- Japan

- /

- Professional Services

- /

- TSE:4825

Weathernews (TSE:4825) Net Profit Margin Jumps to 14.8%, Challenging Valuation Bear Narratives

Reviewed by Simply Wall St

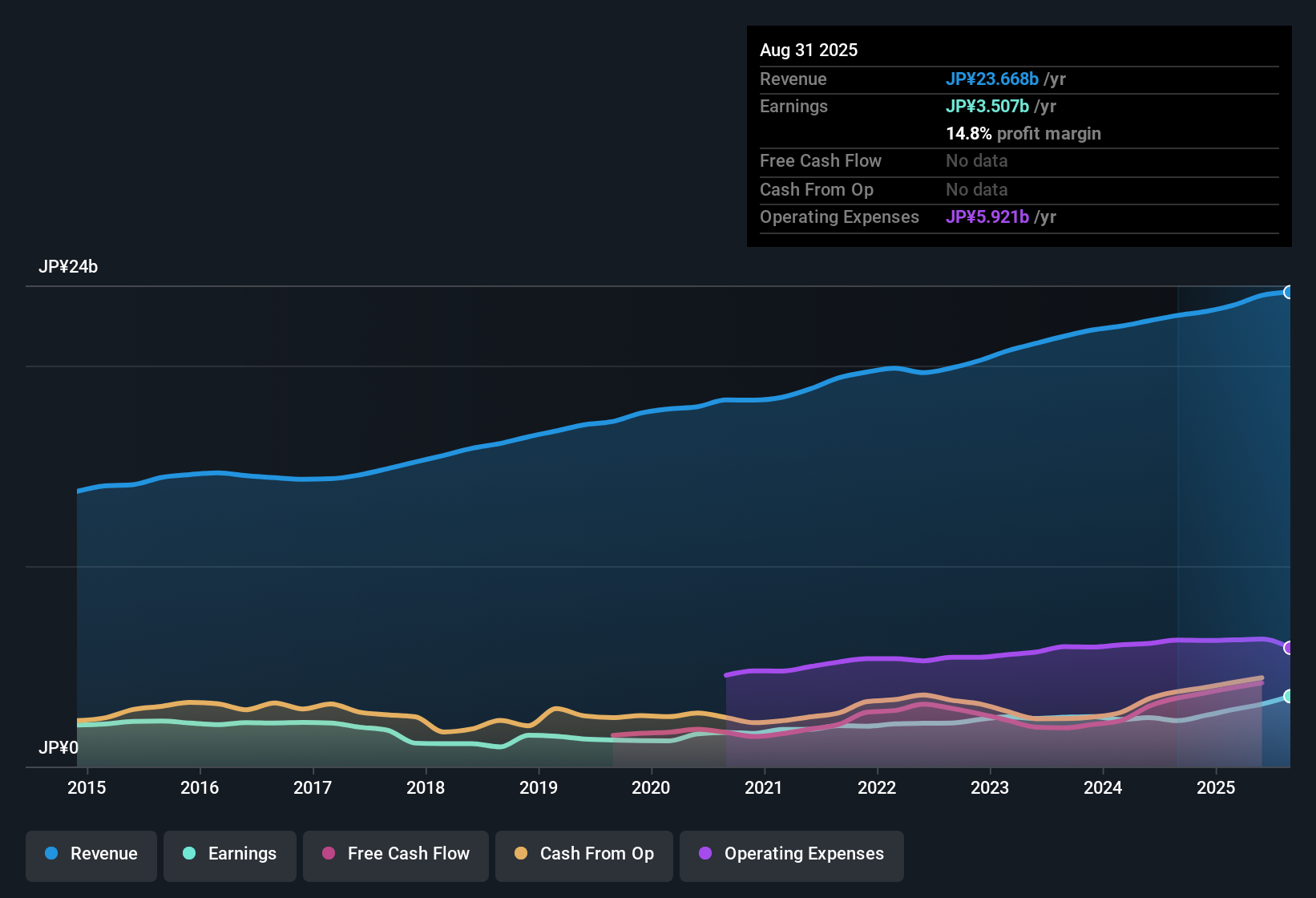

Weathernews (TSE:4825) delivered standout earnings this year, with net profit margin jumping from 10.2% to 14.8% and earnings rising 53.3%, which is well above its 11.2% five-year annual growth average. Looking ahead, revenue is forecast to grow at 6.7% a year, outpacing the Japanese market’s 4.4% rate. However, earnings growth is expected to trail the market at 5.6% per year versus 8.2%. Investors will be weighing the impact of these high-quality results and margin expansion against Weathernews's premium 27.3x P/E ratio, as well as the positive backdrop of no notable risks and several appealing rewards.

See our full analysis for Weathernews.The numbers look impressive, but the next step is to see how they measure up against the dominant market narratives. We will dig into what the consensus, bulls, and bears each see in the story from here.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Hits 14.8%: Quality Drives Premium

- Net profit margin reached 14.8% this year, an increase from the previous 10.2%. This marks a notable improvement in profitability compared to recent years.

- High-quality earnings and expanding margins continue to fuel positive expectations. The prevailing view emphasizes that Weathernews could gain further as demand for actionable weather intelligence picks up globally.

- Sector tailwinds, such as rising corporate demand for climate data, align directly with the jump in margin.

- Investors are looking for proof that these gains translate into lasting earnings power in coming years.

Revenue Growth Outpaces Japanese Market

- Revenue is forecast to climb 6.7% annually, ahead of the Japanese industry’s average of 4.4%. This underscores that top-line growth remains more robust than peers even as earnings growth is set to lag the market rate.

- Prevailing analysis points to sector trends and technological upgrades as the main growth levers. However, execution is crucial if Weathernews wants to convert this revenue edge into higher long-term earnings.

- Ongoing digital transformation and new service launches are significant positives, yet competition and new entrants may test the company’s ability to sustain its advantage.

- Shareholders should watch for large contract wins or international deals as possible triggers for renewed market optimism.

Premium Valuation Still Shows DCF Upside

- Shares trade at a 27.3x price-to-earnings ratio, significantly above both the industry average (15.8x) and peer average (23.2x), yet still below the DCF fair value of ¥4,737.95 with a current share price of ¥4,315.00.

- This valuation tension shapes market focus. Investors see justification for the premium based on earnings quality and margin, but also weigh the risk of limited upside if future growth softens.

- The market appears willing to pay extra for sustained double-digit profit margins, but slower expected earnings growth than the broader Japanese average (5.6% vs. 8.2%) keeps investors cautious.

- The presence of an attractive dividend adds further balance to the ongoing debate about valuation sustainability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Weathernews's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Weathernews boasts strong margins and solid revenue growth, its projected earnings expansion is expected to lag the broader Japanese market in the years ahead.

If you're seeking companies with faster future potential, tap into high growth potential stocks screener to discover established businesses forecasting much stronger earnings growth than the major benchmarks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weathernews might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4825

Weathernews

Engages in the provision of weather services in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives