- Japan

- /

- Trade Distributors

- /

- TSE:9991

Gecoss (TSE:9991) Profit Margins Rebound, Reinforcing Narrative of Improving Efficiency

Reviewed by Simply Wall St

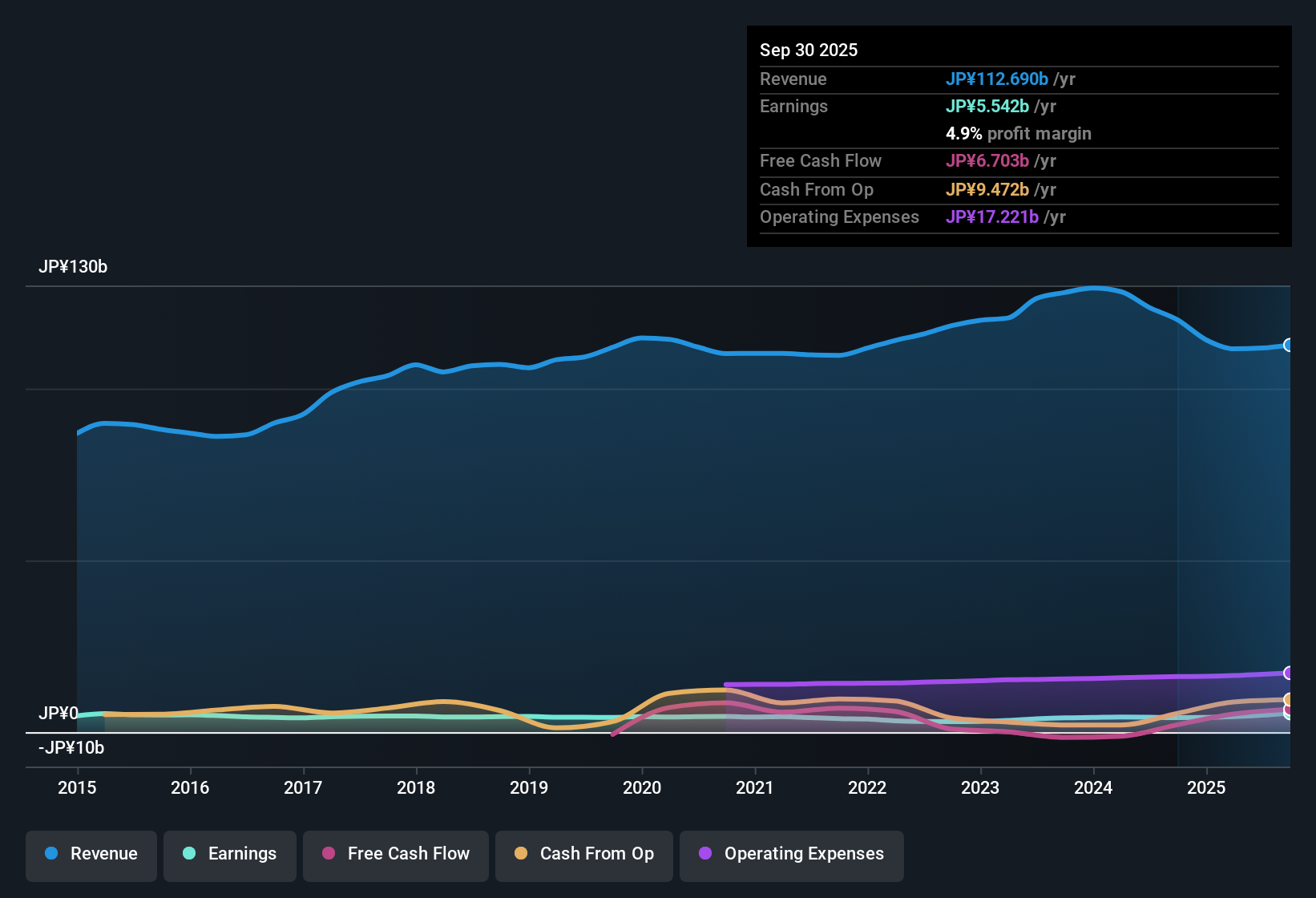

Gecoss (TSE:9991) reported net profit margins of 4.9%, up from 3.5% last year, highlighting an improvement in profitability. Earnings jumped 30.6% year-over-year, notably outpacing the company’s 5-year annual growth average of 3.9%. This strong momentum is underpinned by consistently high-quality earnings. For investors, these results may strengthen the case for Gecoss’s valuation, as the company trades at a price-to-earnings ratio of 8.3x, which is below the Japanese Trade Distributors industry average and its peers. Its current share price of ¥1,373 remains well below estimated fair value.

See our full analysis for Gecoss.Next, we will put these headline figures up against the prevailing narratives. Sometimes the numbers confirm the story, and sometimes they turn it on its head.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Rebound to 4.9%

- Net profit margins climbed to 4.9% from 3.5% last year, marking a significant jump in profitability over the past twelve months that goes beyond the company’s longer-term annual average of 3.9%.

- What stands out is how the latest margin increase strongly supports the narrative that Gecoss’s business model is becoming more efficient. For example:

- Year-on-year profit margin expansion has outpaced the historical five-year trend, a key signal for investors watching for operational improvement.

- The sharp margin improvement helps explain why the company’s earnings grew much faster this year than its longer-term average, reinforcing confidence in management’s recent strategy.

Dividend Sustainability Flags Caution

- The company’s filings highlight dividend sustainability as a risk area to monitor, serving as a reminder that past profit growth does not always guarantee continued high payouts.

- Critics note that even with profits rising by 30.6% this year, vigilance is warranted because:

- Sustainability of dividends is not directly tied to profit margin gains, and investors could face disappointment if cash flows or policy shift even as margins improve.

- The attention on dividend risks challenges any overly optimistic narrative, in contrast to the positive earnings trends noted elsewhere in the report.

Shares Trade Well Below DCF Fair Value

- Gecoss is currently trading at ¥1,373 per share, which is substantially below its DCF fair value estimate of ¥3,420.50. This highlights a sizeable gap between the current price and fundamental valuation.

- The difference between share price and fair value adds weight to claims that the company may be undervalued by the market. For example:

- Its price-to-earnings ratio of 8.3x is at a notable discount compared to peers and the broader Japanese Trade Distributors industry average of 10x, signaling potential upside if the market rerates the stock.

- Persistent undervaluation relative to fair value and industry metrics is likely to catch the attention of investors seeking value opportunities supported by strong profit trends.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Gecoss's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Gecoss’s growth and margins look impressive, dividend sustainability remains a concern. This could disappoint income-focused investors if policies or cash flows shift.

If you want more reliable income for your portfolio, check out these 2003 dividend stocks with yields > 3% to discover companies offering higher-yielding dividends and greater payout stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9991

Gecoss

Gecoss Corporation rents and sells construction machinery and steel products in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives