- Japan

- /

- Trade Distributors

- /

- TSE:8058

A Closer Look at Mitsubishi (TSE:8058)’s Valuation After a Strong Year for Shareholders

Reviewed by Simply Wall St

Mitsubishi (TSE:8058) shares have seen modest movement lately. The stock closed at ¥3,618, with roughly flat returns over the past month. Investors may be eyeing recent numbers for fresh clues on the company’s direction.

See our latest analysis for Mitsubishi.

Mitsubishi’s momentum has cooled a bit after a remarkable year, with a 39.7% share price return year-to-date and a staggering 41.4% total shareholder return over twelve months. This highlights how much investors have gained through both price appreciation and dividends. The rally shows that investor sentiment remains broadly positive, reflecting ongoing earnings strength and a strong long-term growth story.

If you’re interested in what else is moving beyond Mitsubishi, this could be a great time to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Mitsubishi shares are trading at an attractive price given their strong run, or if the current valuation already accounts for all expected earnings and growth, leaving little room for upside.

Most Popular Narrative: 4.5% Overvalued

Mitsubishi’s current share price of ¥3,618 sits modestly above the narrative’s fair value estimate of ¥3,462. This gap frames the present optimism against detailed analyst projections, inviting a closer look at what is driving the sentiment.

Active capital recycling and selective divestitures of lower-margin businesses align the portfolio toward higher-margin and recurring revenue streams. These actions are likely to enhance net margins and improve return on equity over the medium term. Expansion into international food and consumer supply chains (such as Cermaq and Thai Union Group) leverages Mitsubishi's global distribution strength to build stable, recurring revenue. This approach helps counter cyclical downturns and supports long-term revenue growth.

Want the inside story? The underlying financial forecast that supports this valuation involves a blend of margin transformation, ambitious revenue targets, and a future profit multiple some may find bold. Unpack the full set of forward-looking assumptions to see why analysts draw their line just below today’s price.

Result: Fair Value of ¥3,462 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing returns from new sectors or a downturn in commodity prices could quickly challenge the current upbeat outlook for Mitsubishi shares.

Find out about the key risks to this Mitsubishi narrative.

Another View: What Do the Numbers Really Say?

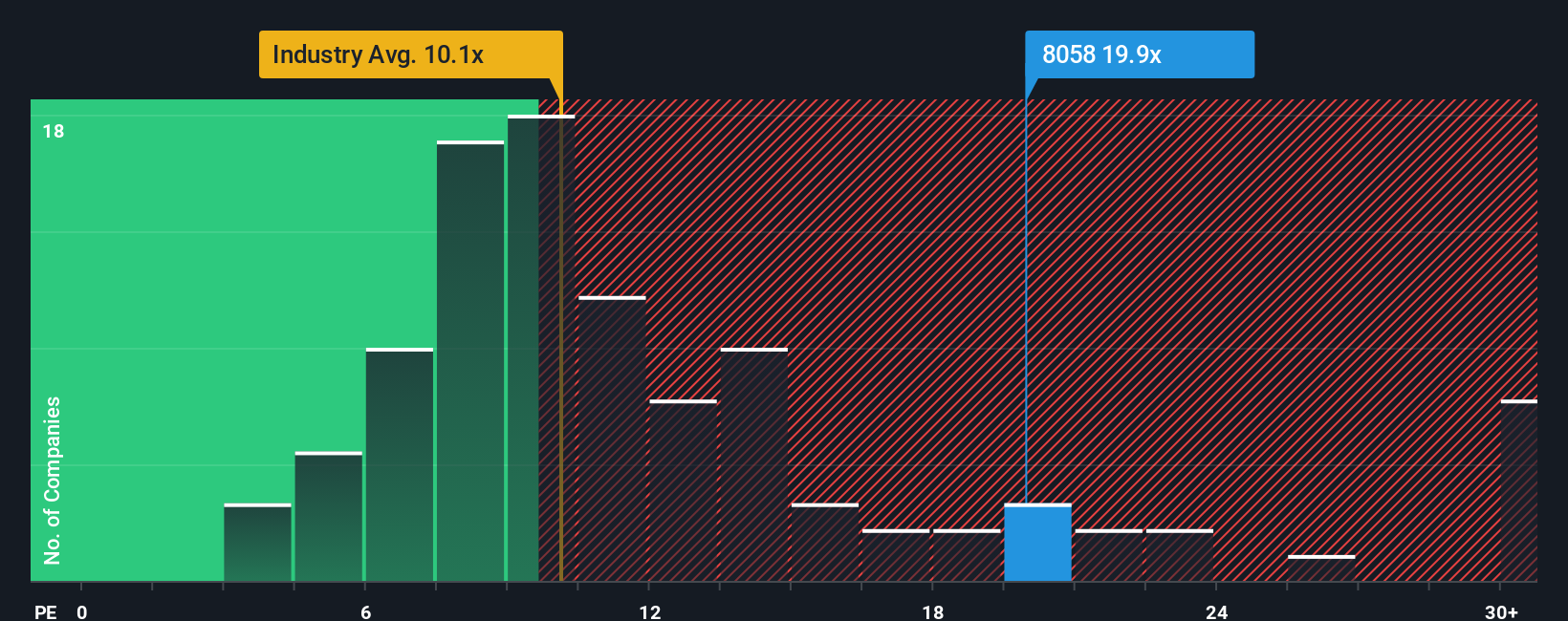

While analysts point to Mitsubishi being overvalued by 4.5% compared to their fair value, a look at market pricing tells a different story. Mitsubishi’s price-to-earnings ratio is 19.7x, making it more expensive than both its peers (11.6x) and the broader industry (9.6x). This gap means investors may be paying a premium, which raises the stakes if the company’s growth falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi Narrative

If you have a different perspective or want to dig into the details yourself, you can put together your own view in just a few minutes, then Do it your way.

A great starting point for your Mitsubishi research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on new opportunities while others take action. Use the Simply Wall Street Screener to find stocks tapping into trends, value, and tomorrow’s breakthroughs before the crowd catches on.

- Grow your portfolio with steady income by checking out these 16 dividend stocks with yields > 3% offering yields above 3% and strong fundamentals.

- Add an innovation edge by spotting companies at the forefront of AI with these 25 AI penny stocks powering next-generation technology and real-world solutions.

- Capture unique value with these 919 undervalued stocks based on cash flows, home to stocks trading below intrinsic cash flow estimates and primed for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8058

Mitsubishi

Engages in the global environment and energy, material solutions, metal resources, social infrastructure, mobility, food industry, SLC, and power solutions businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives