Stock Analysis

- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6976

JAC Recruitment And Two More Japanese Exchange Stocks Estimated As Undervalued Gems For Your Portfolio

Reviewed by Simply Wall St

Japan's stock markets have shown resilience, with the Nikkei 225 Index and broader TOPIX Index both registering gains amid a depreciating yen and anticipations of monetary policy adjustments. In this context, identifying undervalued stocks within such a market can offer intriguing opportunities for investors looking to diversify their portfolios with potentially overlooked gems.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥468.00 | ¥924.49 | 49.4% |

| Hibino (TSE:2469) | ¥2694.00 | ¥5143.22 | 47.6% |

| Hamee (TSE:3134) | ¥1113.00 | ¥2155.75 | 48.4% |

| Sumco (TSE:3436) | ¥2346.00 | ¥4540.05 | 48.3% |

| Cyber Security Cloud (TSE:4493) | ¥2280.00 | ¥4353.83 | 47.6% |

| S-Pool (TSE:2471) | ¥318.00 | ¥622.46 | 48.9% |

| Macromill (TSE:3978) | ¥828.00 | ¥1652.57 | 49.9% |

| Bushiroad (TSE:7803) | ¥366.00 | ¥709.12 | 48.4% |

| Money Forward (TSE:3994) | ¥5270.00 | ¥10439.35 | 49.5% |

| LibertaLtd (TSE:4935) | ¥502.00 | ¥976.46 | 48.6% |

Let's dive into some prime choices out of from the screener

JAC Recruitment (TSE:2124)

Overview: JAC Recruitment Co., Ltd. is a recruitment consultancy based in Japan, with a market capitalization of approximately ¥108.82 billion.

Operations: The firm specializes in recruitment consultancy services in Japan.

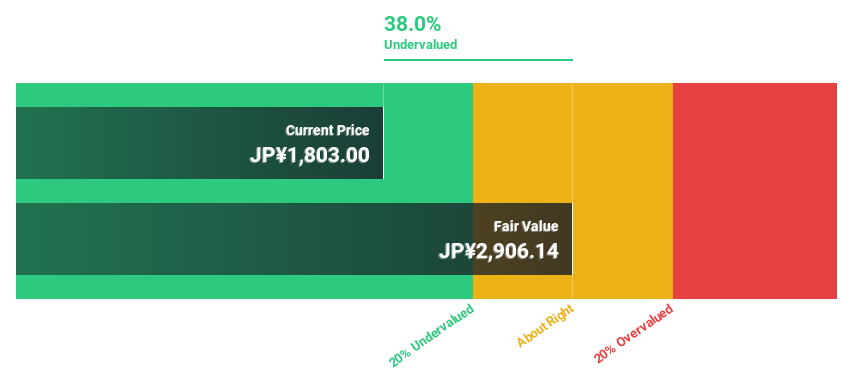

Estimated Discount To Fair Value: 28.1%

JAC Recruitment, currently trading at ¥680, appears undervalued based on a DCF valuation of ¥945.47, marking a 28.1% discrepancy from its estimated fair value. The company's revenue and earnings growth forecasts of 14.9% and 18.2% respectively outpace the Japanese market averages significantly, suggesting robust future performance. Additionally, an expected Return on Equity of 40.2% highlights efficient management and profitability potential despite not reaching the high growth mark above 20%.

- Upon reviewing our latest growth report, JAC Recruitment's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of JAC Recruitment stock in this financial health report.

Comture (TSE:3844)

Overview: Comture Corporation, based in Japan, specializes in offering a range of services including cloud, digital business and learning solutions, and platform operations with a market capitalization of ¥58.99 billion.

Operations: The firm specializes in providing a variety of services such as cloud solutions, digital business and learning enhancements, and platform operations.

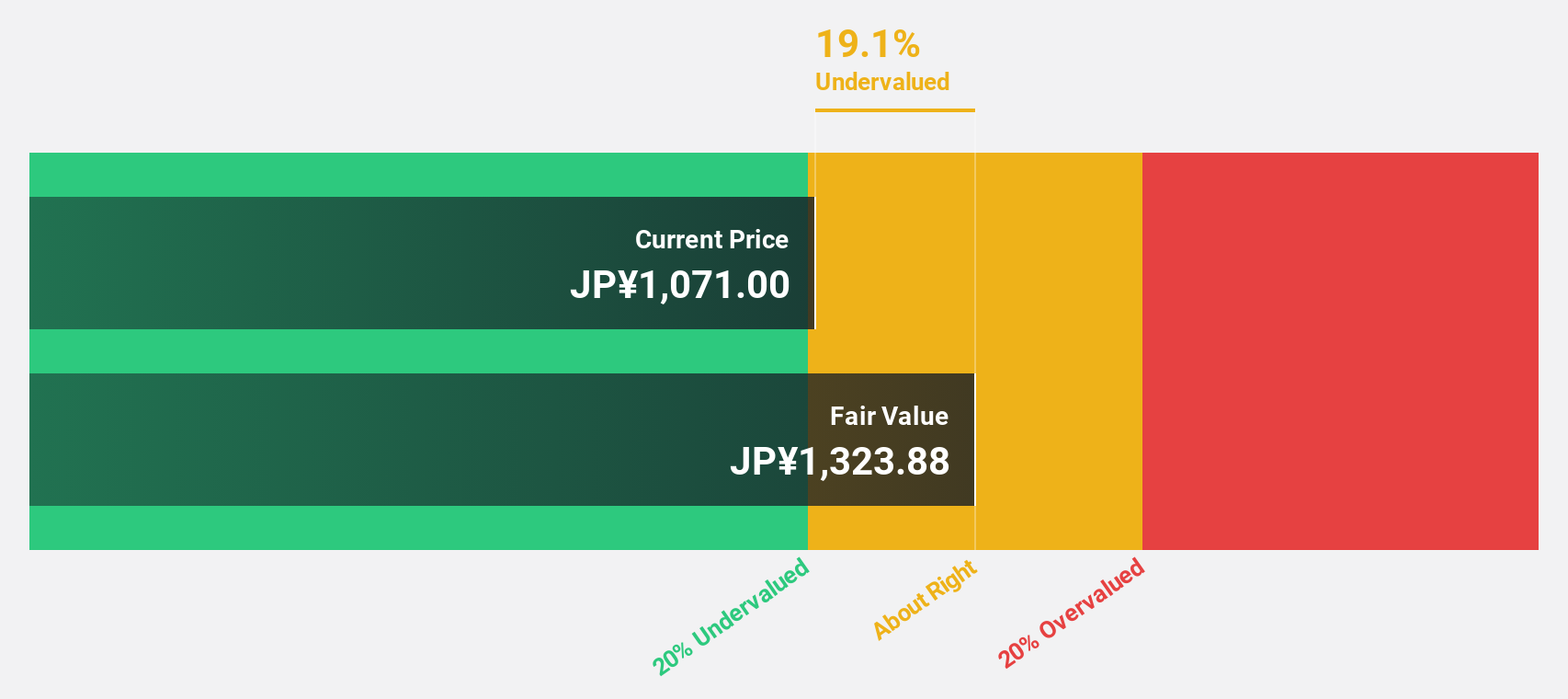

Estimated Discount To Fair Value: 37%

Comture Corporation, priced at ¥1850, is valued below its fair value of ¥2935.85, indicating a potential undervaluation by over 20%. With expected revenue and earnings growth of 10.9% and 12.3% respectively, it outperforms the Japanese market projections. However, its dividend history shows inconsistency despite recent dividend increases to ¥12 per share quarterly. Recent board changes could impact governance and oversight positively. Forecasted high Return on Equity of 20.7% in three years suggests strong profitability ahead.

- In light of our recent growth report, it seems possible that Comture's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Comture's balance sheet health report.

Taiyo Yuden (TSE:6976)

Overview: Taiyo Yuden Co., Ltd. is a global manufacturer and seller of electronic components, operating primarily in Japan, China, and Hong Kong, with a market capitalization of approximately ¥511.59 billion.

Operations: The company generates ¥322.65 billion from its Electronic Components Business.

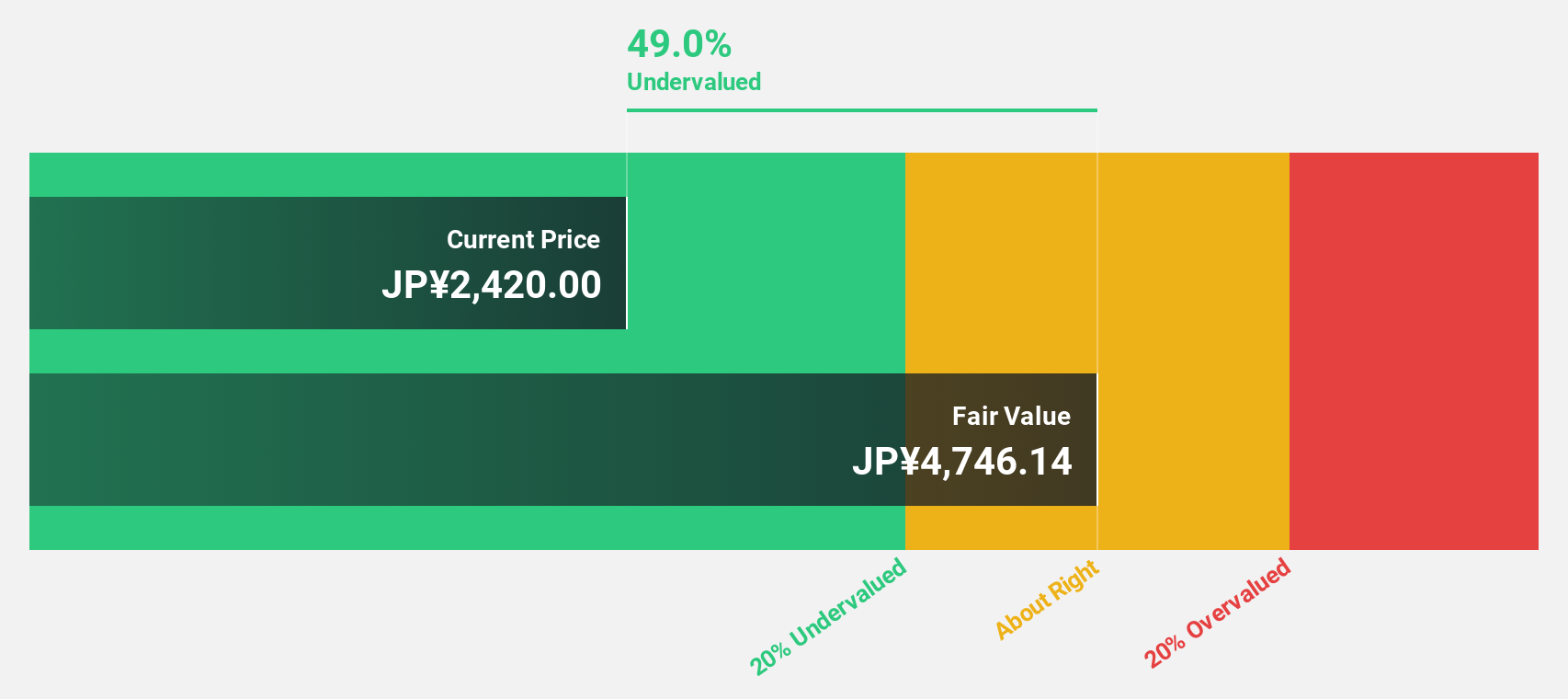

Estimated Discount To Fair Value: 24.5%

Taiyo Yuden, trading at ¥4105, appears undervalued with a fair value estimate of ¥5440.65, suggesting a significant discount. Despite robust forecasted earnings growth of 28.1% annually, challenges persist with low profit margins at 2.6%, down from last year's 7.3%. Additionally, the dividend yield of 2.19% is poorly supported by earnings and cash flows, raising sustainability concerns despite consistent payouts projected for FY2025. Recent board decisions to dispose of treasury stock could influence future financial flexibility and shareholder returns.

- Our growth report here indicates Taiyo Yuden may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Taiyo Yuden.

Where To Now?

- Discover the full array of 93 Undervalued Japanese Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Taiyo Yuden is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6976

Taiyo Yuden

Develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally.

Excellent balance sheet with reasonable growth potential.