- Japan

- /

- Trade Distributors

- /

- TSE:8081

Kanaden (TSE:8081) Earnings Boosted by ¥1.1 Billion One-Off Gain, Pressuring Growth Narrative

Reviewed by Simply Wall St

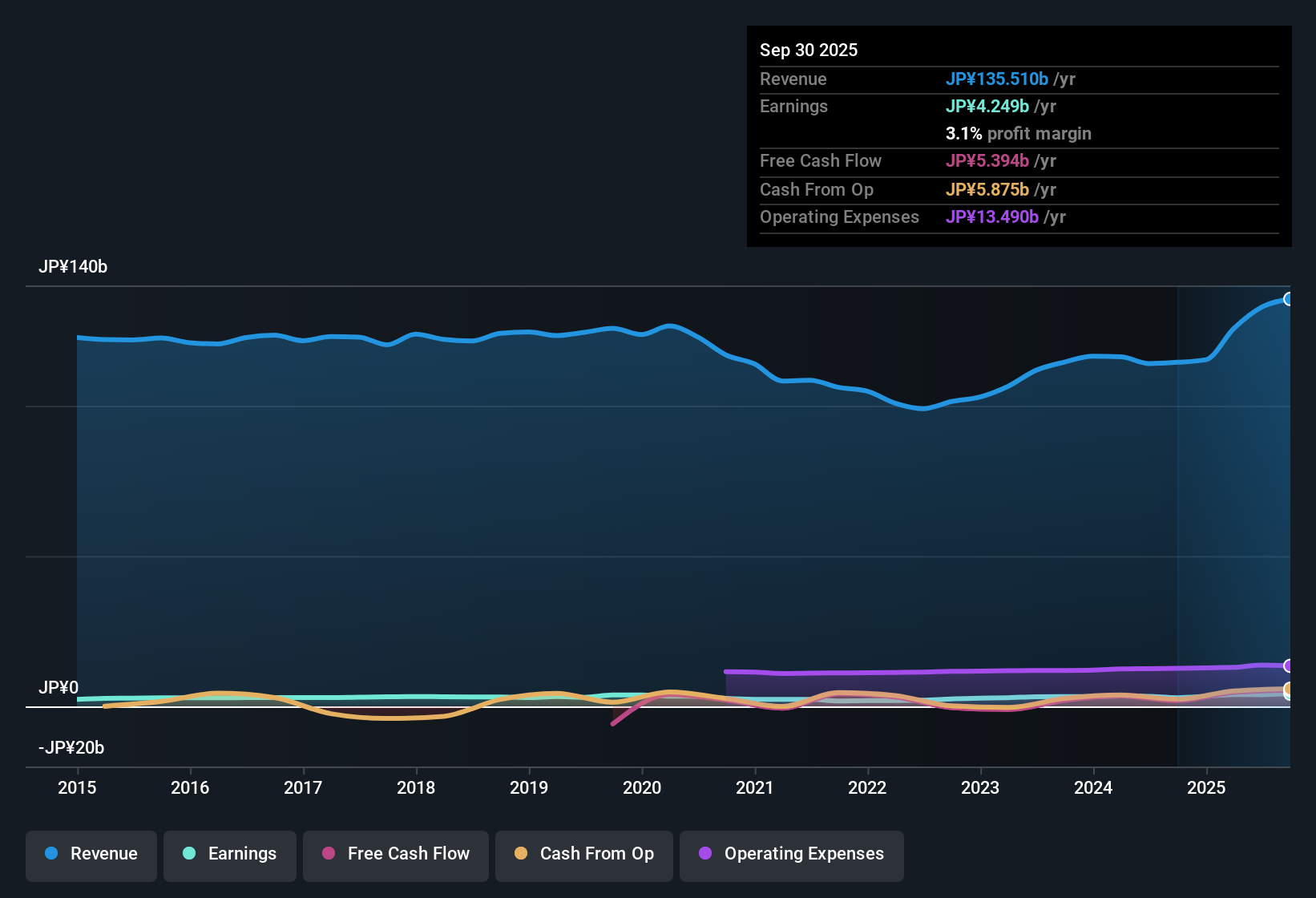

Kanaden (TSE:8081) delivered net profit margins of 2.9%, matching last year's level. Earnings grew 17.4% in the latest period, outpacing the company's five-year average growth of 13.1% per year, and benefited from a notable one-off gain of ¥1.1 billion, which boosted recent results above the usual trend. With the share price at ¥2,031, still well below an estimated fair value of ¥4,286.7 but trading at a higher P/E ratio than its peers, investors are weighing historical growth and apparent value against the sustainability and quality of earnings driven by these exceptional items.

See our full analysis for Kanaden.Now, let's see how these results hold up against the prevailing market narratives. Some expectations may get reinforced, while others could be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-off Gain Adds ¥1.1 Billion Lift

- The most recent results included a significant one-time gain of ¥1.1 billion, which was a temporary factor not present in previous years and inflates the headline growth figure.

- Even with this boost, the narrative highlights that Kanaden’s operational performance remains steady but may not be as strong as the headline earnings suggest.

- The 17.4% annual growth rate outpaces the five-year average of 13.1%, but without the non-recurring gain, true underlying growth would likely be lower.

- It is notable that margins held at 2.9% despite this outsized item, indicating that profitability outside of normal operations was the biggest swing factor in the period.

P/E Hits 11.6x, Peer Premium Despite Discount to Fair Value

- Kanaden’s price-to-earnings multiple stands at 11.6x, running above the Japanese distributor average of 10.1x and well above the peer group’s 9.3x, even though the current share price of ¥2,031 is still trading at less than half the DCF fair value estimate of ¥4,286.70.

- The prevailing market view points to tension between the stock’s perceived “bargain” level under discounted cash flow and its clear premium to industry norms.

- Investors searching for a classic value play might question if the recent results justify paying more for Kanaden than its peers in the sector.

- While bulls may see fair value upside, the higher P/E suggests market optimism is already priced in, especially if future results drop back to the long-term trend once one-offs unwind.

Five-Year Growth Outpaces Sector, But Sustainability in Focus

- Kanaden has averaged 13.1% profit growth per year over the last five years, illustrating a solid track record that outpaces many industry peers.

- The narrative underscores that while historical growth supports the bullish thesis around operational quality,

- Investors must weigh whether the company can maintain this higher trajectory without recurring one-time gains like the recent ¥1.1 billion item.

- Steady margins and regular growth provide comfort, but any decline in non-recurring boosts will put the business’s core momentum to the test.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kanaden's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Kanaden’s reliance on one-off gains clouds the true pace of its growth and raises questions about the sustainability of earnings above the industry average.

If steady performance matters more to you, use our stable growth stocks screener (2083 results) to discover companies delivering consistent results year after year, no surprises required.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kanaden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8081

Kanaden

Operates as an electronics solutions company in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives