- Japan

- /

- Trade Distributors

- /

- TSE:8012

Nagase (TSE:8012) Valuation in Focus Following Share Split and Articles of Incorporation Changes

Reviewed by Simply Wall St

Nagase (TSE:8012) announced on October 24 that its board resolved to carry out a share split, along with related changes to its Articles of Incorporation. This type of move often shifts investor focus toward possible changes in liquidity and company governance.

See our latest analysis for Nagase.

Nagase’s decision to move ahead with a share split comes at a time when the stock is showing renewed momentum. The 1-month share price return stands at 6.03%, and over the past year shareholders have seen a total return of nearly 10%. Looking at a longer timeframe, long-term holders have enjoyed a total return of over 180% in five years, with gains building steadily in recent quarters. These recent moves suggest both management and investors see room for further growth ahead.

If this shift in sentiment has you watching for what could be next, now’s a good time to broaden your horizons and discover fast growing stocks with high insider ownership

With a consistent track record of returns and a recent rally, the key question is whether Nagase remains undervalued at these levels or if the market has already factored in all the potential upside ahead.

Price-to-Earnings of 13.8x: Is it justified?

Nagase is currently trading at a price-to-earnings (P/E) ratio of 13.8x, which is higher than both its industry and peer averages. The last closing price was ¥3,376, putting the shares at a premium relative to competitors in the JP Trade Distributors sector.

The price-to-earnings ratio measures what investors are willing to pay for each yen of Nagase’s earnings. In this case, a higher P/E suggests that the market expects stronger future earnings or views the company as lower risk compared to its peers.

This premium may reflect positive momentum in profit growth and a consistent dividend. It could also imply that the market has already priced in much of the anticipated improvement. Importantly, Nagase’s P/E ratio of 13.8x is above the industry average of 10x and above the peer average of 9.6x. However, it is below the estimated fair P/E ratio of 15.3x, which may offer a potential cushion should market sentiment soften.

Explore the SWS fair ratio for Nagase

Result: Price-to-Earnings of 13.8x (OVERVALUED)

However, slower annual revenue growth and a premium valuation compared to peers could act as potential risks if earnings momentum stalls.

Find out about the key risks to this Nagase narrative.

Another View: Is Nagase Overvalued or Just Misunderstood?

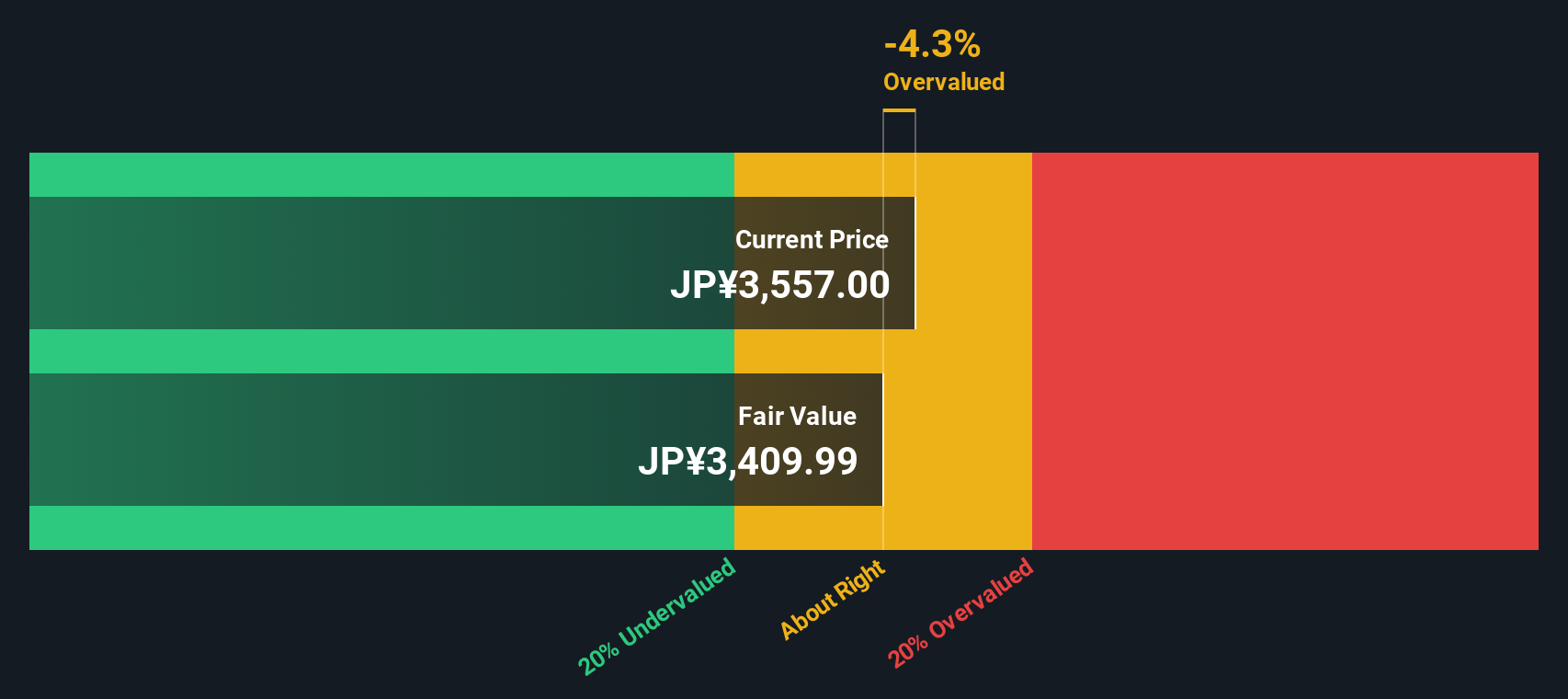

Our DCF model offers another perspective and suggests Nagase is trading above its estimated fair value of ¥3,298 per share. While multiples point to a premium, the DCF view leans toward mild overvaluation. Do these different methods signal caution or opportunity for patient investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nagase for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nagase Narrative

If you want to dive deeper or reach your own conclusions, it’s simple to start building your own story and analysis in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Nagase.

Looking for More Investment Ideas?

Don’t settle for just one opportunity when there’s a world of stocks and themes you can seize right now using the Simply Wall Street Screener.

- Capitalize on high-yield opportunities by checking out these 24 dividend stocks with yields > 3% which delivers consistent returns above 3%.

- Stay ahead of emerging trends and see which companies are pushing the boundaries in artificial intelligence with these 26 AI penny stocks.

- Jump on unique possibilities in the cryptocurrency space by exploring these 81 cryptocurrency and blockchain stocks as it makes waves in blockchain technology and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nagase might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8012

Nagase

Manufactures, imports/exports, and sells chemicals, plastics, electronics materials, cosmetics, and health foods worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives