- Japan

- /

- Trade Distributors

- /

- TSE:8053

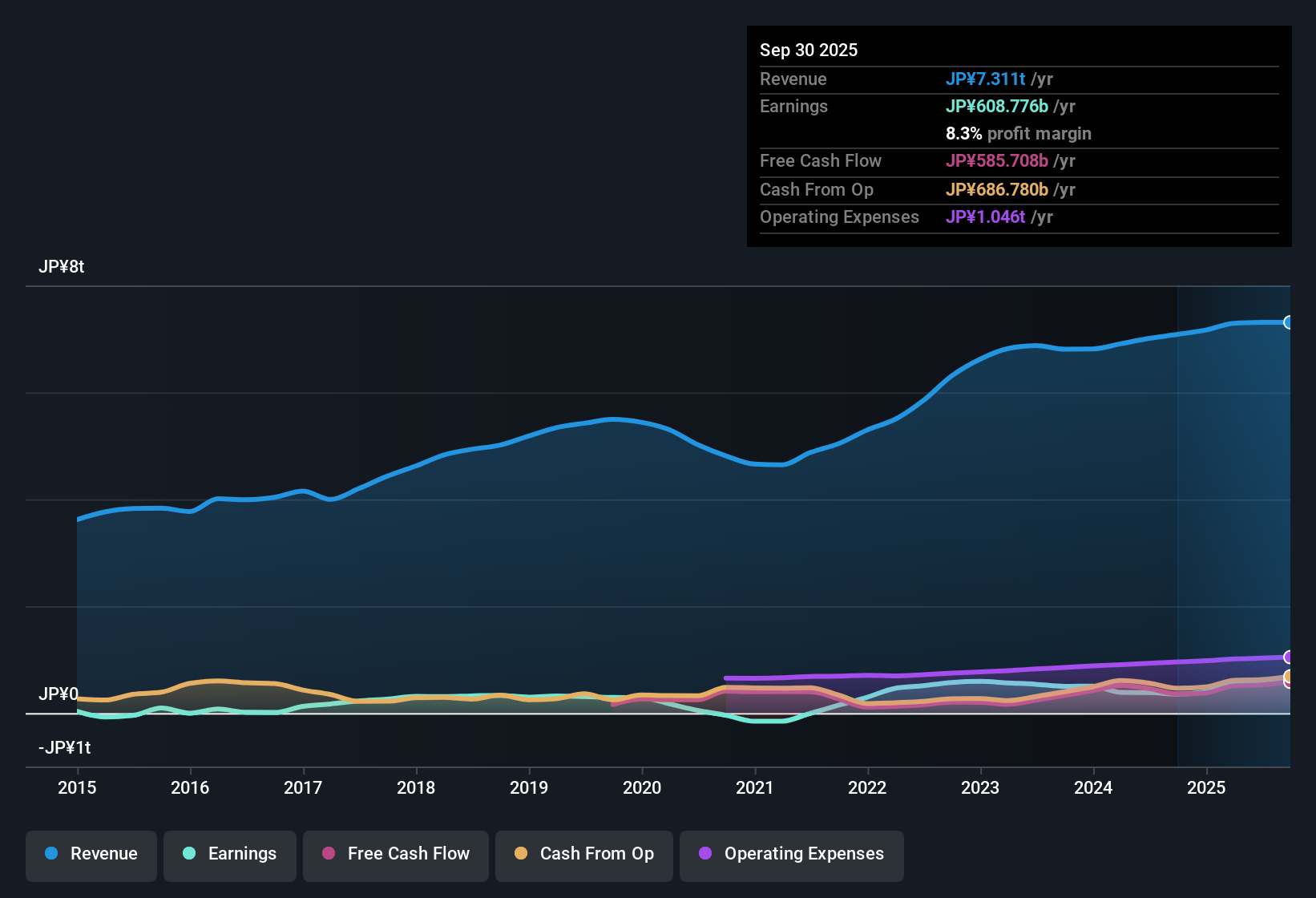

Sumitomo (TSE:8053) Profit Margins Surge, Challenging Bearish Narratives on Earnings Quality

Reviewed by Simply Wall St

Sumitomo (TSE:8053) reported net profit margins of 8.3%, up from 5% a year earlier, with EPS rising sharply as earnings surged 71.4% year-over-year, which is more than double the company’s five-year average annual earnings growth of 30.1%. While the company’s profitability and high-quality earnings have drawn attention, management is signaling caution, as revenue is forecast to rise 4.5% annually in line with the broader Japanese market but earnings are expected to edge down slightly at -0.02% per year over the next three years.

See our full analysis for Sumitomo.The next section puts Sumitomo’s headline results to the test by comparing them directly against the most widely followed market narratives, highlighting where investor expectations might align or diverge from the underlying numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Ratio Undercuts Peers by a Wide Margin

- Sumitomo's Price-to-Earnings ratio is 8.9x, noticeably lower than both the JP Trade Distributors industry average (10.1x) and the peer group average (13.1x).

- What’s notable is that prevailing analysis points to Sumitomo's relatively cheap valuation boosting current sentiment. However, this discount could also signal caution from investors expecting earnings stagnation.

- While a sub-9x P/E often attracts bargain hunters, the company’s earnings outlook shows expected declines of -0.02% per year. Buyers may be weighing the risk of flat performance against immediate value.

- Sumitomo's current price of ¥4,486 is below both the DCF fair value (¥5,058.16) and the analyst price target (¥4,994.17), underscoring the debate over whether this discount represents mispricing or justified wariness around future growth.

Profit Margins Rebound as Dividends Raise Eyebrows

- Net profit margins climbed to 8.3% this year from 5% a year ago, but rewards are offset by flagged risks of unsustainable dividends and questions about the financial position.

- Digging deeper, the analysis highlights the tension between Sumitomo’s strong profitability and emerging concerns:

- Rising margins would typically support the bullish case for robust dividend payouts. However, flagged worries about dividend sustainability and the financial base suggest that these boosts may not last.

- This contrast complicates the bullish narrative. Investors may cheer headline profit improvements but are cautioned not to overlook the risk that dividends could come under pressure if financial footing weakens.

Revenue Growth Matches Market, but Earnings Flatline Ahead

- Forecasts show Sumitomo’s revenue is expected to grow at 4.5% per year, mirroring the Japanese market, yet earnings are projected to dip slightly at -0.02% per year over the next three years.

- The model assessment draws out a central tension:

- Steady sales growth with no meaningful earnings pickup challenges the case for strong near-term upside, especially as prior-year earnings soared 71.4%, a pace not predicted to continue.

- This raises an important investor question: Can stable revenues alone keep shares attractive, or is the lack of earnings growth a bigger concern for Sumitomo’s future returns?

See our latest analysis for Sumitomo.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sumitomo's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Sumitomo’s surging profits and low valuation, lingering doubts over dividend sustainability and the company’s financial base raise red flags for investors.

If you are seeking stocks with stronger balance sheets and fewer financial risks, discover solid balance sheet and fundamentals stocks screener (1974 results) that offer greater stability even as market conditions shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8053

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives