- Japan

- /

- Trade Distributors

- /

- TSE:9845

Parker (TSE:9845) Margin Jump Reinforces Bullish Narrative on Profitability

Reviewed by Simply Wall St

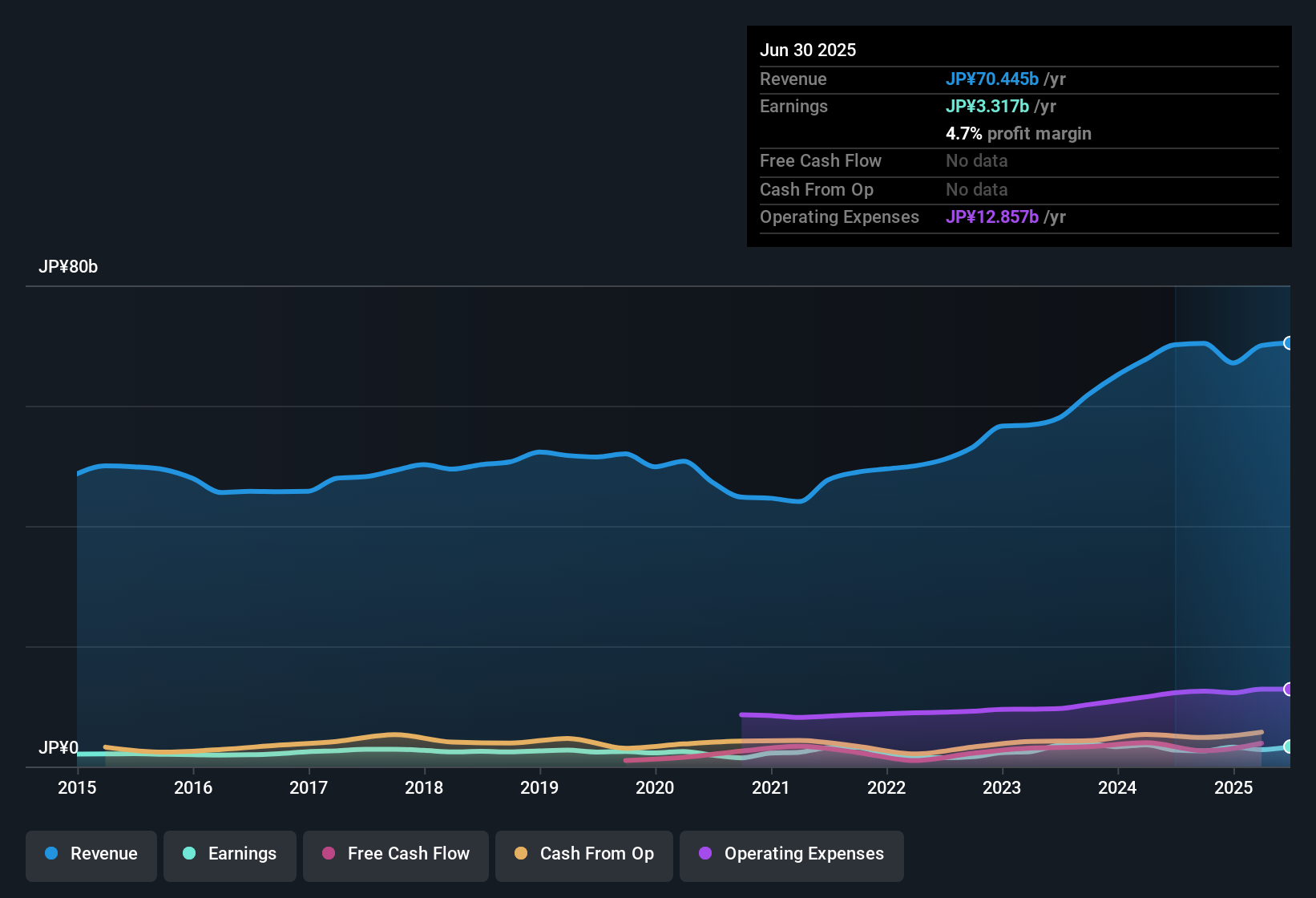

Parker (TSE:9845) posted a net profit margin of 4.7%, rising from 3.9% last year, as EPS soared with 21.5% growth over the past year. The company’s five-year record of 10.3% annualized earnings growth underscores its consistent profit expansion. Trading at ¥1187 per share, which is well below the estimated fair value and with a lower Price-to-Earnings Ratio than industry peers, Parker’s latest results offer investors the appealing combination of margin gains and valuation headroom. However, some caution remains regarding the sustainability of its dividend.

See our full analysis for Parker.Next, we’ll see how these figures compare to the narratives that typically shape investor sentiment. Some perspectives may be confirmed, while others could be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Run Beats the Five-Year Pace

- Parker’s latest net profit margin landed at 4.7%, which not only marks a year-on-year improvement from 3.9% but also stands out relative to its five-year average of 10.3% earnings growth per year. This signifies that margin gains have steadily contributed to long-term profit expansion.

- In the prevailing market view, the pace of annual earnings growth now surpasses even its historical average. This strongly supports optimistic views that Parker’s profitability expansion is running ahead of schedule and adds fuel for continued momentum.

- 21.5% earnings growth for the year outperformed the company’s 10.3% five-year CAGR.

- Margin improvement potentially signals higher-quality earnings, challenging the notion that the company’s past gains might fade.

Dividend Sustainability Flagged as a Key Risk

- The major risk noted for Parker’s outlook is the sustainability of its dividend, which is the only flagged issue in the latest disclosures and has become a focal point for investors evaluating future cash flow reliability.

- According to the prevailing market view, this single risk highlights a potential tension for income-focused shareholders, who may be concerned that stable profits will not necessarily translate into secure dividends.

- Even as net margins expand and earnings rise, there is explicit caution in the filings regarding consistent dividend payments ahead.

- Dividend sustainability risk remains present despite the strength in headline profitability figures and serves as a counterweight to an otherwise positive run.

Valuation Offers Unusual Discount to DCF Fair Value

- With shares trading at ¥1,187, Parker is currently priced at a steep 63% discount to its DCF fair value (¥3,237.58). Its Price-to-Earnings Ratio of 9x is meaningfully lower than peer and industry averages (10.7x and 10.1x), pointing to a low market valuation despite high-quality earnings.

- The prevailing market view suggests that this valuation disconnect creates room for upside if investors begin to re-rate Parker toward its intrinsic worth. However, sharp discounts can also signal skepticism about growth durability or the flagged dividend risk.

- Trading well below calculated fair value is not common for stocks with Parker’s profit trajectory, which could attract value-oriented buyers.

- A persistent discount may imply that some investors remain cautious about risks that are not immediately visible in earnings results.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Parker's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Parker’s robust earnings and margin gains, concerns about the sustainability of its dividend make its income outlook less dependable for investors.

For steadier payouts and greater peace of mind, consider these 1985 dividend stocks with yields > 3%, which consistently deliver stronger, more reliable dividends even in changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9845

Parker

Provides product development, manufacturing, sales, and technical services for the automobiles, electrical machinery, chemicals, steel, electronics, food, etc.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives