- Japan

- /

- Commercial Services

- /

- TSE:4666

### 3 Japanese Growth Stocks With High Insider Ownership And 20% Earnings Growth ###

Reviewed by Simply Wall St

Despite recent turbulence in Japan's stock markets, driven by a hawkish turn from the Bank of Japan and a rebounding yen, opportunities for growth remain. In such an environment, companies with strong insider ownership and robust earnings growth can offer compelling investment prospects.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 43.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| Medley (TSE:4480) | 34% | 28.7% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| ExaWizards (TSE:4259) | 21.8% | 91.1% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| AeroEdge (TSE:7409) | 10.7% | 28.5% |

Here we highlight a subset of our preferred stocks from the screener.

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

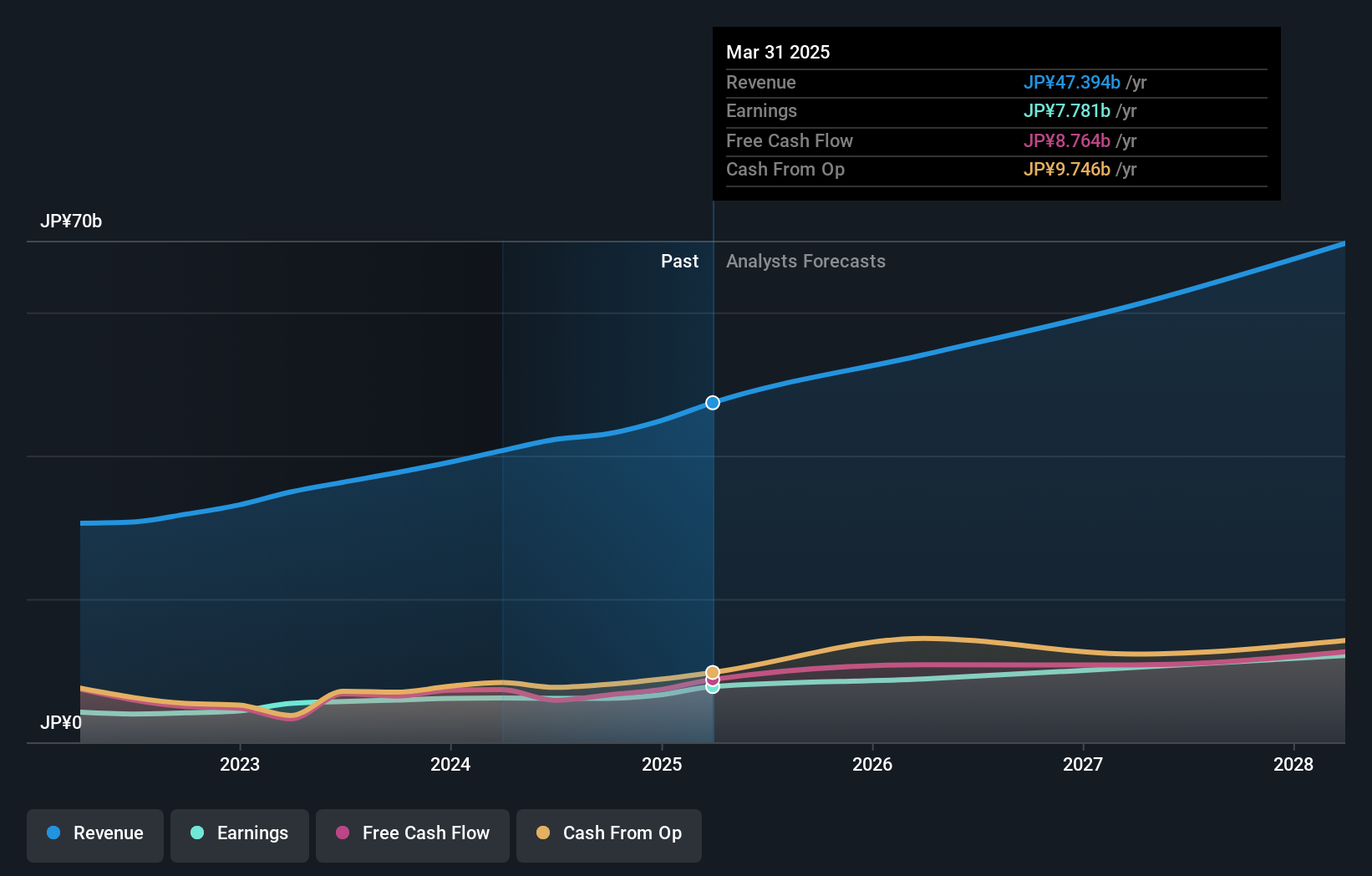

Overview: Avant Group Corporation, with a market cap of ¥54.58 billion, provides accounting, business intelligence, and outsourcing services through its subsidiaries.

Operations: Revenue Segments (in millions of ¥): Accounting: ¥5,200 Business Intelligence: ¥3,800 Outsourcing Services: ¥2,500 Avant Group's revenue is derived from accounting services (¥5.20 billion), business intelligence (¥3.80 billion), and outsourcing services (¥2.50 billion).

Insider Ownership: 33.9%

Earnings Growth Forecast: 18.9% p.a.

Avant Group demonstrates strong growth potential with high insider ownership. The company's revenue is forecast to grow at 16.9% annually, outpacing the broader Japanese market. Earnings are expected to increase by 18.9% per year, supported by a recent profit growth of 36.1%. Recent corporate guidance projects net sales of ¥28.8 billion and an operating profit of ¥4.9 billion for FY2025, alongside a dividend increase from ¥19 to ¥25 per share, reflecting robust financial health and confidence in future performance.

- Unlock comprehensive insights into our analysis of Avant Group stock in this growth report.

- The analysis detailed in our Avant Group valuation report hints at an deflated share price compared to its estimated value.

Simplex Holdings (TSE:4373)

Simply Wall St Growth Rating: ★★★★☆☆

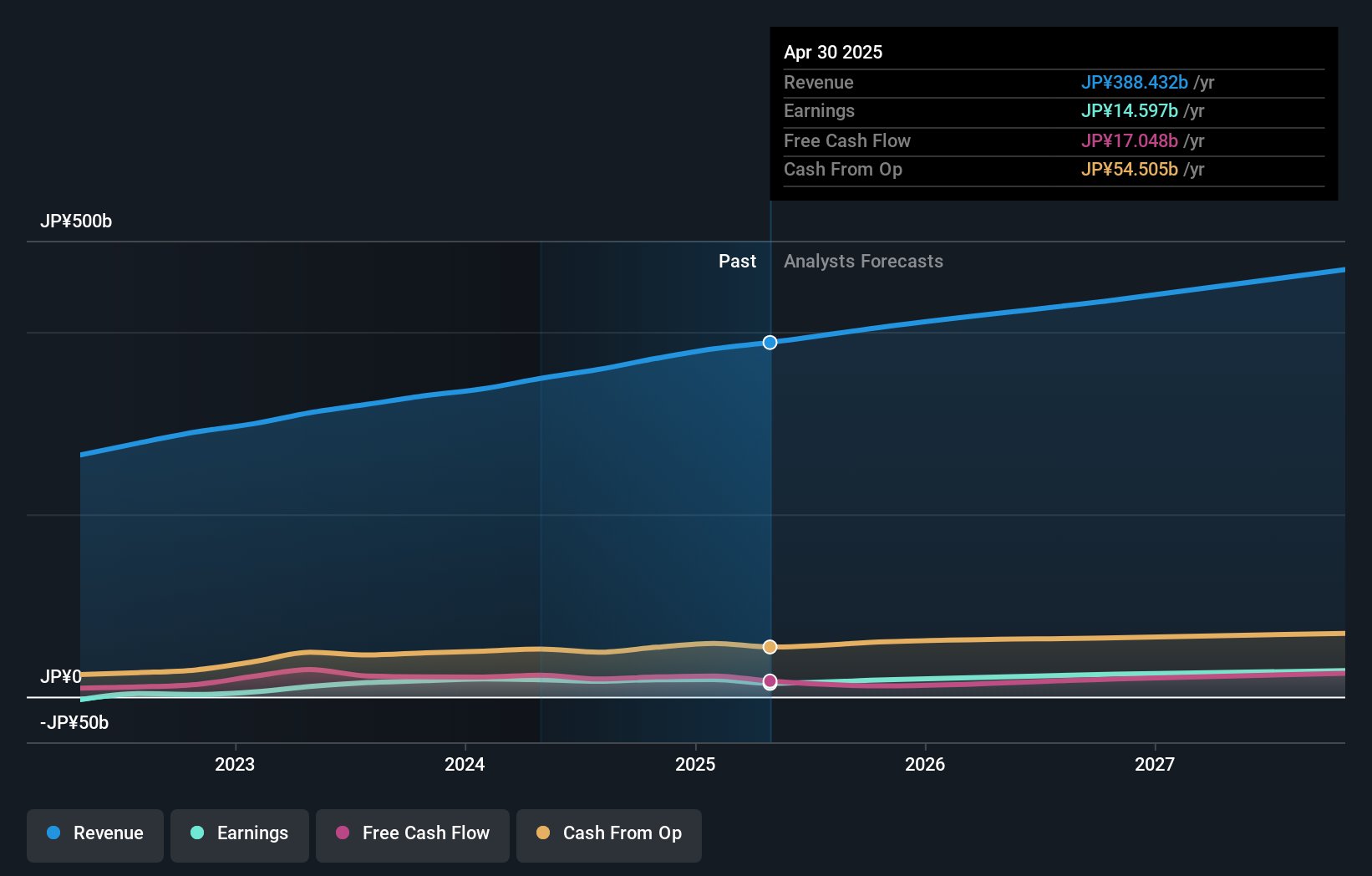

Overview: Simplex Holdings, Inc. offers strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and public sectors globally, with a market cap of ¥126.39 billion.

Operations: The company generates revenue primarily through the provision of IT solutions, amounting to ¥42.26 billion.

Insider Ownership: 28.8%

Earnings Growth Forecast: 20.2% p.a.

Simplex Holdings exhibits strong growth potential, with revenue forecasted to grow at 12.8% annually and earnings projected to increase by 20.2% per year, both surpassing the broader Japanese market. Despite a highly volatile share price recently and an unstable dividend track record, the company approved a significant dividend increase from ¥25 to ¥42 per share for FY2024. Analysts expect the stock price to rise by 52.3%, indicating substantial upside potential.

- Take a closer look at Simplex Holdings' potential here in our earnings growth report.

- Our valuation report here indicates Simplex Holdings may be undervalued.

PARK24 (TSE:4666)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PARK24 Co., Ltd. operates and manages parking facilities in Japan and internationally, with a market cap of ¥248.64 billion.

Operations: The company's revenue segments include parking facility operations in Japan and internationally.

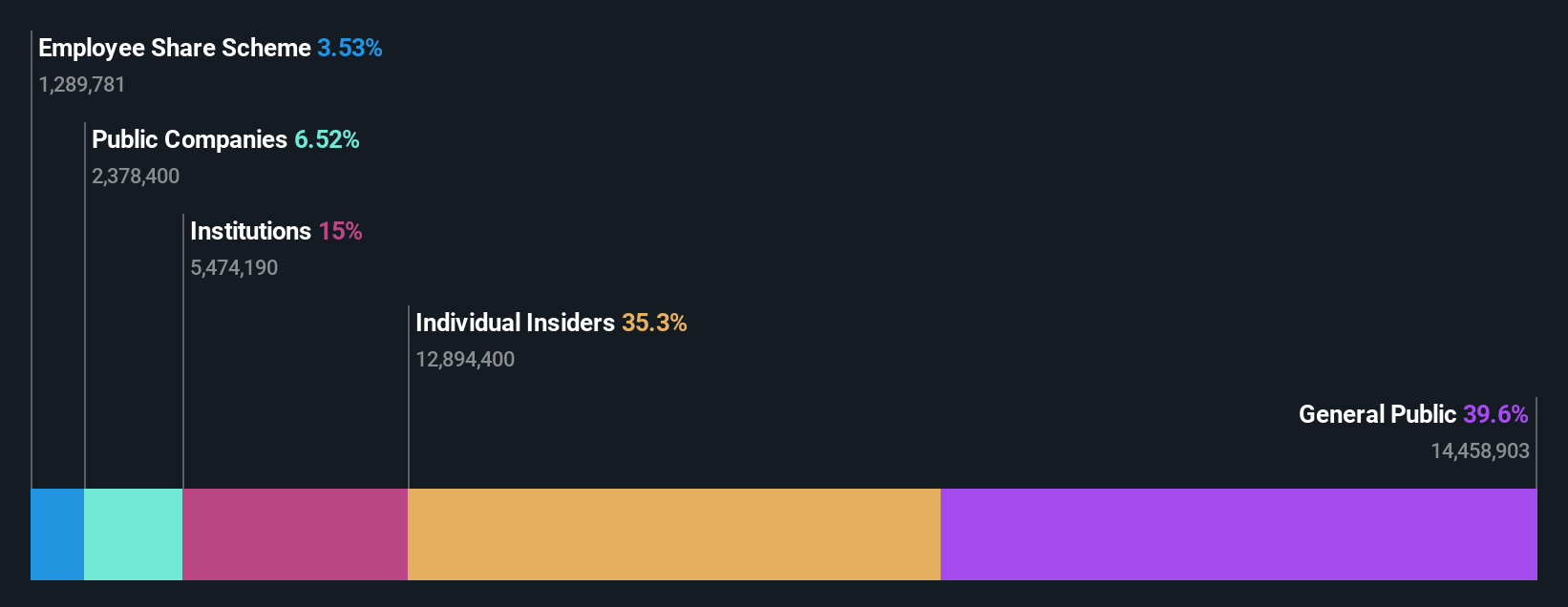

Insider Ownership: 10.5%

Earnings Growth Forecast: 12.9% p.a.

PARK24 demonstrates solid growth potential with earnings forecasted to grow at 12.9% annually, outpacing the broader Japanese market. Despite a high debt level, the company is trading at 30.4% below its fair value estimate and has shown significant profit growth of 67.5% in the past year. Revenue is expected to increase by 5.8% per year, which is higher than the market average but not exceptionally high for a growth company with insider ownership.

- Get an in-depth perspective on PARK24's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that PARK24 is priced lower than what may be justified by its financials.

Key Takeaways

- Embark on your investment journey to our 100 Fast Growing Japanese Companies With High Insider Ownership selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4666

PARK24

Operates and manages parking facilities in Japan and Internationally.

Solid track record and good value.