- Japan

- /

- Trade Distributors

- /

- TSE:8020

A Look at Kanematsu (TSE:8020) Valuation Following Share Split and Dividend Hike Announcement

Reviewed by Simply Wall St

Kanematsu (TSE:8020) just announced a share split to boost share liquidity and make stock ownership easier for investors. In addition, the company raised its dividend forecast, reflecting continued profit growth and positive momentum.

See our latest analysis for Kanematsu.

Kanematsu’s recent share split and bump in dividend guidance have helped build positive momentum, with a year-to-date share price return of 25.6% and a robust total shareholder return of 27.2% over the past year. Longer-term investors have also been rewarded handsomely, with total shareholder returns of over 145% in three years and 227% in five years. These are all signs that confidence and growth potential remain strong in the current environment.

If Kanematsu’s strong run has you thinking bigger, now’s a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares riding high on recent gains, and both the share split and higher dividend guidance pointing to optimism, investors may wonder whether Kanematsu is still trading at a discount or if markets are already pricing in future growth.

Price-to-Earnings of 9.6x: Is it justified?

Kanematsu’s stock is trading at a price-to-earnings (P/E) multiple of 9.6x, lower than the peer average of 10.9x, the industry average of 9.7x, and well below the Japanese market average of 13.9x. This places the stock firmly in undervalued territory compared to its direct competitors.

The P/E ratio measures what investors are currently willing to pay for each unit of the company’s earnings. In trade distribution, this multiple is crucial as it gives a sense of how the market is pricing future growth, profits, and risk. A lower P/E may signal the market has more modest expectations, or that there is an undervaluation opportunity brewing.

Compared to the averages across its peer group and sector, Kanematsu’s earnings look attractively priced, suggesting that either the market hasn’t fully appreciated its profit growth or there are factors suppressing enthusiasm. Notably, Kanematsu’s 9.6x multiple also sits well below the estimated fair P/E ratio of 15x. This is a level the market could eventually move toward if current trends persist.

Explore the SWS fair ratio for Kanematsu

Result: Price-to-Earnings of 9.6x (UNDERVALUED)

However, currency fluctuations or a slowdown in key markets could impact Kanematsu’s earnings outlook and reduce momentum in the near term.

Find out about the key risks to this Kanematsu narrative.

Another View: Discounted Cash Flow Model

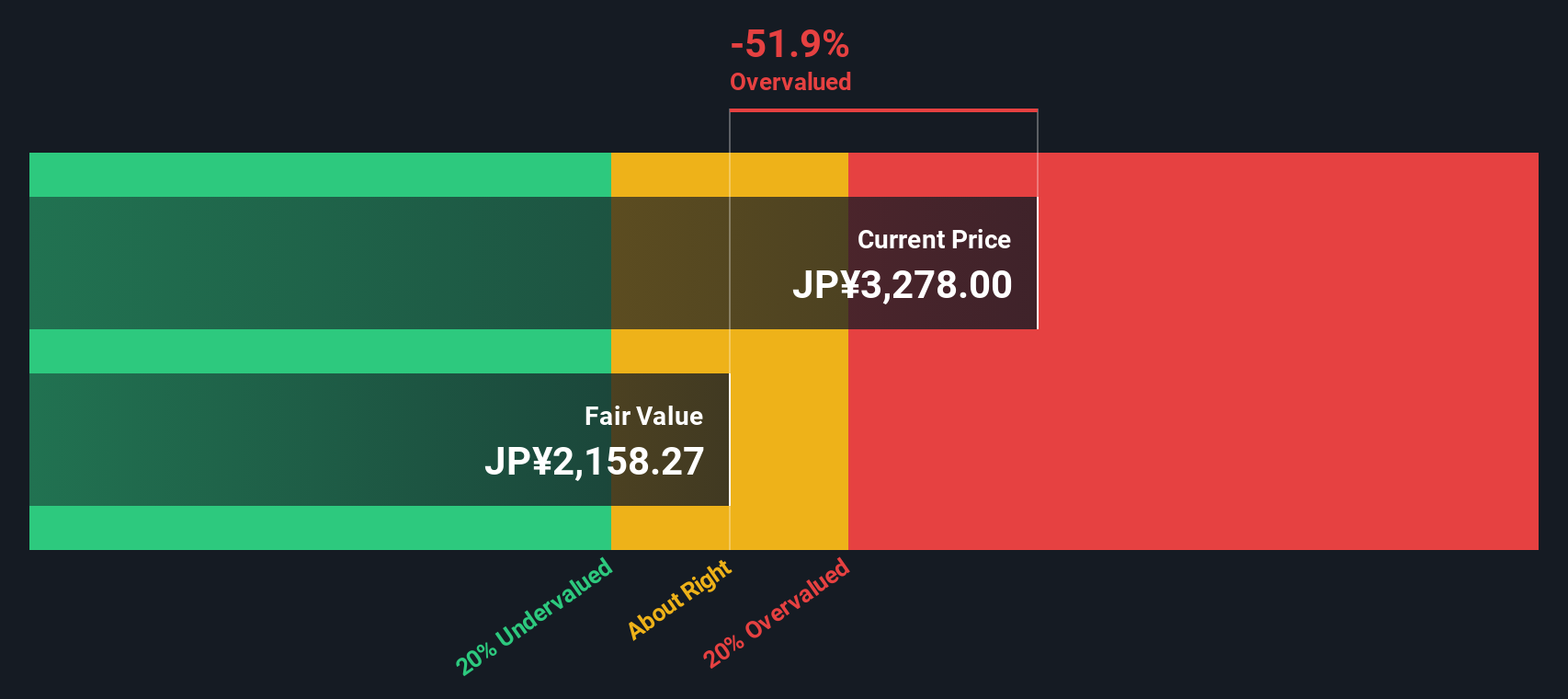

Shifting focus to the SWS DCF model, the story changes. This approach pegs Kanematsu's fair value at ¥3,155, which is actually below the current share price of ¥3,295. Rather than suggesting a bargain, this method points toward slight overvaluation at the moment. Should investors tread carefully, or is the market pricing in future upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kanematsu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kanematsu Narrative

If you'd rather draw your own conclusions or have unique insights you want to test, it’s easy to assemble your own Kanematsu story in just a few minutes. Do it your way

A great starting point for your Kanematsu research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to a single stock. Take charge of your investing strategy by tapping into fresh opportunities that others might be missing right now.

- Uncover the potential of market leaders with strong yields by using these 14 dividend stocks with yields > 3% to reveal companies paying dependable dividends above 3%.

- Target explosive growth by navigating these 26 AI penny stocks, connecting you to innovators driving the next wave in artificial intelligence.

- Capitalize on hidden gems by hunting for significant value among these 920 undervalued stocks based on cash flows, focusing on companies trading below what their cash flows suggest they’re really worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kanematsu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8020

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success