- Japan

- /

- Trade Distributors

- /

- TSE:9830

Trusco Nakayama (TSE:9830) Earnings Forecast Reinforces Bullish Narrative With Growth Outpacing Market

Reviewed by Simply Wall St

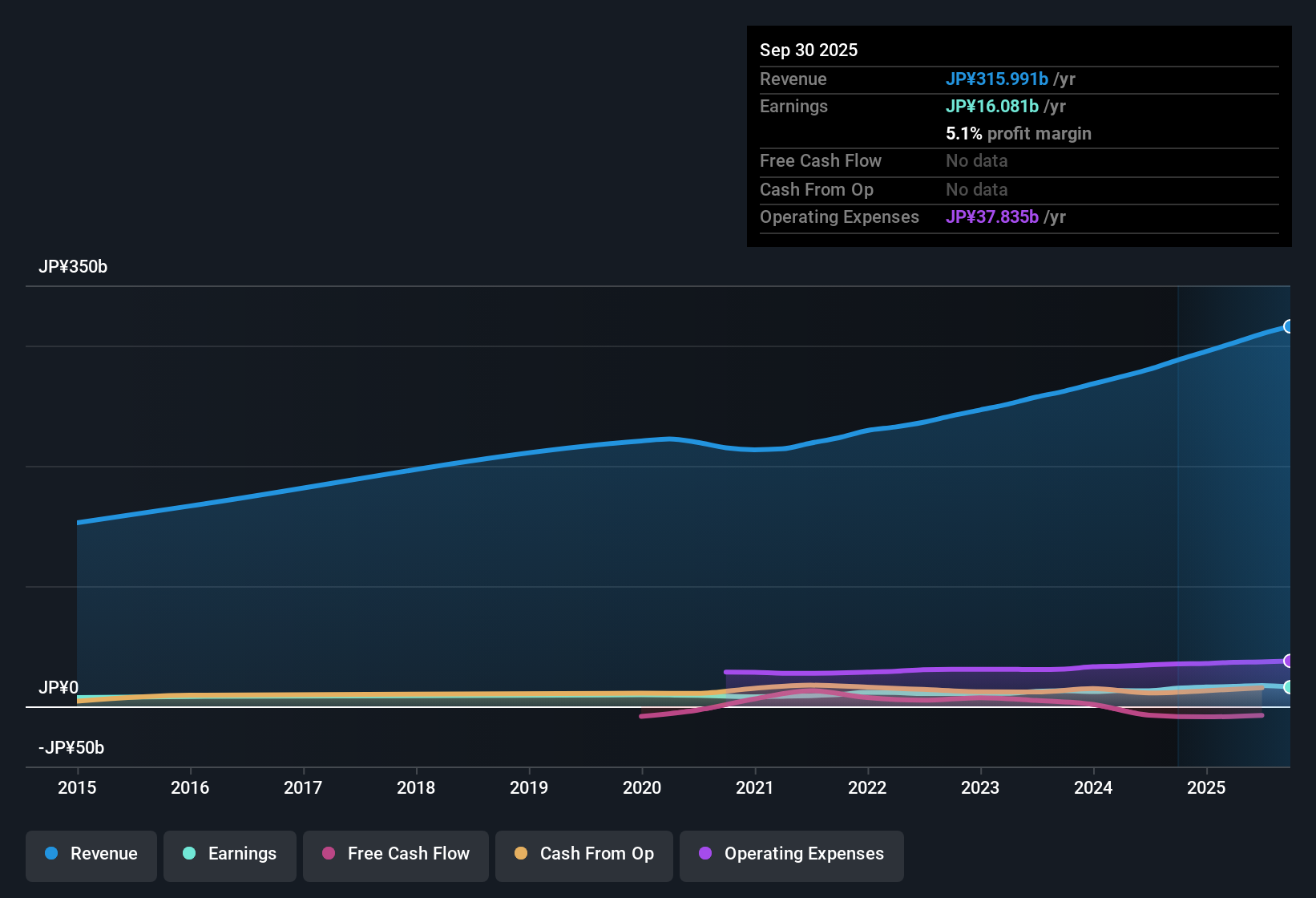

Trusco Nakayama (TSE:9830) has delivered consistent performance, with earnings growing by 14.3% annually over the past five years and a recently reported growth rate of 6.5% for the last year. Looking ahead, the company projects annual earnings growth of 8.9% and revenue growth of 7.5%, both notably ahead of the broader Japanese market’s expectations. Investors will be monitoring these growth rates and the company’s net profit margin of 5.1%, which has slightly dipped from 5.2% last year, for further signs of momentum.

See our full analysis for Trusco Nakayama.Next, we will see how these results compare with what the market has been expecting and whether the latest numbers reinforce or challenge key narratives.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Resilient Despite Cost Pressures

- Net profit margin holds at 5.1%, showing only a slight decline from last year’s 5.2%, despite sector-wide input and distribution cost challenges cited in recent coverage.

- What’s surprising is that stable margins heavily support the view that Trusco’s logistics investments are helping defend profitability even as labor shortages and competition rise in Japan’s industrial supply sector.

- Bulls highlight that incremental margin dips are modest, backing the belief that operational efficiency and robust supply chains are offsetting inflationary headwinds.

- This resilience aligns with narrative claims that the company’s investments in its distribution network and digital upgrades should provide downside protection relative to sector peers facing steeper margin compression.

Forecasts Outpace the Market’s Expectations

- Management projects annual earnings growth of 8.9% and revenue growth of 7.5%, which are meaningfully above the Japanese market’s expected 7.8% earnings and 4.5% revenue growth.

- The prevailing view is that these above-market forecasts echo confidence in Trusco’s ongoing market share capture and the credibility of its stable compounder reputation.

- Steady historical earnings growth of 14.3% per year over five years gives weight to management’s outlook, suggesting past execution could continue anchoring future gains.

- Yet, some investors remain watchful for signs that sector headwinds, such as labor shortages or cost inflation, might eventually drag on these above-consensus targets.

Valuation Attractive Relative to Peers

- Shares trade at 10x earnings, undercutting both the industry average of 10.1x and peer group’s 10.7x. The shares also sit far below the DCF fair value of ¥18,356.67 versus the current share price of ¥2,434.00.

- The prevailing perspective is that this valuation gap heavily supports the quality- and value-focused bull case, as Trusco’s combination of consistent profitability and discounted pricing is rare among large Japanese industrial suppliers.

- The market’s failure to re-rate the stock despite decades of stable earnings and above-market growth forecasts creates a potential disconnect savvy investors may look to exploit.

- Meanwhile, the only official risk noted relates to dividend sustainability, which has not yet materially dented sentiment given strong underlying earnings metrics.

To see what’s behind these figures and how the community narrative frames Trusco Nakayama’s edge, check the full consensus commentary for more on where the story might go next. 📊 Read the full Trusco Nakayama Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Trusco Nakayama's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Trusco Nakayama’s only prominent concern is its flagged dividend sustainability. This could worry income-focused investors despite strong fundamentals elsewhere.

If steady and reliable payouts are a priority for your portfolio, check out these 2001 dividend stocks with yields > 3% to find companies with robust dividend yields and proven staying power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trusco Nakayama might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9830

Trusco Nakayama

Engages in the wholesale of machine tools, and other equipment in Japan and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives