- Japan

- /

- Trade Distributors

- /

- TSE:9934

Inaba Denki Sangyo (TSE:9934): Assessing Valuation After Buyback, Stock Split, and Dividend Upgrade

Reviewed by Simply Wall St

Inaba Denki Sangyo (TSE:9934) has rolled out several initiatives that are sure to catch investors' eyes. These include a new share buyback, a stock split, and a boost to its second-quarter dividend.

See our latest analysis for Inaba Denki SangyoLtd.

Momentum has been steadily building for Inaba Denki SangyoLtd this year, with recent moves like the buyback and stock split adding fuel to a share price that is now up over 21% year-to-date and delivering a 23.9% total shareholder return over the past twelve months, well ahead of most peers. Looking even further back, shareholders have nearly doubled their money over three years and more than doubled it over five, underscoring strong long-term growth potential as the company continues to announce shareholder-friendly initiatives.

If these latest developments have you thinking bigger, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares already rallying and multiple shareholder-friendly actions in play, the key question now is whether Inaba Denki Sangyo’s current valuation still leaves room for upside or if the market has already accounted for future growth potential.

Price-to-Earnings of 12.4x: Is it justified?

Inaba Denki SangyoLtd currently trades at a price-to-earnings (P/E) ratio of 12.4x, placing it above both its peer average of 8.7x and the broader JP Trade Distributors industry average of 10.1x. This higher multiple suggests the market is assigning a premium to the company compared to comparable businesses, despite steady earnings growth and a robust run-up in share price.

The P/E ratio represents how much investors are willing to pay per yen of the company’s earnings. For trade distributors, this metric is commonly used to gauge whether a stock is expensive relative to its earnings power and sector performance. A higher P/E may indicate the market expects superior growth or unique advantages, yet it can also signal overvaluation if current results do not justify such optimism.

Compared with industry peers, Inaba Denki SangyoLtd’s P/E of 12.4x is notably higher than the JP Trade Distributors sector average of 10.1x and the peer group average of 8.7x. This premium shows the market may be pricing in additional growth or stability, but it also means the bar for sustained outperformance is set higher.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 12.4x (OVERVALUED)

However, changes in industry conditions or slowing earnings growth could quickly alter the company’s premium valuation and test investor confidence in its long-term outlook.

Find out about the key risks to this Inaba Denki SangyoLtd narrative.

Another View: Our DCF Model Suggests Undervaluation

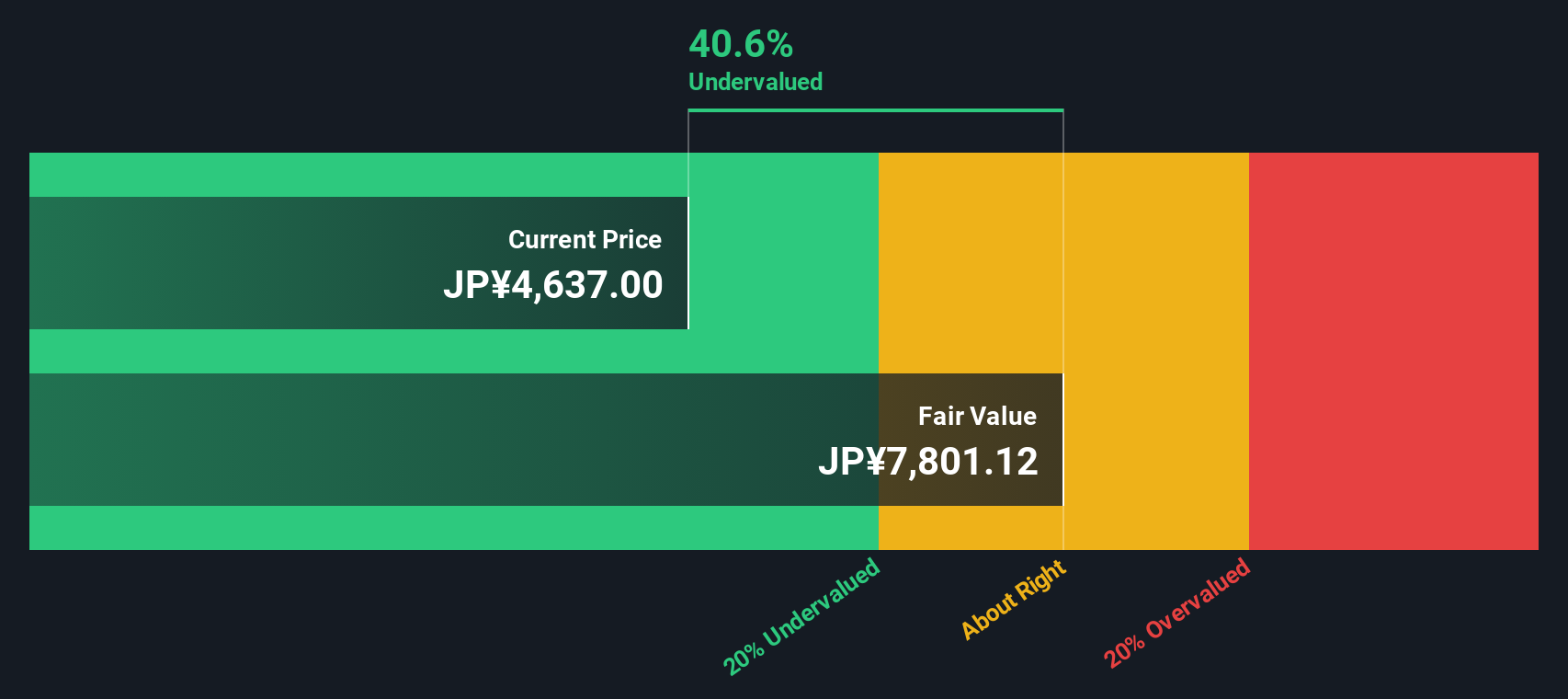

While the price-to-earnings ratio places Inaba Denki SangyoLtd in overvalued territory relative to its industry, our SWS DCF model presents a different perspective. The shares are currently trading about 40.6% below our estimate of fair value, which suggests the market may be underestimating the company's potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Inaba Denki SangyoLtd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 871 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Inaba Denki SangyoLtd Narrative

If you see the numbers differently or want to investigate further on your own, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Inaba Denki SangyoLtd research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Want to stay ahead of the market curve? Start searching for stocks packed with untapped potential using the Simply Wall Street Screener and never let a smart investment pass you by.

- Supercharge your passive income by reviewing these 16 dividend stocks with yields > 3%, which boasts yields above 3% and strong underlying fundamentals.

- Ride the AI revolution and uncover the next big trend by checking out these 24 AI penny stocks, which are poised for tech-driven growth.

- Unlock value with these 871 undervalued stocks based on cash flows, which stands out thanks to attractive cash flow-driven pricing signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9934

Inaba Denki SangyoLtd

Sells electrical equipment and materials, industrial automation, and proprietary products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives