- Japan

- /

- Professional Services

- /

- TSE:6083

Only Four Days Left To Cash In On ERI Holdings' (TSE:6083) Dividend

Readers hoping to buy ERI Holdings Co., Ltd. (TSE:6083) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. Thus, you can purchase ERI Holdings' shares before the 27th of November in order to receive the dividend, which the company will pay on the 2nd of February.

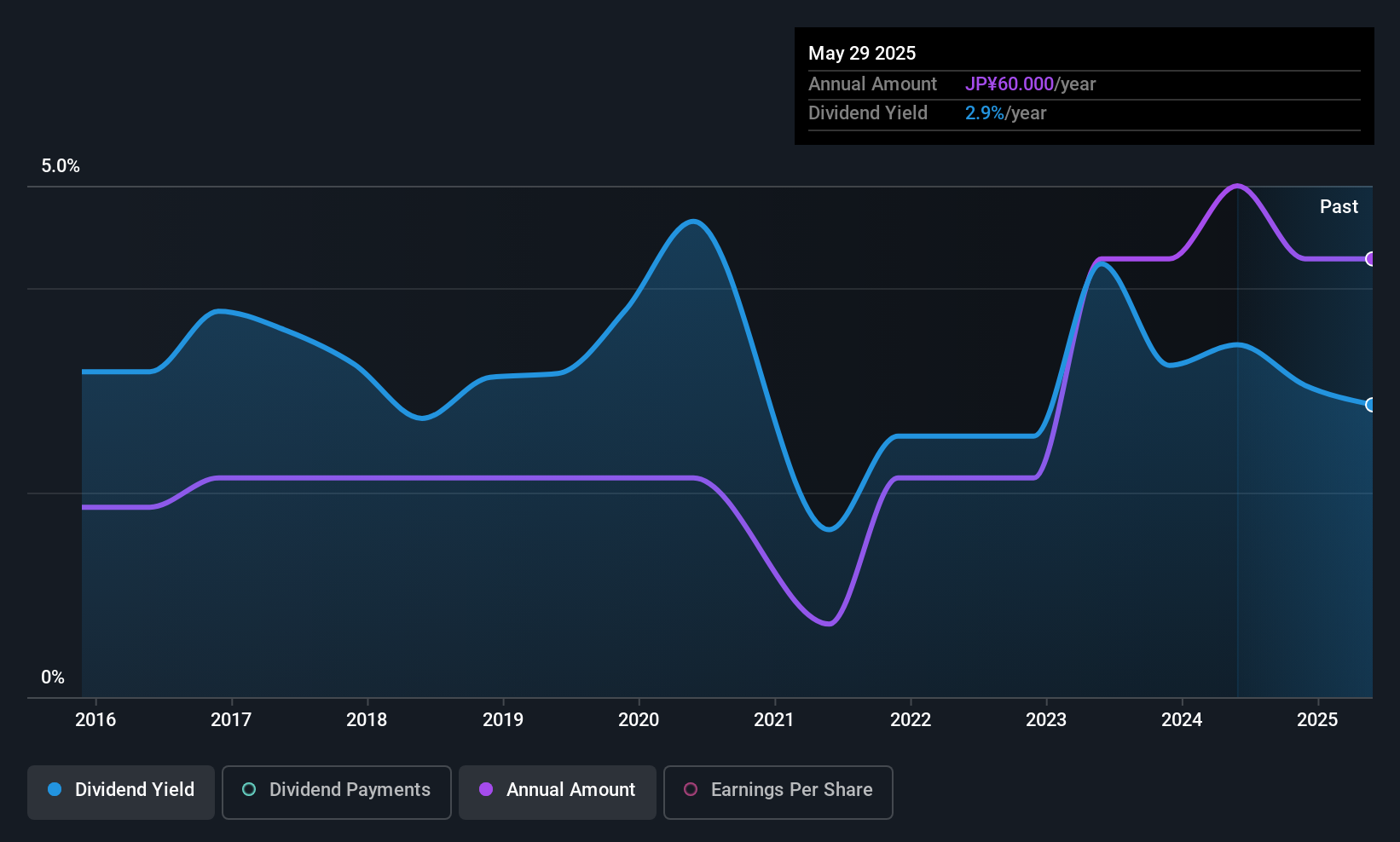

The company's upcoming dividend is JP¥35.00 a share, following on from the last 12 months, when the company distributed a total of JP¥70.00 per share to shareholders. Based on the last year's worth of payments, ERI Holdings has a trailing yield of 1.9% on the current stock price of JP¥3670.00. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. ERI Holdings paid out a comfortable 26% of its profit last year. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the past year it paid out 113% of its free cash flow as dividends, which is uncomfortably high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

ERI Holdings does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

While ERI Holdings's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were ERI Holdings to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Check out our latest analysis for ERI Holdings

Click here to see how much of its profit ERI Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. It's encouraging to see ERI Holdings has grown its earnings rapidly, up 48% a year for the past five years. Earnings have been growing quickly, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. ERI Holdings has delivered an average of 10% per year annual increase in its dividend, based on the past 10 years of dividend payments. It's great to see earnings per share growing rapidly over several years, and dividends per share growing right along with it.

To Sum It Up

Is ERI Holdings worth buying for its dividend? We're glad to see the company has been improving its earnings per share while also paying out a low percentage of income. However, it's not great to see it paying out what we see as an uncomfortably high percentage of its cash flow. In summary, while it has some positive characteristics, we're not inclined to race out and buy ERI Holdings today.

In light of that, while ERI Holdings has an appealing dividend, it's worth knowing the risks involved with this stock. For example, we've found 2 warning signs for ERI Holdings that we recommend you consider before investing in the business.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if ERI Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6083

ERI Holdings

Provides building confirmation and inspection services in Japan.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives