- Japan

- /

- Trade Distributors

- /

- TSE:8052

Tsubakimoto Kogyo (TSE:8052) Earnings Growth Surpasses Five-Year Trend, Reinforcing Stable Profit Narrative

Reviewed by Simply Wall St

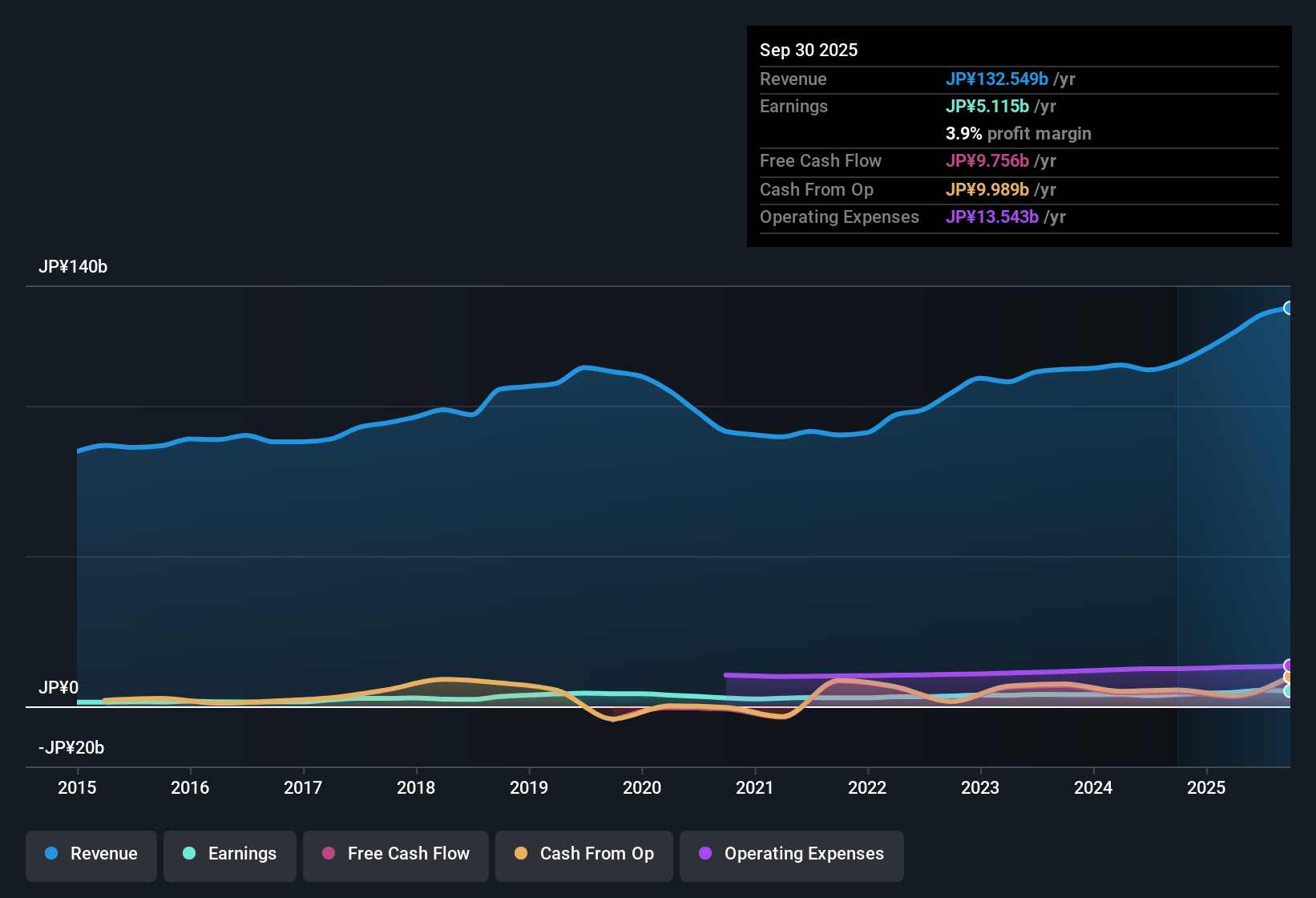

Tsubakimoto Kogyo (TSE:8052) posted an impressive 29.1% earnings growth in the past year, outpacing its already strong five-year CAGR of 12.9%. Net profit margin improved to 3.9% from 3.5% the previous year, reflecting enhanced profitability for shareholders. Investors have taken note, with the company flagging high-quality earnings and reward signals pointing to strong value, an attractive dividend, and robust profit growth. No material risks have been identified in the current data.

See our full analysis for Tsubakimoto Kogyo.Next up, we’ll see how these headline results compare to the most widely followed market narratives. Some conventional wisdom will be confirmed while other views might get challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Moves Above 3.5%

- Net profit margin increased to 3.9% this year compared to last year’s 3.5%, marking a notable gain in underlying profitability beyond pure topline growth.

- What is surprising is the steady margin expansion aligns closely with the prevailing view that Tsubakimoto Kogyo’s performance is anchored in operational stability, not aggressive cost-cutting.

- The margin improvement reinforces the stock’s reputation as a “steady performer,” supporting the view that underlying business quality is consistently earning its way to better profitability.

- While there is no mention of flashy new initiatives, market sentiment around the shares remains moderately positive. Investors see stable, incremental progress rather than volatility.

Trading at a Discount to DCF Value

- The current share price of ¥2,729 sits significantly below the DCF fair value of ¥3,490.28, highlighting a 21.8% implied discount that makes the valuation stand out among peer comparisons.

- Contrary to the idea that “stable” stocks always command full valuation, the fact that Tsubakimoto Kogyo trades below fair value despite multi-year growth and margin progress underlines a persistent opportunity for value-focused investors.

- Peer comparisons show its price-to-earnings ratio of 9.8x edges out the broader JP Trade Distributors industry average (10.1x), suggesting that even the sector recognizes the company’s stronger earnings profile.

- However, the slight premium to direct peers (9.7x) may signal market appreciation of its consistent delivery, while remaining at a discount to intrinsic value.

High-Quality Earnings Propel Positive Signals

- Five-year annual earnings growth of 12.9% has now been outpaced by this year’s 29.1% lift, and filings specifically call out “high quality” earnings as a driver of value.

- The prevailing view holds that consistently strong profit growth and robust reward signals, such as attractive dividends and improved margins, heavily support the positive case for long-term investors.

- The lack of material risks reinforces the narrative that Tsubakimoto Kogyo’s operational model is resilient. Positive financial trends have not triggered investor concerns.

- Investors attracted to compounding growth and capital returns find that the company demonstrates both, with a sustained performance that stands out amid sector-wide normalization.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tsubakimoto Kogyo's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Tsubakimoto Kogyo’s share price lags its solid growth and margin gains. The company is trading below intrinsic value despite operating strengths.

If you’re seeking companies where the market undervalues solid financials, now’s the time to discover these 831 undervalued stocks based on cash flows as your next opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tsubakimoto Kogyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8052

Tsubakimoto Kogyo

Engages in the sale of machinery, equipment, parts, and accessories in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives