- Japan

- /

- Trade Distributors

- /

- TSE:8031

Mitsui (TSE:8031) Is Up 5.4% After Announcing Higher Dividend, Buyback and Profit Guidance - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On November 5, 2025, Mitsui & Co., Ltd. announced an interim dividend increase to ¥55 per share, raised its full-year profit guidance for March 2026 to ¥820 billion, and unveiled a large-scale share buyback and cancellation program worth ¥200 billion.

- The combination of higher earnings expectations and significant capital returns signals Mitsui's intent to reward shareholders and optimize its capital structure.

- We'll examine how Mitsui's aggressive buyback program and improved earnings outlook reshape the company's investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Mitsui Investment Narrative Recap

To see Mitsui as an appealing investment, you need to believe the company can successfully transition its earnings base beyond traditional commodities and generate stable long-term value, even as it faces global energy shifts and fluctuating resource prices. The latest dividend hike, profit guidance, and aggressive buyback could help support near-term sentiment, but the core short-term catalyst, recovery in resource profitability, remains largely unchanged, while commodity price weakness still stands out as the biggest risk and is not materially reduced by this news.

The share buyback and cancellation plan, enabling up to ¥200 billion of repurchases, is one of the most relevant announcements here. By reducing the number of shares in circulation and signaling a focus on shareholder returns, this move could support share price stability in periods of earnings volatility, yet it does not offset structural risks from overexposure to cyclical commodity markets or the pace of decarbonization efforts.

Yet, for all the attention on capital returns, investors should be aware of the ongoing exposure to commodity cycles and how...

Read the full narrative on Mitsui (it's free!)

Mitsui's narrative projects ¥15,578.0 billion revenue and ¥878.2 billion earnings by 2028. This requires 3.3% yearly revenue growth and a ¥62.3 billion earnings increase from the current earnings of ¥815.9 billion.

Uncover how Mitsui's forecasts yield a ¥4010 fair value, in line with its current price.

Exploring Other Perspectives

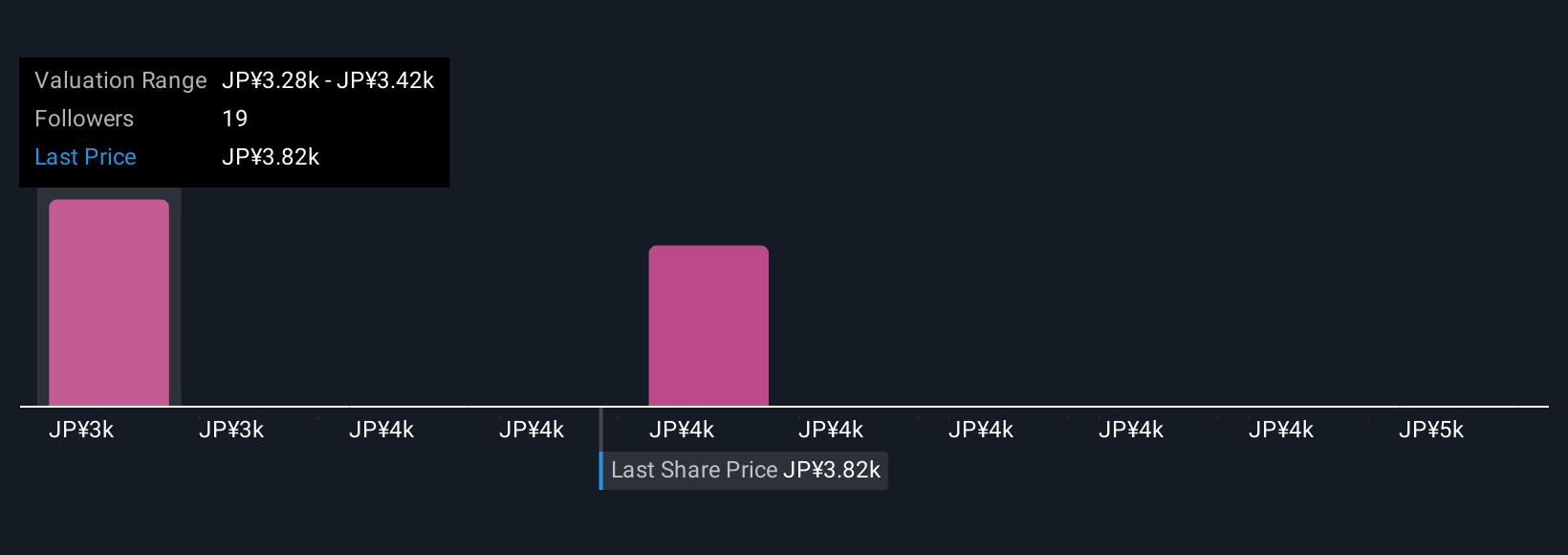

Simply Wall St Community members offer four fair value estimates for Mitsui stock, ranging from ¥3,610 to ¥4,700 per share. While capital returns remain in focus, ongoing commodity price risk could continue to shape opinions about the company’s future. Explore several alternative viewpoints from the market.

Explore 4 other fair value estimates on Mitsui - why the stock might be worth 8% less than the current price!

Build Your Own Mitsui Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsui research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mitsui research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsui's overall financial health at a glance.

No Opportunity In Mitsui?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8031

Mitsui

Operates as trading company in Japan, Singapore, the United States, Australia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives