- Japan

- /

- Trade Distributors

- /

- TSE:8015

How Raised Profit and Dividend Guidance at Toyota Tsusho (TSE:8015) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On October 31, 2025, Toyota Tsusho Corporation raised its consolidated earnings guidance and dividend forecast for the fiscal year ending March 31, 2026, after reporting stronger-than-expected second quarter results, attributing the improvement mainly to a continuously weak Japanese yen against the US dollar.

- This move not only highlights resilient operational performance but also suggests confidence in sustaining higher shareholder returns amidst ongoing currency fluctuations.

- We'll explore how Toyota Tsusho's increased profit and dividend projections could influence expectations for its long-term growth trajectory.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Toyota Tsusho Investment Narrative Recap

To be a Toyota Tsusho shareholder, you need to believe in the company's ability to sustain growth across diverse sectors, with a particular edge in mobility, industrials, and logistics, while managing the risks that come from heavy reliance on automotive markets, rapidly shifting electrification trends, and currency fluctuations. The recent upward revision to earnings and dividends is primarily a short-term response to continued yen weakness, which, while enhancing near-term results, does not materially change the fact that profit volatility linked to currency movements remains the company's most significant current risk.

Among the latest developments, the raised dividend to JPY 58.00 per share for the second quarter stands out, reflecting management's commitment to rewarding shareholders amid favorable currency-driven earnings tailwinds. This aligns with increasing profit visibility, but investors will still want to consider whether these currency effects are sustainable as the company pursues longer-term growth drivers like battery recycling and emerging market expansion.

Yet, while profit guidance is up, investors must not overlook the continued exposure to sharp yen reversals and how...

Read the full narrative on Toyota Tsusho (it's free!)

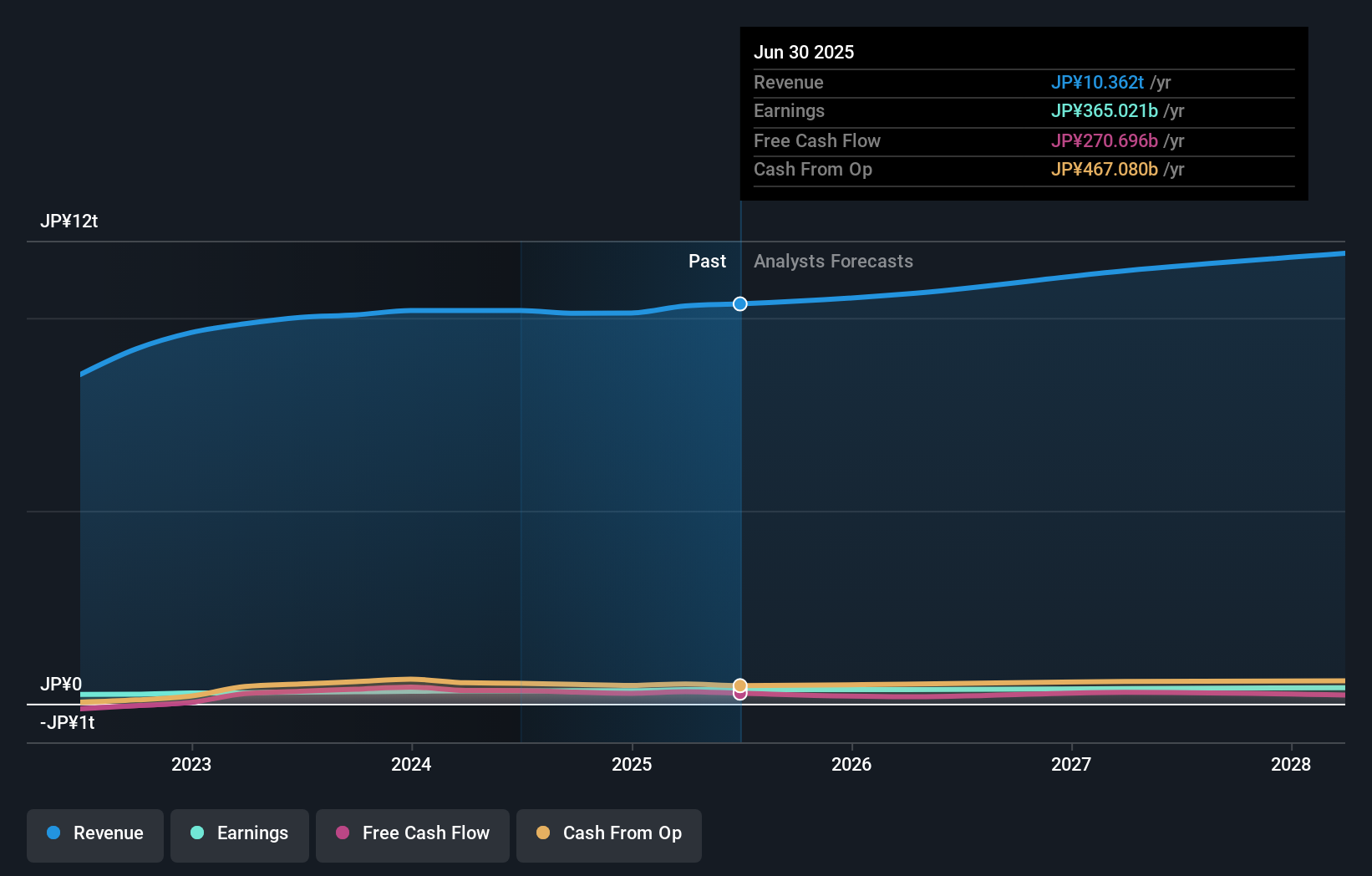

Toyota Tsusho's narrative projects ¥11,762.2 billion in revenue and ¥410.6 billion in earnings by 2028. This requires 4.3% yearly revenue growth and a ¥45.6 billion earnings increase from the current ¥365.0 billion.

Uncover how Toyota Tsusho's forecasts yield a ¥4238 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Toyota Tsusho range widely from ¥1,992 to ¥4,238 per share, based on 2 contributors. Participants' sharply different outlooks come as the company's heavy reliance on currency trends continues to shape earnings and shareholder value, making it important to compare several viewpoints.

Explore 2 other fair value estimates on Toyota Tsusho - why the stock might be worth less than half the current price!

Build Your Own Toyota Tsusho Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toyota Tsusho research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Toyota Tsusho research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toyota Tsusho's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Tsusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8015

Toyota Tsusho

Engages in the metals, circular economy, supply chain, mobility, green infrastructure, digital solutions, and lifestyle businesses.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives