- Japan

- /

- Trade Distributors

- /

- TSE:8012

How Investors Are Reacting To Nagase (TSE:8012) Share Buyback, Employee Stock Plan, and Earnings Update

Reviewed by Sasha Jovanovic

- Nagase & Co., Ltd. announced a ¥8,000 million share repurchase program of up to 3,500,000 shares alongside the adoption of a new restricted stock plan for employees and a revision of its consolidated earnings forecast following a recent board meeting on November 6, 2025.

- The combination of buybacks, employee stock incentives, and updated financial guidance highlights the company's multifaceted approach to supporting both shareholder returns and long-term corporate growth.

- We'll explore how the substantial share buyback signals management's confidence and influences Nagase's investment appeal for stakeholders.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Nagase's Investment Narrative?

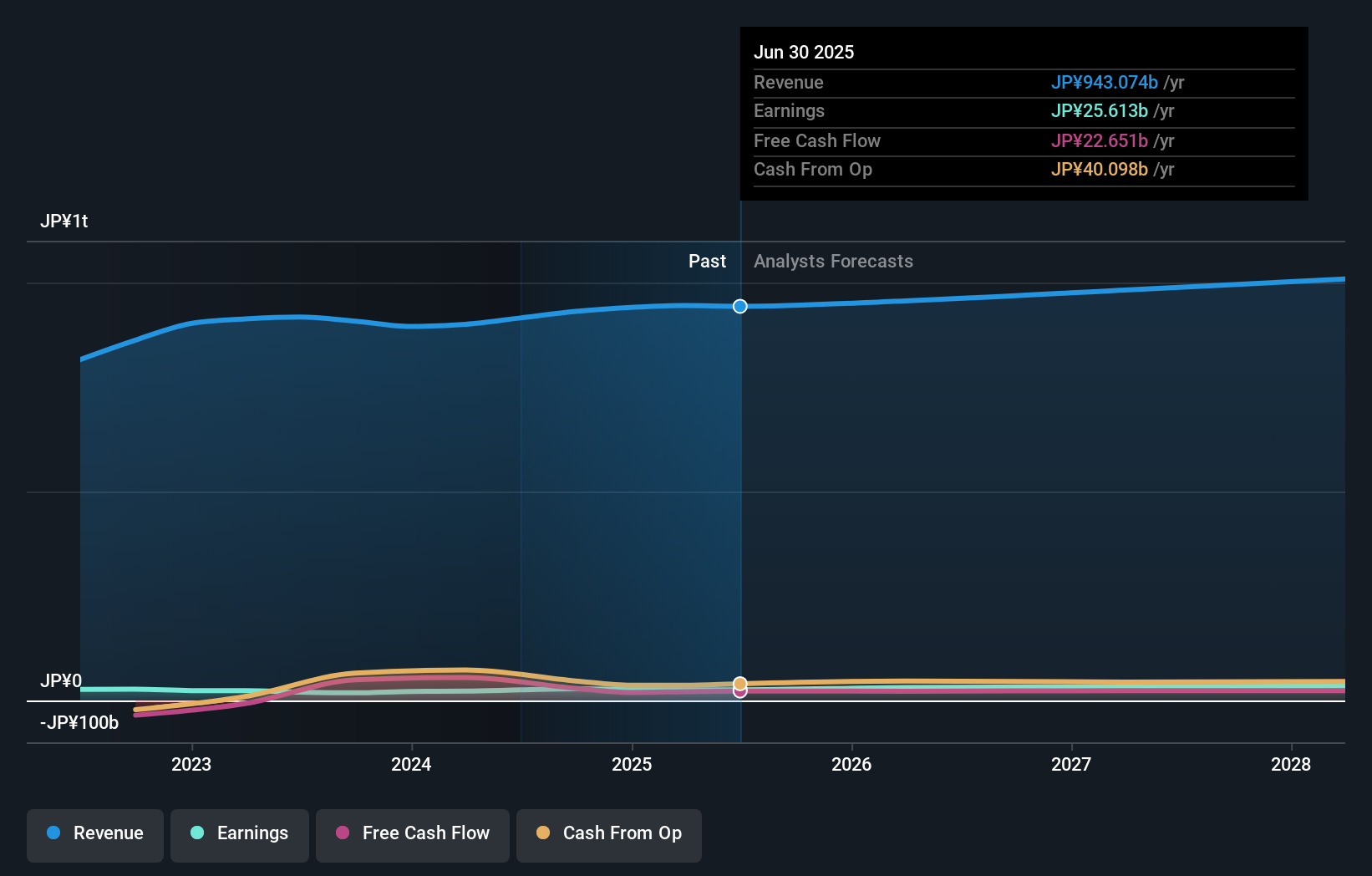

For those considering Nagase as a potential investment, the big picture centers on the company’s ability to balance steady, if unspectacular, earnings growth with shareholder-friendly capital management. The recent announcement of a ¥8,000 million buyback (covering 3.35% of shares) and revised earnings guidance points to a responsive management team acting on near-term business trends. This move may add support to the share price and refresh short-term catalysts, especially after a solid 13% three-month price gain. However, with revenue growth forecasts remaining modest and profit margins edging lower, one risk is that buybacks alone may not offset bigger questions about sustainable margin expansion. The restricted stock plan also reinforces a focus on employee alignment, but it doesn’t address the competitive pressures or relatively low returns on equity that still linger as fundamental hurdles. Investors should weigh whether these recent actions meaningfully shift the risk and reward profile or mainly maintain the status quo.

But, when it comes to low profit margins, there’s more to consider before making any decisions. Nagase's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Nagase - why the stock might be worth just ¥4000!

Build Your Own Nagase Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nagase research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Nagase research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nagase's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nagase might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8012

Nagase

Manufactures, imports/exports, and sells chemicals, plastics, electronics materials, cosmetics, and health foods worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives