As global markets react to the recent U.S. election results, with small-cap indices like the Russell 2000 leading gains, investors are optimistic about potential growth fueled by anticipated policy changes and economic stimuli. Amidst this dynamic backdrop, identifying promising small-cap stocks that can capitalize on these trends becomes crucial for portfolio diversification and potential long-term growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Citra Tubindo | NA | 9.17% | 14.32% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Tibet Development (SZSE:000752)

Simply Wall St Value Rating: ★★★★★★

Overview: Tibet Development Co., Ltd. focuses on the production and sale of beer in China, with a market capitalization of CN¥2.09 billion.

Operations: Tibet Development generates revenue primarily from its beer segment, totaling CN¥389.61 million. The company operates with a market capitalization of CN¥2.09 billion.

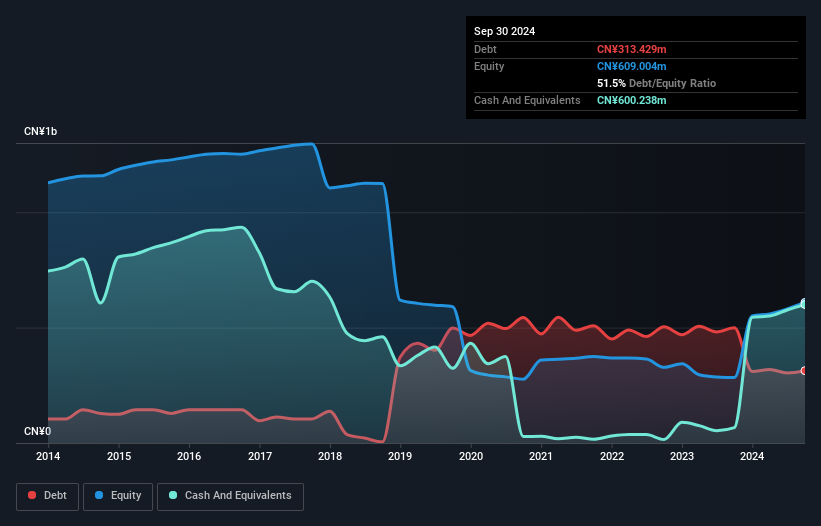

Tibet Development, a small-cap player, has shown promising signs of growth recently. For the nine months ending September 2024, sales reached CNY 299.46 million, up from CNY 245.88 million the previous year. Net income swung to a positive CNY 23.99 million from a loss of CNY 53.37 million last year, indicating a significant turnaround in profitability. Basic earnings per share improved to CNY 0.091 compared to a loss per share of CNY 0.2 previously, reflecting enhanced operational efficiency and financial health despite ongoing industry challenges and competitive pressures in its sector.

- Unlock comprehensive insights into our analysis of Tibet Development stock in this health report.

Understand Tibet Development's track record by examining our Past report.

Smaregi (TSE:4431)

Simply Wall St Value Rating: ★★★★★★

Overview: Smaregi, Inc. is engaged in planning, designing, developing, and providing Internet services with a market capitalization of ¥61.55 billion.

Operations: The primary revenue stream for Smaregi comes from its Cloud Service Business, generating ¥9.09 billion.

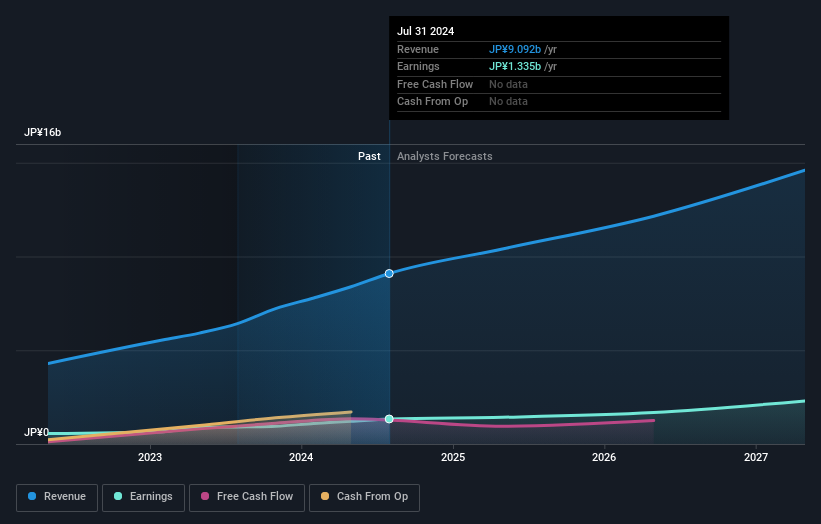

Smaregi, a nimble player in the tech space, is catching eyes with its robust performance. Over the past year, earnings shot up by 46.9%, outpacing the broader Software industry's 14.7% growth rate. This reflects strong operational execution and market positioning. The company's debt-free status indicates prudent financial management, eliminating concerns over interest payments or leverage risks. Despite a highly volatile share price recently, Smaregi's high-quality earnings signal underlying business strength. Looking ahead, projected annual earnings growth of 18.69% suggests potential for continued upward momentum in this competitive sector.

- Navigate through the intricacies of Smaregi with our comprehensive health report here.

Evaluate Smaregi's historical performance by accessing our past performance report.

Seika (TSE:8061)

Simply Wall St Value Rating: ★★★★★★

Overview: Seika Corporation is engaged in the import, sale, and export of plants, machinery, and environmental protection and electronic information system equipment across Asia, Europe, the United States, and other international markets with a market cap of ¥52.84 billion.

Operations: Seika generates revenue primarily through the import, sale, and export of plants, machinery, and environmental protection and electronic information system equipment. The company has a market cap of ¥52.84 billion.

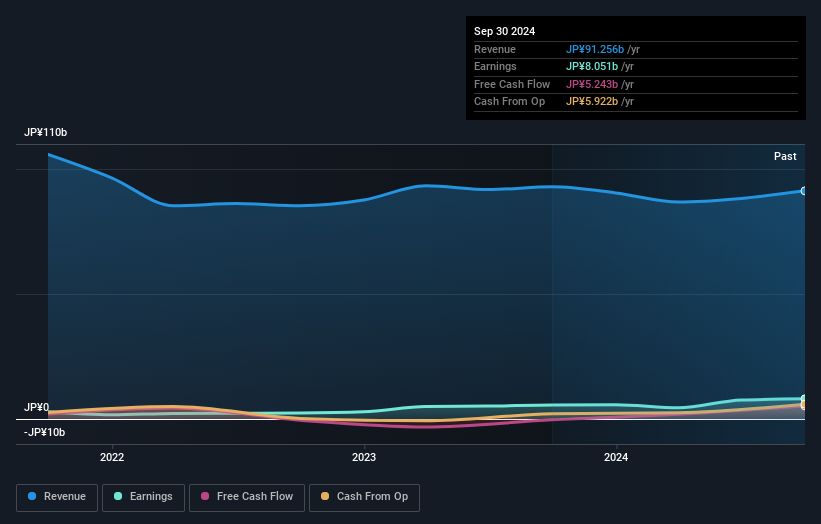

Seika, a compact player in its field, is showing promising signs with a price-to-earnings ratio of 6.9x, significantly under the JP market average of 13.5x, suggesting potential undervaluation. The company has impressively reduced its debt-to-equity ratio from 31.7% to just 0.05% over five years, indicating effective financial management and lower risk exposure. Earnings have surged by 47%, outpacing the industry’s growth rate of 4.9%, reflecting robust operational performance despite a ¥2.9 billion one-off gain impacting recent results. With more cash than total debt and positive free cash flow, Seika appears financially sound ahead of its upcoming earnings release on Nov 12th.

Seize The Opportunity

- Access the full spectrum of 4670 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000752

Flawless balance sheet with proven track record.