Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Cookbiz Co.,Ltd. (TSE:6558) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is CookbizLtd's Net Debt?

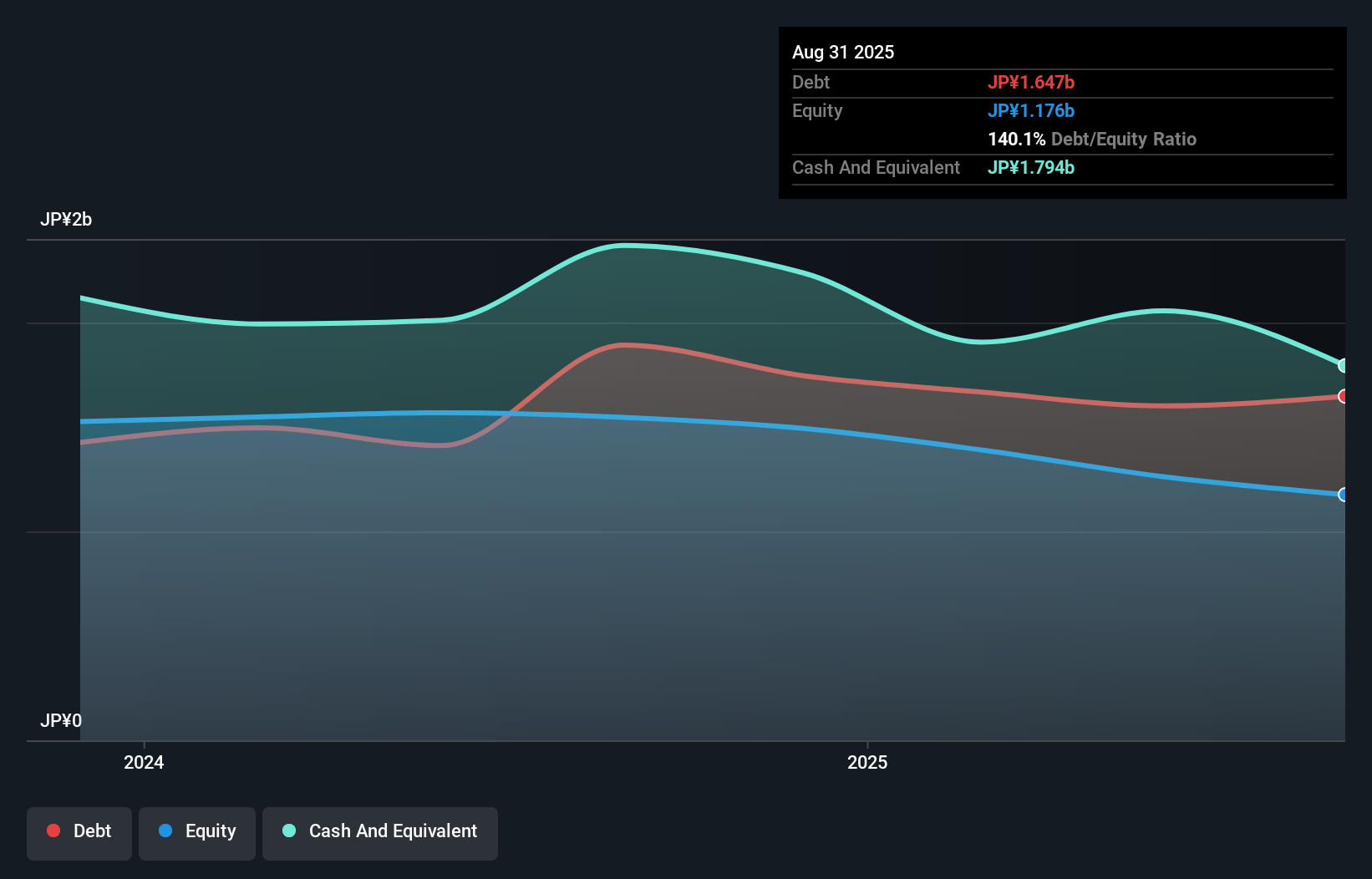

The image below, which you can click on for greater detail, shows that CookbizLtd had debt of JP¥1.65b at the end of August 2025, a reduction from JP¥1.89b over a year. However, its balance sheet shows it holds JP¥1.79b in cash, so it actually has JP¥147.0m net cash.

A Look At CookbizLtd's Liabilities

The latest balance sheet data shows that CookbizLtd had liabilities of JP¥1.03b due within a year, and liabilities of JP¥1.07b falling due after that. On the other hand, it had cash of JP¥1.79b and JP¥145.0m worth of receivables due within a year. So it has liabilities totalling JP¥154.0m more than its cash and near-term receivables, combined.

Of course, CookbizLtd has a market capitalization of JP¥1.56b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, CookbizLtd also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since CookbizLtd will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

See our latest analysis for CookbizLtd

In the last year CookbizLtd had a loss before interest and tax, and actually shrunk its revenue by 13%, to JP¥2.8b. We would much prefer see growth.

So How Risky Is CookbizLtd?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that CookbizLtd had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of JP¥137m and booked a JP¥377m accounting loss. With only JP¥147.0m on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that CookbizLtd is showing 3 warning signs in our investment analysis , and 1 of those is a bit concerning...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6558

CookbizLtd

Provides human resource services for the food and beverage industry.

Good value with mediocre balance sheet.

Market Insights

Community Narratives