- Japan

- /

- Commercial Services

- /

- TSE:6544

Japan Elevator Service Holdings (TSE:6544): Assessing Valuation Following Updated Earnings Guidance and Dividend Policy

Reviewed by Simply Wall St

Japan Elevator Service Holdings (TSE:6544) announced revised earnings guidance and updated its dividend outlook following a board meeting. The company highlighted its latest approach to managing profits and shareholder returns after a recent share split.

See our latest analysis for Japan Elevator Service HoldingsLtd.

Japan Elevator Service HoldingsLtd’s latest moves come after an impressive run, with a year-to-date share price return of 35.6% and a one-year total shareholder return of 47.1%. This signals that optimism about growth and resilient profit delivery is still strong. The recent dividend forecast revision and share split have attracted renewed attention, keeping momentum building despite a few strategic adjustments.

If you’re watching how companies are adapting and growing, it’s a great moment to expand your search and discover fast growing stocks with high insider ownership

With shares up sharply this year and an analyst price target still some distance away, the question now is whether Japan Elevator Service Holdings is undervalued or if the market has already factored in all its future growth potential.

Price-to-Earnings of 55.2x: Is it justified?

Japan Elevator Service Holdings Ltd trades at a price-to-earnings (P/E) ratio of 55.2x, putting it far above its industry and peer averages. The stock's last close was at ¥1,952.5. This valuation suggests the market is placing a significant premium on its future growth prospects.

The P/E ratio is one of the most widely tracked ways to assess how much investors are willing to pay for each unit of company earnings. For a company like Japan Elevator Service Holdings, which has posted strong earnings growth, a high P/E can indicate that investors expect continued rapid expansion.

This company's P/E multiple is dramatically higher than both the JP Commercial Services industry average of 13.7x and the peer group average of 19.1x. This reflects market optimism about further outperformance. However, when compared to an estimated fair P/E of 23.2x, the market is set well above what might be justified by fundamentals alone. Such a premium could signal very high expectations that may be tough to sustain if growth slows.

Explore the SWS fair ratio for Japan Elevator Service HoldingsLtd

Result: Price-to-Earnings of 55.2x (OVERVALUED)

However, slower revenue growth or earnings not meeting expectations could quickly reverse sentiment around Japan Elevator Service Holdings' demanding valuation.

Find out about the key risks to this Japan Elevator Service HoldingsLtd narrative.

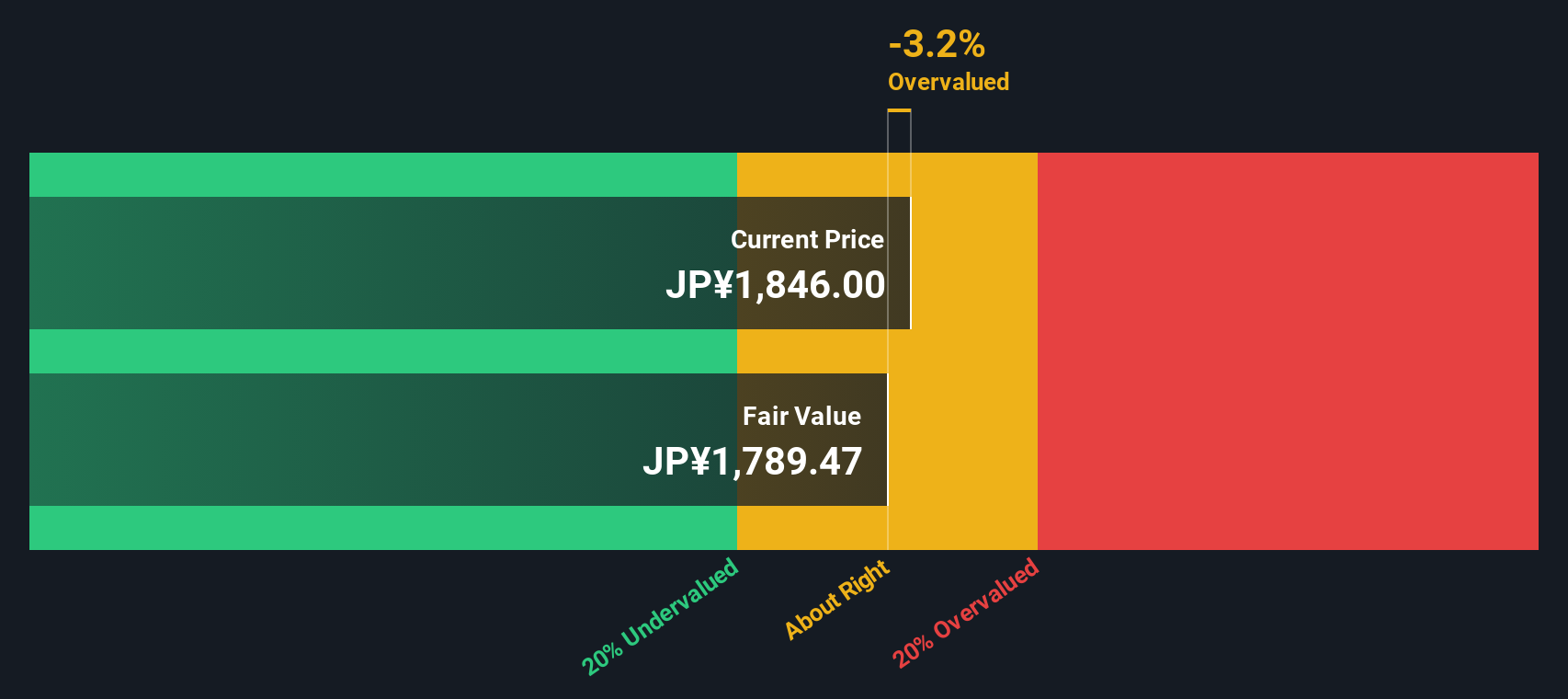

Another View: Discounted Cash Flow Model Offers a Different Perspective

While the market’s expectations are reflected in its high price-to-earnings ratio, our SWS DCF model presents a slightly different picture. According to this discounted cash flow approach, Japan Elevator Service Holdings is currently trading above its estimated fair value of ¥1,795.42. This suggests the stock appears overvalued by this method. Could the market be pricing in more future growth than the fundamentals suggest, or is this just temporary optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Elevator Service HoldingsLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Elevator Service HoldingsLtd Narrative

If you have a different view or want to dive deeper into the details, you can easily craft your own analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Japan Elevator Service HoldingsLtd.

Looking for more investment ideas?

Level up your stock search and get ahead of the market by checking hand-picked opportunities with unique upside, hidden gems, and exciting trends only found on Simply Wall St.

- Uncover income potential and grow your passive earnings through these 14 dividend stocks with yields > 3% with yields above 3%.

- Ride the AI wave and target businesses driving innovative breakthroughs by checking out these 26 AI penny stocks that are raising the bar in artificial intelligence.

- Capitalize on value mispricings and find growth bargains before the crowd with these 924 undervalued stocks based on cash flows using real cash flow insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6544

Japan Elevator Service HoldingsLtd

Provides repair, maintenance, and modernization services for elevators and escalators in Japan.

Outstanding track record with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success