- Japan

- /

- Professional Services

- /

- TSE:3640

Densan (TSE:3640) Profit Margin Doubles, Challenging Cautious Market Sentiment

Reviewed by Simply Wall St

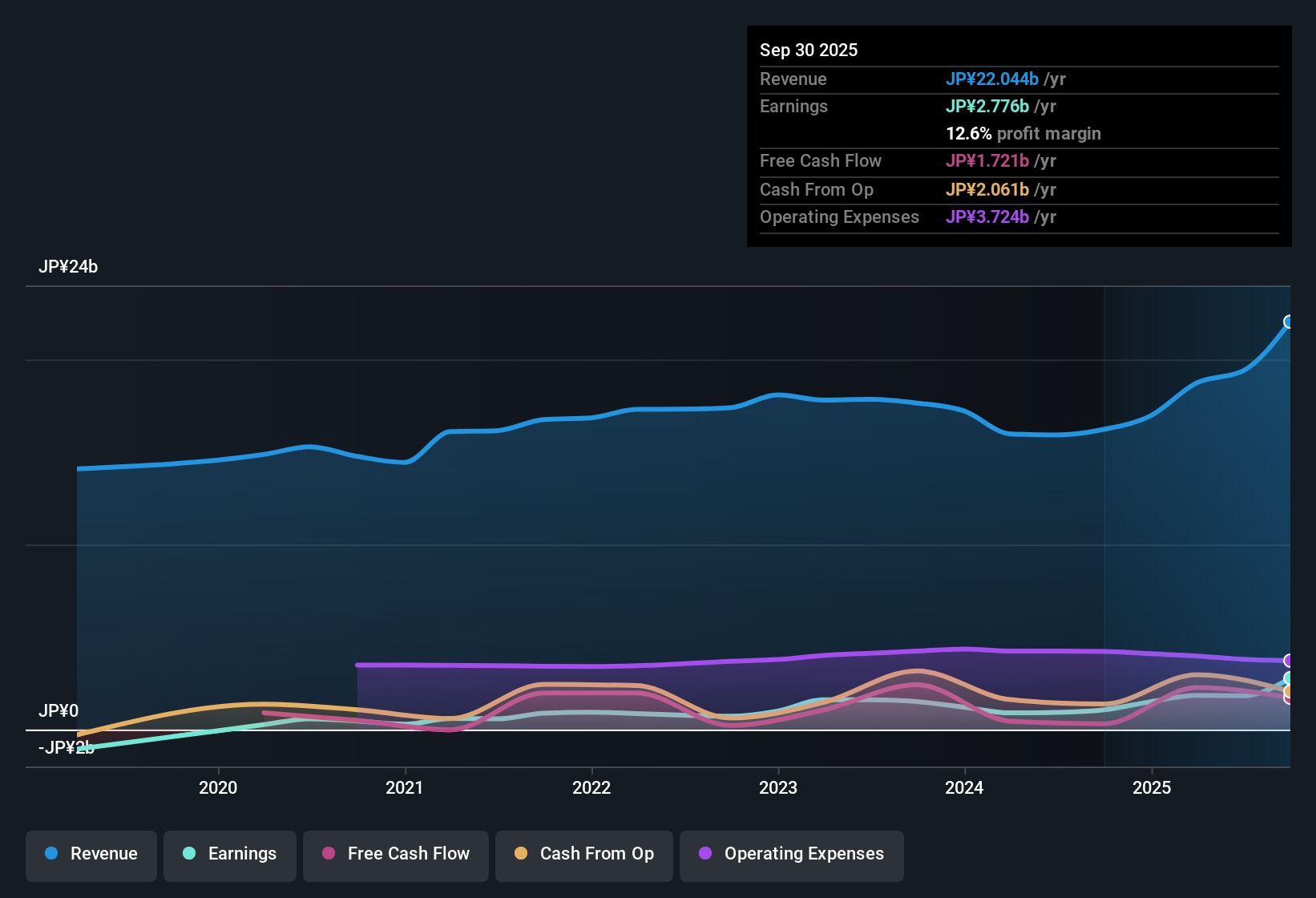

Densan (TSE:3640) delivered a breakout year, with earnings growing 26.6% annually over the last five years and accelerating to a massive 159.9% in the most recent year. Net profit margin more than doubled to 12.6% from 6.6%, and the company is now recognized for its high-quality earnings. With strong profit expansion and a discounted valuation versus industry peers, investors are likely to see plenty of upside. However, recent share price volatility could weigh on sentiment for now.

See our full analysis for Densan.Next, we will see how these standout numbers compare with the most widely-followed narratives on Densan. This will show where expectations get confirmed and where market perceptions could shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Jumps to 12.6%

- Densan’s net profit margin currently sits at 12.6%, a significant step up from its previous 6.6%. This highlights that more of its revenue is now translating into actual profit instead of being lost to costs.

- What’s surprising is how this margin expansion lines up with prevailing analysis that sees Densan leveraging industry trends to support sustainable profit growth.

- Company earnings reflect a consistent ability to improve profitability and quality. This supports claims that management is capitalizing on sector momentum rather than simply benefiting from one-off factors.

- Still, higher margins in a rapidly evolving sector often invite additional scrutiny or imitation from competitors, which could challenge how durable this improvement really is.

Valuation Gap Under the Spotlight

- With Densan trading at a price-to-earnings ratio of just 6.5x while its professional services peers average 17.4x and the broader industry at 14.8x, the company is priced at a striking discount.

- Seen through this lens, analysts note that such a deep valuation gap gives the company both downside protection and a chance for upside if its solid track record continues.

- A current share price of ¥3,115 stands well below the DCF fair value estimate of ¥9,412.14, making the stock look especially undervalued by fundamental standards.

- However, while favorable peer comparisons matter, they do not guarantee a re-rating if broader market skepticism about smaller cap names persists.

Curious how numbers become stories that shape markets? Curious how numbers become stories that shape markets? Explore Community Narratives

Share Price Lags Despite Strong Results

- The recent three-month period has seen unstable share price performance even as the company’s financial results hit new highs.

- The prevailing analysis points out a tension here, as strong internal metrics have not yet translated into sustained gains for shareholders.

- Bulls would expect that robust growth and a fattening margin should trigger improved sentiment and momentum, but price volatility underscores lingering caution.

- Densan may need several quarters of repeat performance to convince the market, with current price swings limiting immediate enthusiasm from new investors.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Densan's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Densan boasts exceptional profit growth and an attractive valuation, its unreliable share price and recent volatility raise doubts about consistency.

Concerned about unpredictable returns? Use stable growth stocks screener (2091 results) to focus on companies that deliver steady growth and resilient performance through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3640

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives