- Japan

- /

- Commercial Services

- /

- TSE:7846

Can Stability in Profits and Expansion Offset Slower Growth for Pilot (TSE:7846)?

Reviewed by Sasha Jovanovic

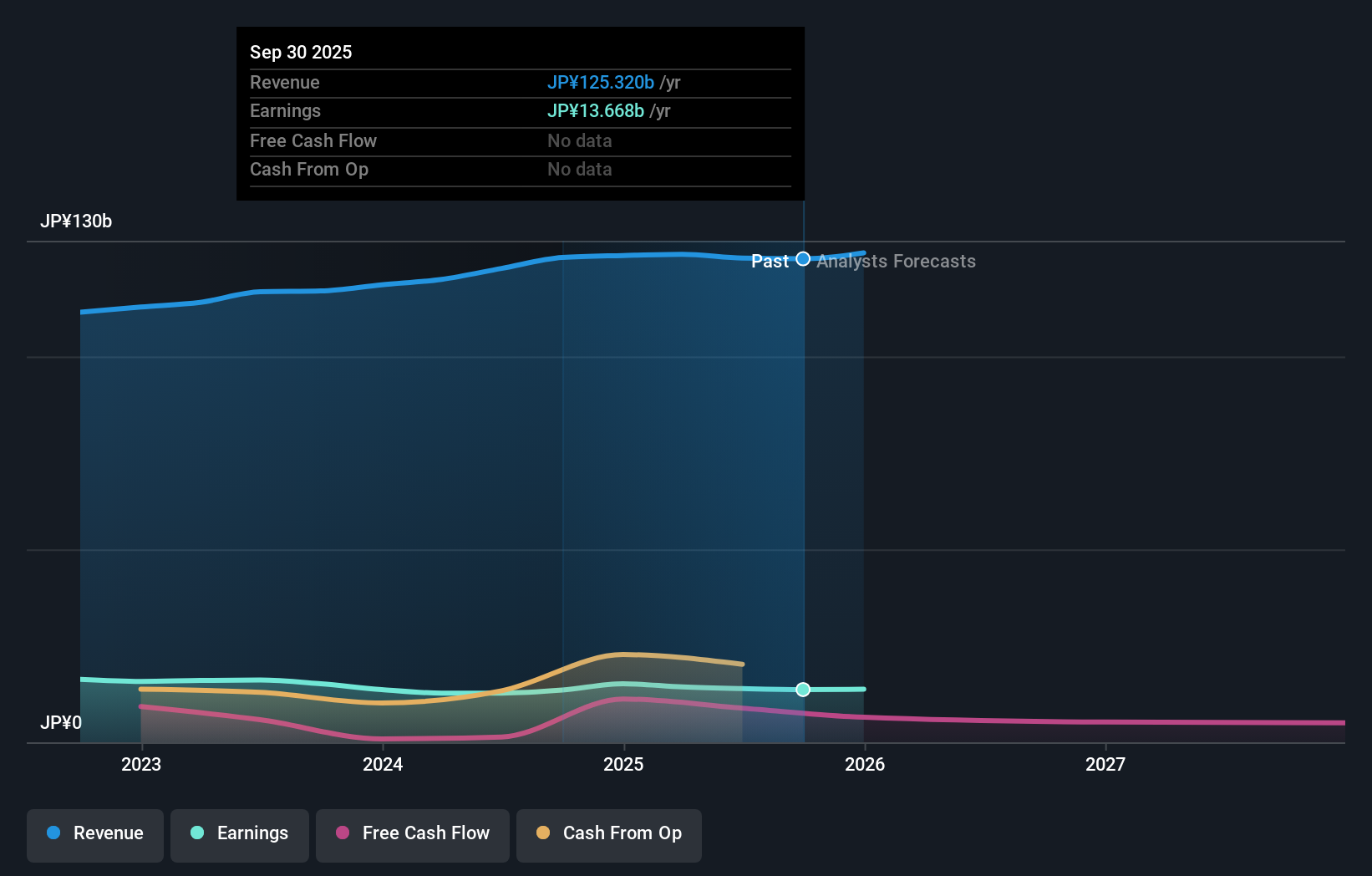

- Pilot Corporation recently reported a slight decline in net sales and profits for the nine months ending September 30, 2025, compared to the previous year.

- Despite a challenging market, the company maintained steady operating profits, enhanced its equity ratio, and deepened its presence in India through a new subsidiary.

- We’ll explore how Pilot’s combination of stable operating results and equity ratio improvement shapes its overall investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Pilot's Investment Narrative?

To be a shareholder in Pilot right now, you’d want to have confidence in the company's ability to deliver resilient operating results, even when market growth faces headwinds. The recent news of slightly lower net sales and profits marks a shift in momentum, but steady operating profits and a stronger equity ratio show that management is maintaining financial discipline. The addition of the Indian subsidiary and continued share buybacks also signal a focus on long-term value, rather than reactive short-term moves. That said, consensus catalysts like sustained dividend reliability and incremental international expansion remain relevant, but the earnings dip may put upward pressure on risks linked to further demand softness or margin erosion. For now, market reaction appears muted, so current risks and catalysts are largely unchanged, with the most pressing question being whether Pilot’s business can quickly regain its growth footing. On the other hand, ongoing pressure on net sales is something every investor should have on their radar.

Pilot's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Pilot - why the stock might be worth just ¥6100!

Build Your Own Pilot Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pilot research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Pilot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pilot's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7846

Pilot

Engages in the manufacturing, purchase, and sale of writing instruments and other stationery goods in Japan, the United States, Europe, and Asia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives