- Japan

- /

- Trade Distributors

- /

- TSE:9932

Sugimoto & Co., Ltd. (TSE:9932) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

Sugimoto & Co., Ltd. (TSE:9932) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The last month has meant the stock is now only up 7.7% during the last year.

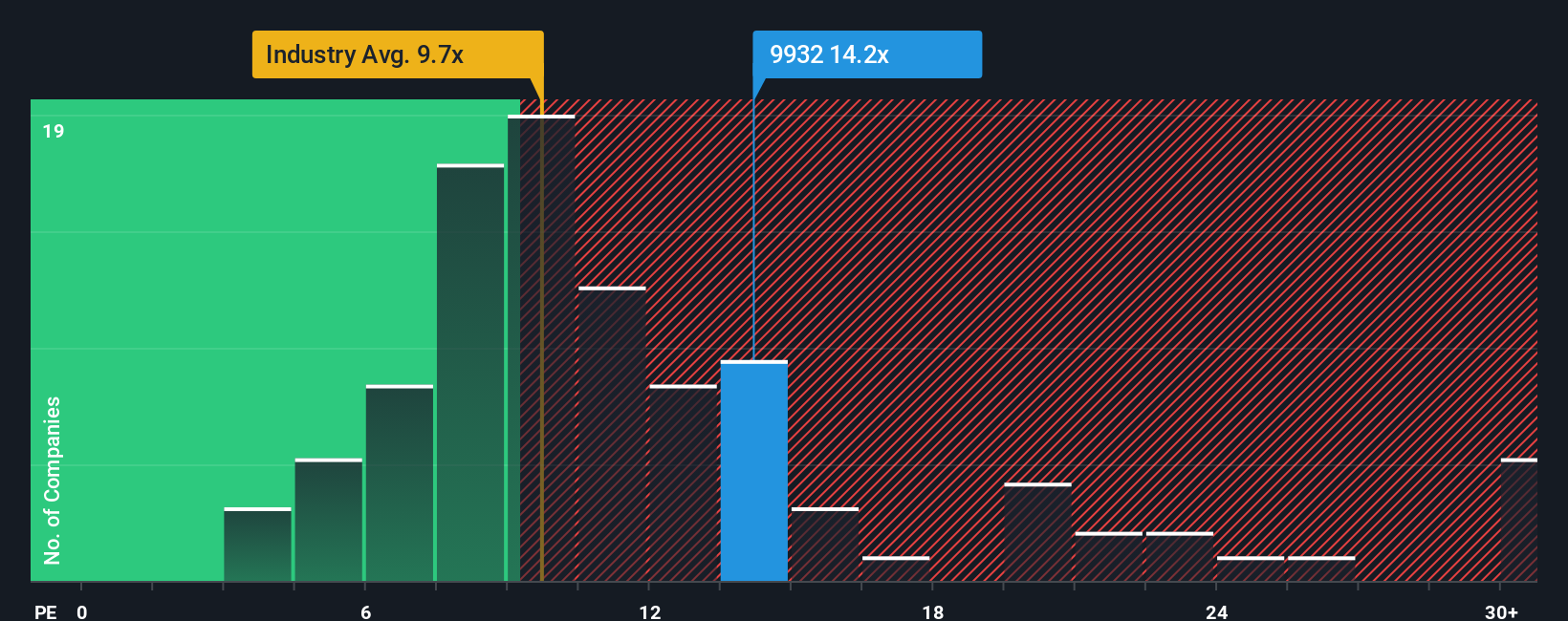

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Sugimoto's P/E ratio of 14.2x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Earnings have risen at a steady rate over the last year for Sugimoto, which is generally not a bad outcome. One possibility is that the P/E is moderate because investors think this good earnings growth might only be parallel to the broader market in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

See our latest analysis for Sugimoto

How Is Sugimoto's Growth Trending?

In order to justify its P/E ratio, Sugimoto would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.2% last year. The latest three year period has also seen a 23% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 9.1% shows it's about the same on an annualised basis.

With this information, we can see why Sugimoto is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From Sugimoto's P/E?

With its share price falling into a hole, the P/E for Sugimoto looks quite average now. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Sugimoto revealed its three-year earnings trends are contributing to its P/E, given they look similar to current market expectations. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Sugimoto is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9932

Sugimoto

Engages in the sale, import, and export of machinery and apparatus in Japan and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives