’s current value? Here is where things get interesting: the company scores a 5 out of 6 on our valuation score, signaling it is undervalued on nearly all of the metrics we track. But are traditional valuation checks enough? Next, we will break down each method, and I will share something even better to help you understand whether Dai Nippon Printing is truly a bargain.

Why Dai Nippon Printing is lagging behind its peersApproach 1: Dai Nippon Printing Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis estimates a company's value by forecasting its future cash flows and then discounting them back to today's value. For Dai Nippon Printing, this model draws on projected free cash flow figures and adjusts them for the time value of money.

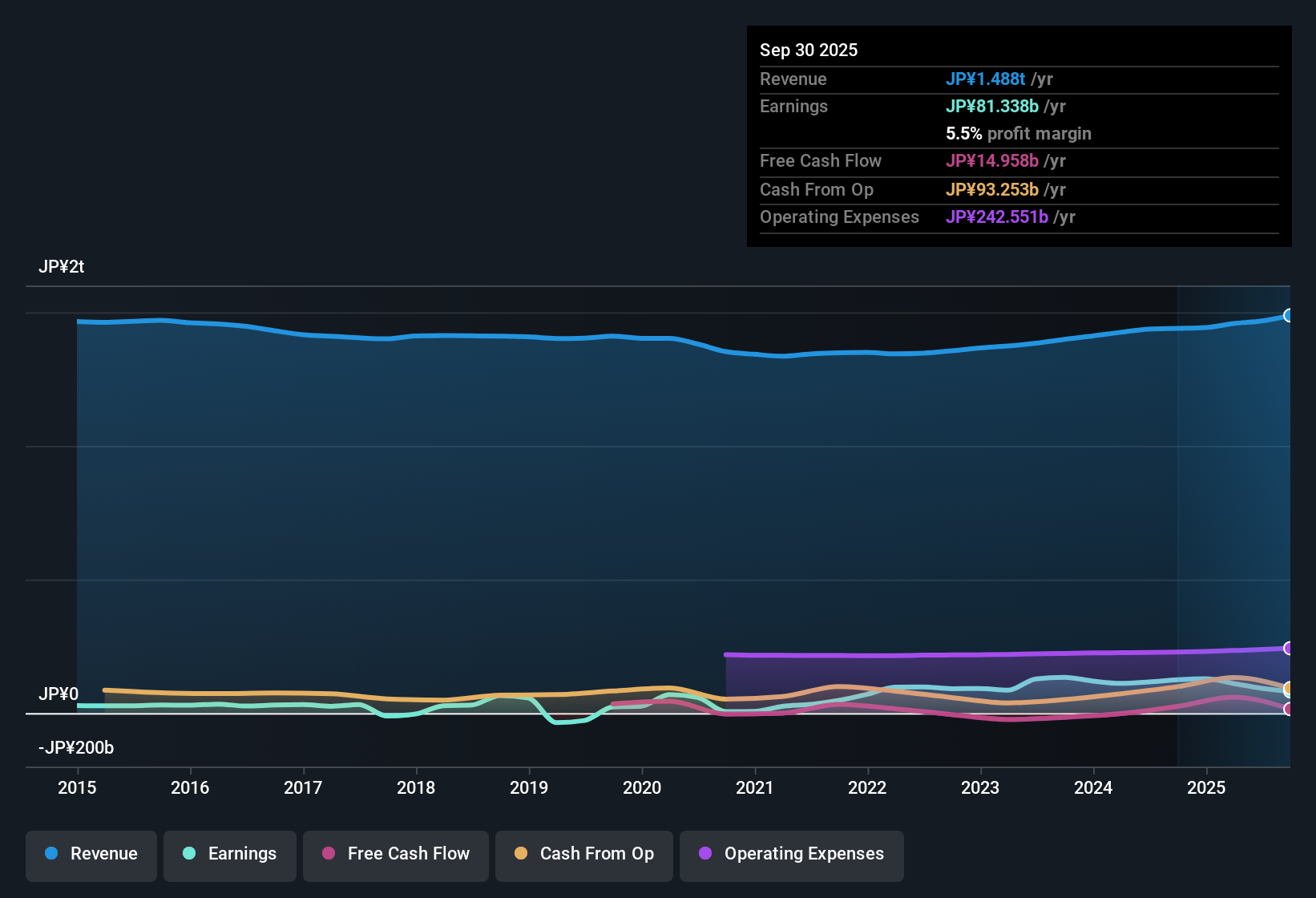

Currently, Dai Nippon Printing generates free cash flow of around ¥61.4 billion, and analysts see this number rising in coming years. By 2029, projections expect free cash flow to hit ¥88 billion. The model incorporates detailed analyst estimates through 2029 and then extends those projections further using established financial methods. This means that for the next decade, anticipated free cash flow figures remain well above ¥44 billion, according to Simply Wall St's calculations.

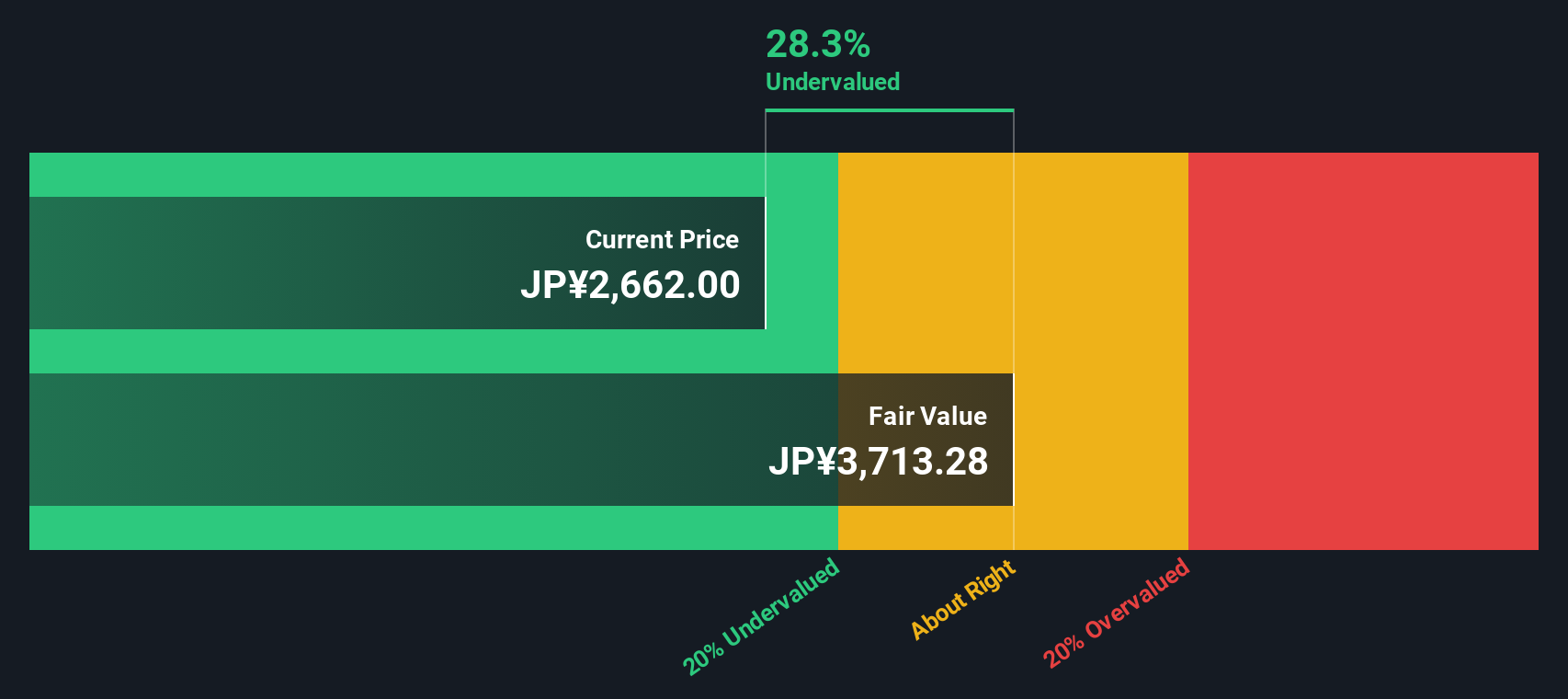

Based on these projections and applying the 2 Stage Free Cash Flow to Equity model, the DCF analysis implies an intrinsic value of ¥3,615 per share. Given the current share price of ¥2,544.5, the calculation points to Dai Nippon Printing being nearly 29.6% undervalued by this method.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Dai Nippon Printing.

Approach 2: Dai Nippon Printing Price vs Earnings

For profitable companies like Dai Nippon Printing, the Price-to-Earnings (PE) ratio is a widely used valuation tool. It tells you how much investors are willing to pay today for a yen of current earnings, making it a useful yardstick for established businesses with steady profits. A higher PE often signals growth expectations or lower perceived risk. A lower PE may hint at market skepticism or headwinds.

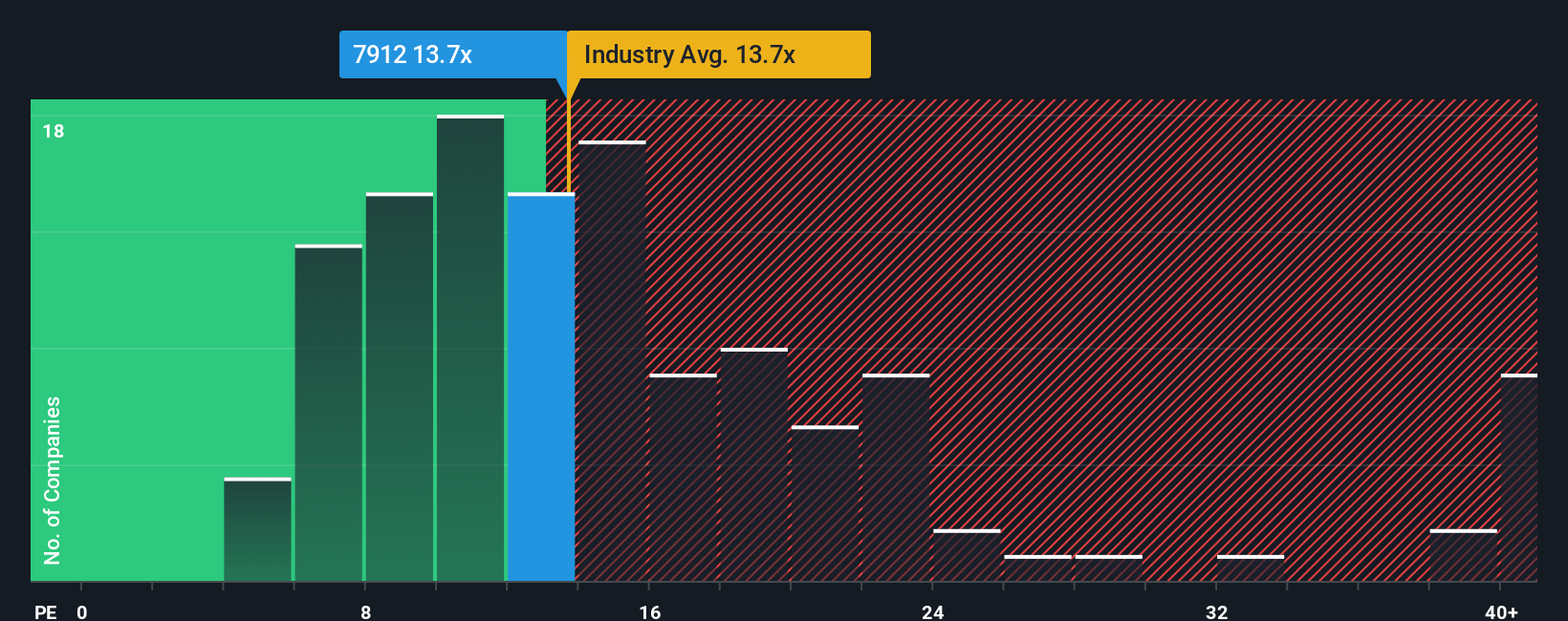

Right now, Dai Nippon Printing trades at a PE of 12.2x. For context, the average for the Commercial Services industry stands at 13.9x. Peers in the sector trade closer to 16.9x. On the surface, this suggests the company is priced below both industry and peer benchmarks, often a positive sign for value-seeking investors.

However, Simply Wall St goes a step further with its proprietary "Fair Ratio" model. This custom metric estimates a fair PE based not just on averages, but by blending Dai Nippon Printing’s growth prospects, profit margins, risk profile, industry dynamics, and overall market cap. In this case, the Fair Ratio works out to 19.7x, well above the current market PE.

Because the Fair Ratio factors in the full picture, tailoring expectations to reflect the company's unique qualities, it gives a more accurate read than simple comparisons to industry averages. This model helps prevent the pitfalls of comparing very different businesses or overlooking hidden growth drivers or risks.

With Dai Nippon Printing’s actual PE ratio of 12.2x sitting well below its Fair Ratio of 19.7x, the conclusion here is clear: the shares appear undervalued using this approach.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Dai Nippon Printing Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply the story behind your valuation, allowing you to pair your perspective about a company’s future with your own assumptions about its fair value and financial outlook. Instead of only looking at the numbers, Narratives connect a company’s business story with the numbers you believe in, and then link that to a fair value you can use for investment decisions.

Narratives are simple and accessible to use on Simply Wall St’s Community page, where millions of investors build and share their outlooks. They help you decide when to buy or sell by letting you compare your fair value against the current stock price and adapt as soon as new information, like news or earnings, becomes available. For Dai Nippon Printing, one investor narrative might see the company’s fair value well above the current price due to expected innovation, while another might view it as below market value due to industry headwinds. Narratives put you firmly in control and give you a dynamic view to make smarter, more personalized decisions.

Do you think there's more to the story for Dai Nippon Printing? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7912

Dai Nippon Printing

Primarily engages in the printing and information business.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives