- Japan

- /

- Professional Services

- /

- TSE:4746

Toukei Computer (TSE:4746) Expanding Profit Margin Reinforces Bullish Narrative on Efficiency and Value

Reviewed by Simply Wall St

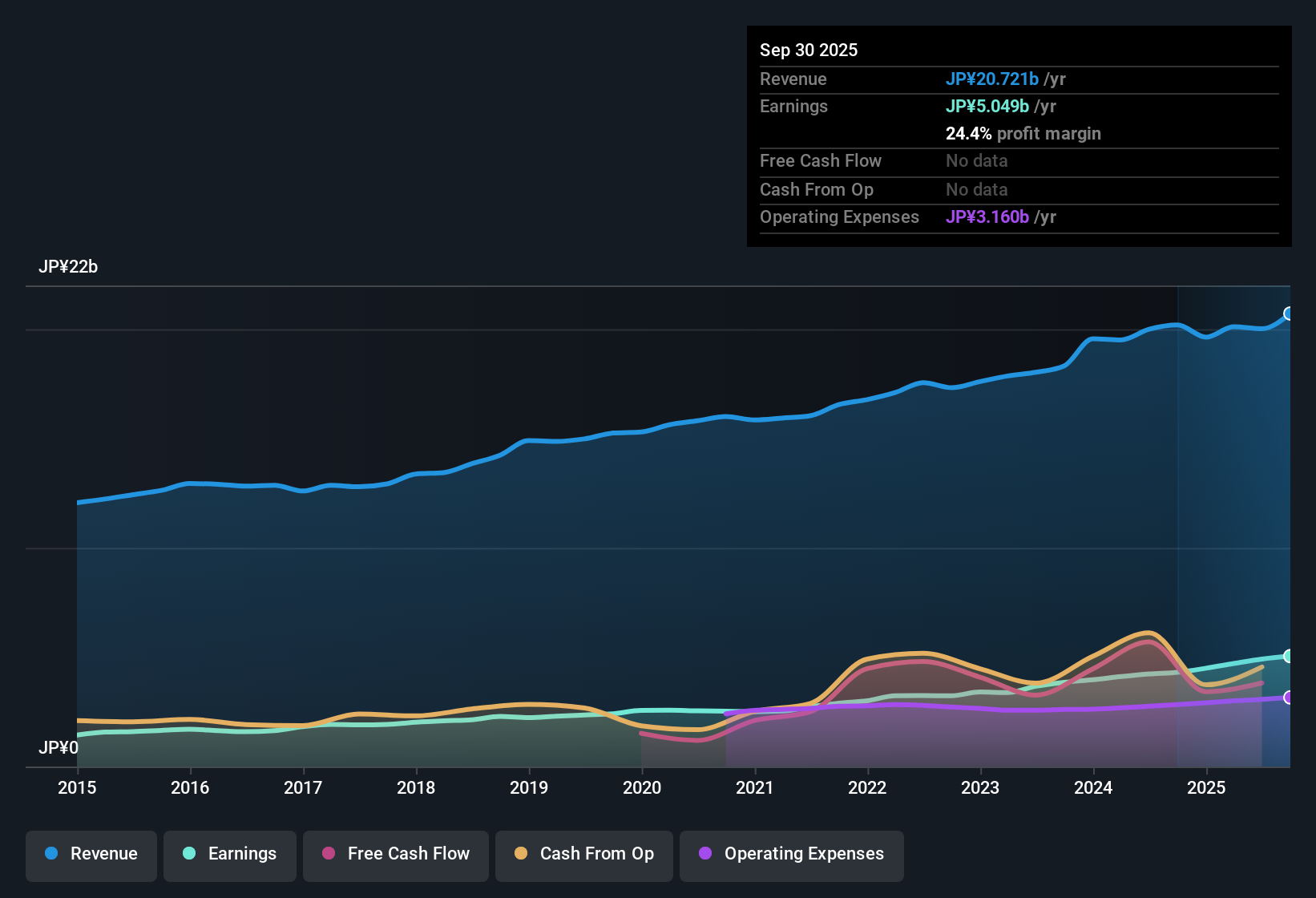

Toukei Computer (TSE:4746) delivered earnings growth of 16% over the last year, outpacing its 5-year average of 14.1% annually. Net profit margin reached 24.5%, up from 21.2% the previous year, and shares are trading at ¥3,880, well below an estimated fair value of ¥5,781.5. With sustained growth, robust profit margins, and a Price-to-Earnings ratio of 14.1x, which is lower than both peers and the industry, the company’s strong operational performance and attractive valuation are likely to catch investors’ attention this earnings season.

See our full analysis for Toukei Computer.The next section puts these headline figures in context by comparing them to the market narratives that investors follow closely, highlighting where the numbers reinforce or challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Stretch Further Than Peers

- Net profit margin reached 24.5%, topping the prior year's 21.2% and indicating Toukei Computer is squeezing more efficiency from its revenues than most competitors.

- Despite the company's already strong reputation for quality earnings, this improvement heavily supports the narrative that Toukei is able to maintain both growth and financial discipline in a sector where margin compression is common.

- With no reported profitability risks or write-downs, efficiency looks sustainable and lends weight to claims about operational strength.

- This trend would put pressure on any bearish case based on margin risks because the figures run counter to concerns about cost creep or competitive pricing.

Dividend and Growth Rewards Stand Out

- A combination of ongoing profit and revenue growth along with an attractive dividend enhances Toukei Computer's appeal compared to peers who may have either slower growth or less shareholder-friendly payout policies.

- Presenting these dual rewards, the prevailing market view argues that investors who seek a balance of compounding returns and income will see Toukei’s sustained momentum and payouts as reinforcing a quality-oriented, value-conscious thesis.

- This is underscored by tangible improvements in both annual growth rates and margin expansion, amplifying perceptions of durability.

- In the context of industry trends, these figures help explain why bulls remain optimistic on future outperformance and defensive attributes alike.

Valuation Lags Sector Despite Outperformance

- Toukei Computer's Price-to-Earnings ratio is 14.1x, lower than the peer average of 21.3x and the wider industry at 14.9x. Shares trade at ¥3,880 compared to a DCF fair value of ¥5,781.5.

- This gap means bulls can point to a compelling argument. The company's growing profitability and reliable rewards are not yet fully reflected in its market price compared to peers, supporting a "quality at a discount" view.

- Stronger and more consistent profit margins set Toukei apart from many competitors, further justifying arguments for a valuation rerating.

- For investors seeking a blend of value and momentum, these indicators both challenge the idea of sector-wide overvaluation and invite a closer look at why Toukei’s price may not reflect its progress.

See what the community is saying about Toukei Computer

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Toukei Computer's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Toukei Computer’s strong profit margins and growth, its valuation still trails peers. This suggests market skepticism about how quickly its price will catch up.

If you want opportunities where the market already recognizes value, try these 840 undervalued stocks based on cash flows to zero in on companies whose prices better match their underlying quality right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toukei Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4746

Toukei Computer

Engages in the system design, development, and operation of solutions for various industries and businesses in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives