- Japan

- /

- Trade Distributors

- /

- TSE:8285

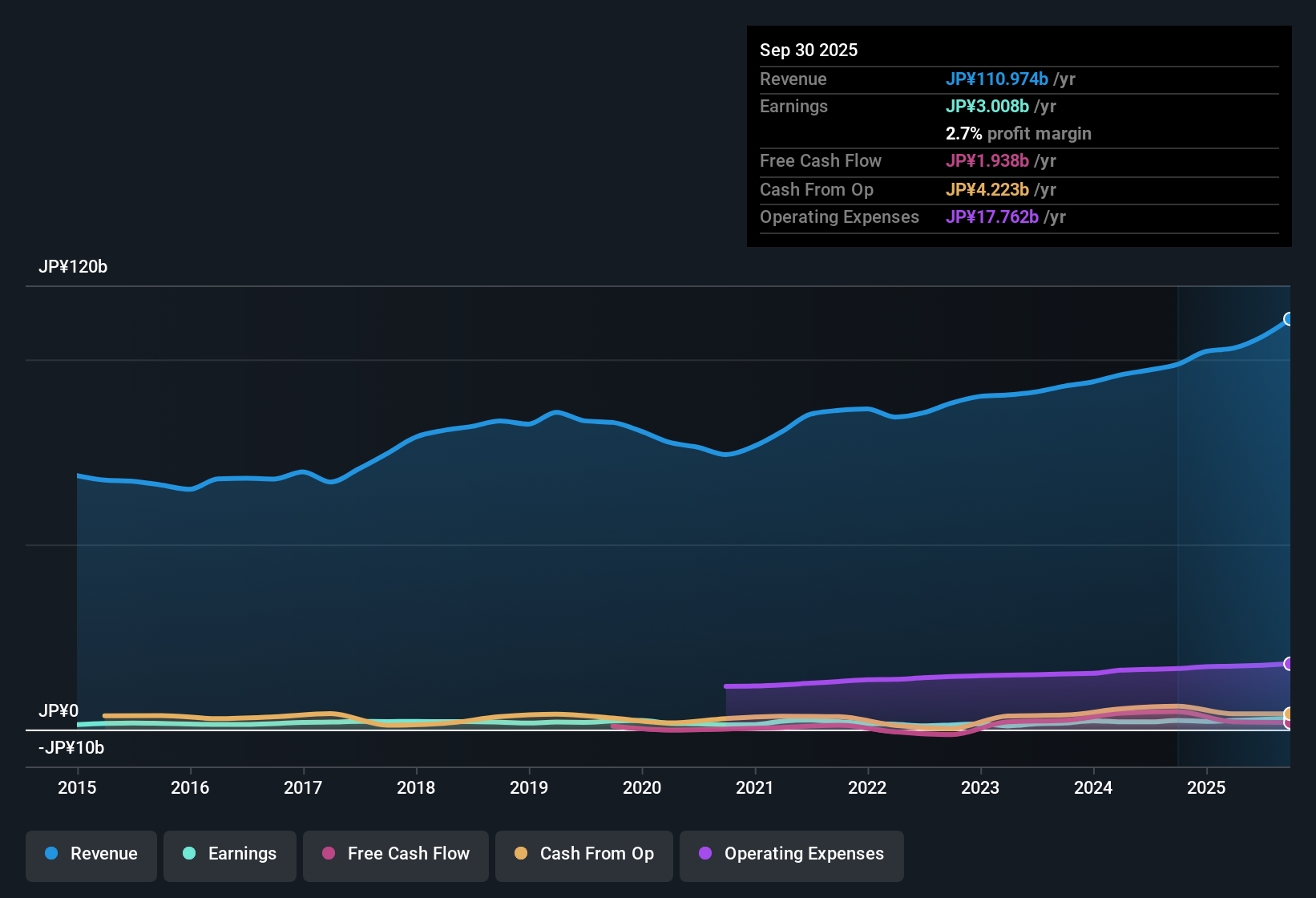

Mitani Sangyo (TSE:8285) Margin Expansion Reinforces Narrative of High-Quality, Consistent Earnings Growth

Reviewed by Simply Wall St

Mitani Sangyo (TSE:8285) posted a net profit margin of 2.7% for the most recent period, up from 2.5% a year earlier. Earnings surged 22% year-over-year, handily beating its five-year annual average growth of 11.2%. At the current share price of ¥499, investors are likely weighing the upside, given that the company trades at a 10.2x Price-To-Earnings Ratio and offers an attractive dividend, all while generating consistently high-quality profits and profit or revenue growth.

See our full analysis for Mitani Sangyo.Next up, we will set these headline numbers against the prevailing narratives in the market to see where the story strengthens or gets challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Inch Higher as Profits Stay High Quality

- Net profit margin rose to 2.7% from 2.5% the prior year, marking a small but steady expansion in profitability not always seen in the sector.

- The prevailing market view argues that this steady margin improvement backs Mitani Sangyo’s reputation as a stable player adapting to sector change, with high-quality earnings now supported by five consecutive years averaging 11.2% profit growth.

- Despite earnings growth running noticeably ahead of its long-term average this year, the underlying margin expansion suggests the business remains resilient rather than volatile.

- What is surprising is that these margin gains come as the industry faces transformation pressures, so bulls can point to management consistency and proven execution during shifting market conditions.

Peer-Beating Valuation Adds to Upside Case

- Shares trade at a Price-To-Earnings Ratio of 10.2x, below the peer average of 11.4x. The current price of ¥499 stands at a substantial discount to the DCF fair value estimate of ¥675.32.

- The prevailing market view highlights how this valuation gap makes Mitani Sangyo relatively attractive when fundamentals are strong and sector sentiment is steady.

- With reliable profit growth and an attractive valuation relative to both peers and intrinsic value, investors may see less downside risk compared to stocks trading at a premium.

- This margin of safety is further supported by an established dividend, rounding out the value proposition for those focused on both income and growth.

Dividend and Growth Support a Constructive Outlook

- The dividend is described as attractive, and combined with ongoing profit or revenue growth above the five-year annual average, it enhances the case for income-oriented investors.

- The prevailing market view suggests that even in a sector facing incremental change, the company’s blend of steady growth and dividend reliability bolsters confidence in a measured, constructive outlook.

- What stands out is a lack of flagged risks, allowing investors to focus on tangible rewards like profitability and value, without distractions from negative surprises.

- This sets up a “wait and see” approach for some, while others may choose to act now as the fundamentals align cleanly with the company’s current valuation.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Mitani Sangyo's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong profit growth and an appealing valuation, Mitani Sangyo’s narrow margins and modest scale may limit the pace or consistency of future gains.

If you want more reliable profitability over the long haul, use our stable growth stocks screener (2101 results) to discover companies that consistently deliver steady earnings and revenue expansion cycle after cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8285

Mitani Sangyo

Engages in chemicals, resin, electronics, information systems, air conditioning systems, housing equipment, energy businesses in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives