- Japan

- /

- Trade Distributors

- /

- TSE:8002

How Investors May Respond To Marubeni (TSE:8002) Strong Earnings, Dividend Hike and Upbeat Full-Year Outlook

Reviewed by Sasha Jovanovic

- Marubeni Corporation reported strong half-year results as of September 2025, posting revenue of ¥4.20 trillion and net income of ¥305.50 billion, and announced a second quarter-end dividend increase to ¥50.00 per share.

- The company has also issued guidance for robust full-year profits, indicating confidence in continued earnings growth heading into fiscal 2026.

- We’ll explore what Marubeni’s earnings momentum and higher dividend signal for the company’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Marubeni's Investment Narrative?

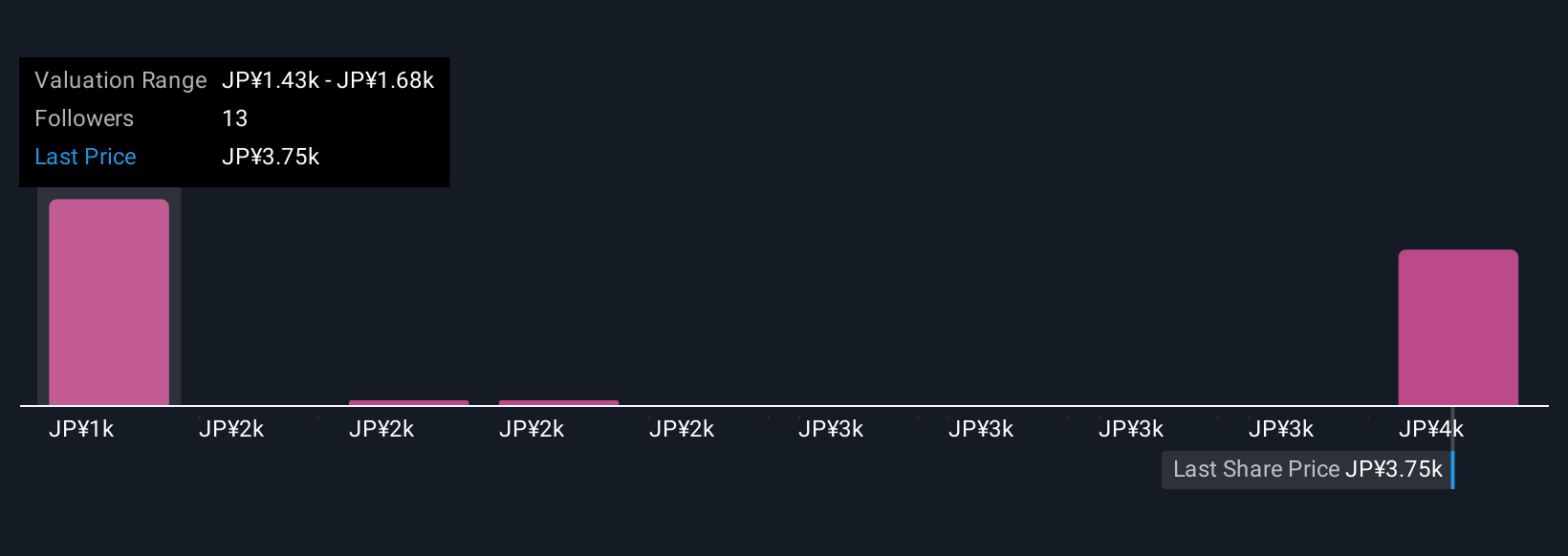

Marubeni’s recent half-year earnings beat and dividend hike add more substance to an already strong investment story focused on steady profit growth, shareholder returns, and a push into new markets. The increased dividend and upward earnings momentum may bring renewed optimism, particularly for those watching short-term catalysts like sustained performance from core trading arms and the ramp-up of new ventures in power and sustainability. However, the fundamentals, especially profit growth rates forecast below the market and a board with short average tenure, remain front of mind as potential risk areas. While the latest financials exceed previous results, the company’s reiteration of profit guidance suggests limited change to these key risks and catalysts for now. Investors are weighing strong track records against questions about how corporate governance and growth priorities might shape the next phase. Yet board turnover and governance questions could affect how profits turn into lasting value for shareholders.

Marubeni's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on Marubeni - why the stock might be worth less than half the current price!

Build Your Own Marubeni Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marubeni research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Marubeni research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marubeni's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8002

Marubeni

Marubeni Corporation purchases, distributes, and markets industrial and consumer goods.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives