- Japan

- /

- Professional Services

- /

- TSE:2475

WDB Holdings Co., Ltd.'s (TSE:2475) 26% Share Price Surge Not Quite Adding Up

WDB Holdings Co., Ltd. (TSE:2475) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.3% over the last year.

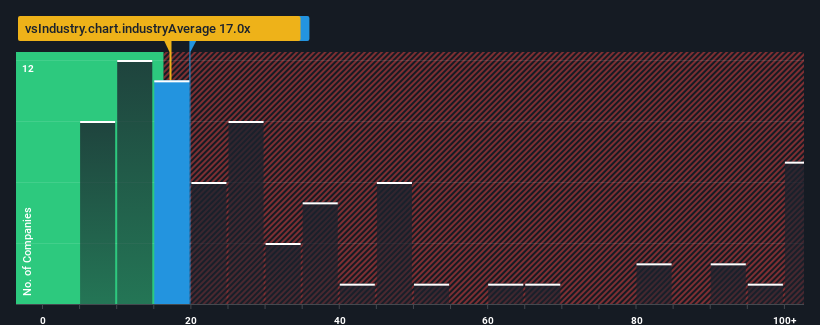

Although its price has surged higher, it's still not a stretch to say that WDB Holdings' price-to-earnings (or "P/E") ratio of 13.1x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

We've discovered 1 warning sign about WDB Holdings. View them for free.While the market has experienced earnings growth lately, WDB Holdings' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for WDB Holdings

What Are Growth Metrics Telling Us About The P/E?

WDB Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 18% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 1.1% as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 9.6% growth forecast for the broader market.

In light of this, it's curious that WDB Holdings' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

WDB Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that WDB Holdings currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 1 warning sign for WDB Holdings you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if WDB Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2475

WDB Holdings

Provides human resources services in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth