How Revised Forecasts and Dividend Updates at MISUMI Group (TSE:9962) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On October 31, 2025, MISUMI Group Inc. held a board meeting and announced revisions to its full-year consolidated business forecast for the fiscal year ending March 2026, citing steady performance from the newly consolidated Fictiv Inc. and favorable foreign exchange trends.

- The company also introduced interim dividend changes and updated its year-end dividend outlook, emphasizing a commitment to balancing growth investment with shareholder returns as part of its long-term capital efficiency plan.

- We'll explore how the successful integration of Fictiv Inc. and changes to dividend policy influence the company's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is MISUMI Group's Investment Narrative?

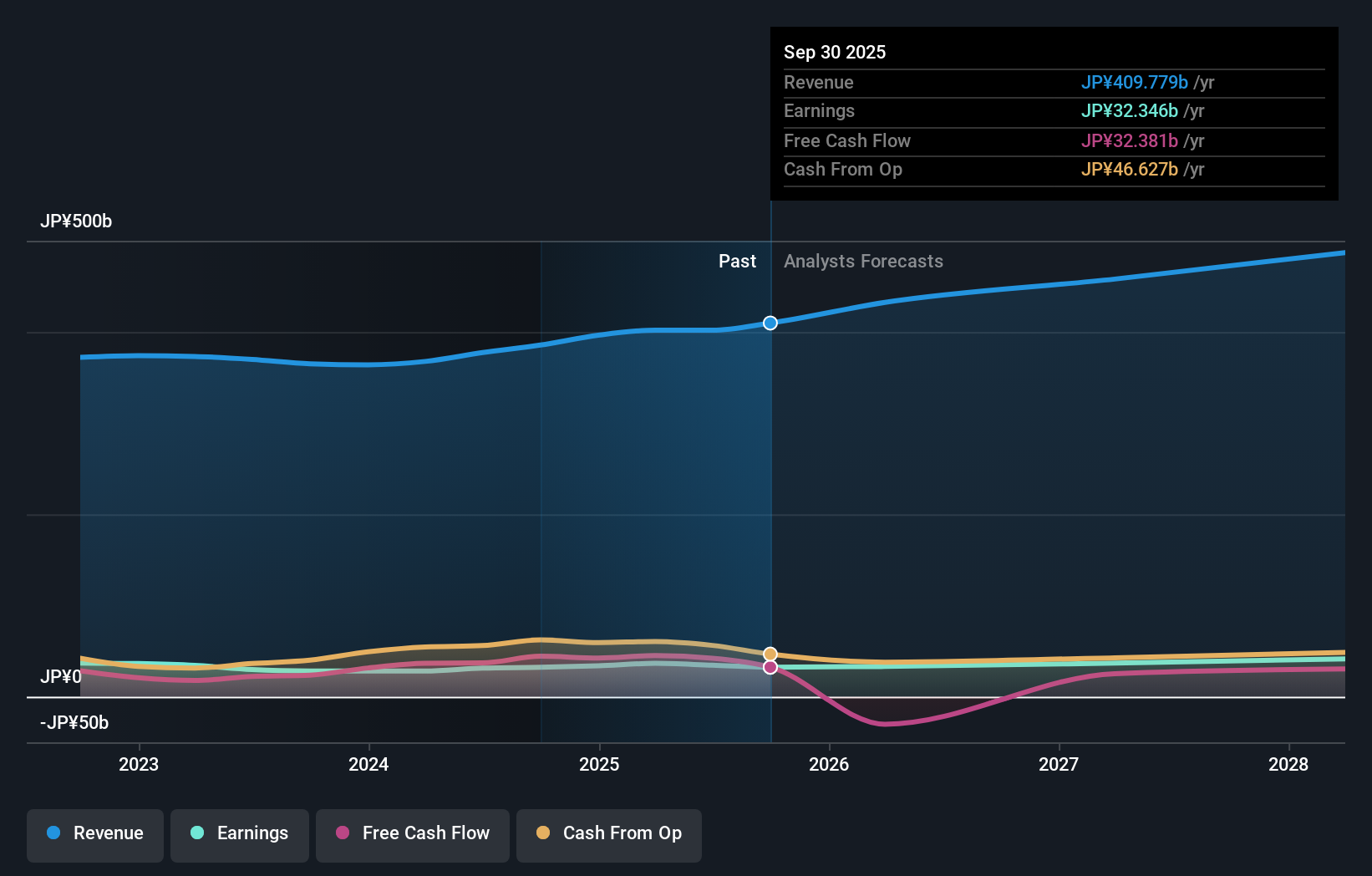

For anyone considering MISUMI Group, the big picture centers on its ability to transform manufacturing services through a broad platform and ongoing innovation, with recent moves, like the integration of Fictiv, serving as a real test of that strategy. The board’s recently announced upward revision to the full-year forecast suggests immediate momentum, despite half-year results showing some profit pressure and ongoing headwinds from the automotive sector and international markets. In the short term, successful consolidation of Fictiv and disciplined use of foreign exchange gains could help offset some of those risks by supporting the revised sales and income targets. At the same time, the new dividend policy, coupled with a robust buyback, could prop up shareholder confidence, although softer profit margins and weaker earnings growth versus history remain important risks. Still, given the subdued share returns and a valuation discount to consensus price targets, investor sentiment may remain cautious until clearer signs of margin improvement and sustainable profit growth emerge.

On the other hand, keep an eye on those lower operating margins, risks can sometimes hide in the details. MISUMI Group's shares have been on the rise but are still potentially undervalued by 16%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on MISUMI Group - why the stock might be worth just ¥2878!

Build Your Own MISUMI Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MISUMI Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free MISUMI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MISUMI Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9962

MISUMI Group

Engages in the factory automation, die components, and VONA businesses in Japan, China, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives