- Japan

- /

- Trade Distributors

- /

- TSE:8001

How ITOCHU's Rising Profits Amid Lower Sales Will Impact Investors (TSE:8001)

Reviewed by Sasha Jovanovic

- On November 5, 2025, ITOCHU Corporation reported earnings for the half year ended September 30, 2025, with revenue amounting to ¥7.25 trillion, a slight decrease from the previous year, but net income rising to ¥500.28 billion from ¥438.44 billion.

- Despite a small drop in revenue, ITOCHU's significantly higher net income and earnings per share underscored improved profitability, reflecting effective cost controls or stronger margins over the past six months.

- We'll explore how ITOCHU's strong earnings growth amid lower revenue shapes the company's investment case and future outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

ITOCHU Investment Narrative Recap

The core belief for ITOCHU shareholders centers on the company’s ability to transition away from volatile resource-linked segments toward more stable, higher-margin consumer and retail operations. The recent results, highlighting improved profitability even as revenue slightly declined, do not materially change the key short-term catalyst, which remains the successful execution of its non-resource business strategy. The main risk for investors continues to be ITOCHU’s exposure to commodity cycles, which may drive earnings volatility in the near term.

Among recent announcements, ITOCHU’s continued share buyback program, most recently repurchasing over 7 million shares last quarter, is particularly relevant. This buyback activity aligns with efforts to support shareholder returns and enhance earnings per share, tying directly to the same profitability improvements seen in the latest earnings release. However, while shareholder returns are in focus, there remains the need for investors to be mindful of...

Read the full narrative on ITOCHU (it's free!)

ITOCHU's outlook projects ¥16,471.1 billion in revenue and ¥981.5 billion in earnings by 2028. This is based on analysts’ assumptions of 3.9% annual revenue growth and a ¥23.9 billion increase in earnings from the current ¥957.6 billion level.

Uncover how ITOCHU's forecasts yield a ¥9696 fair value, in line with its current price.

Exploring Other Perspectives

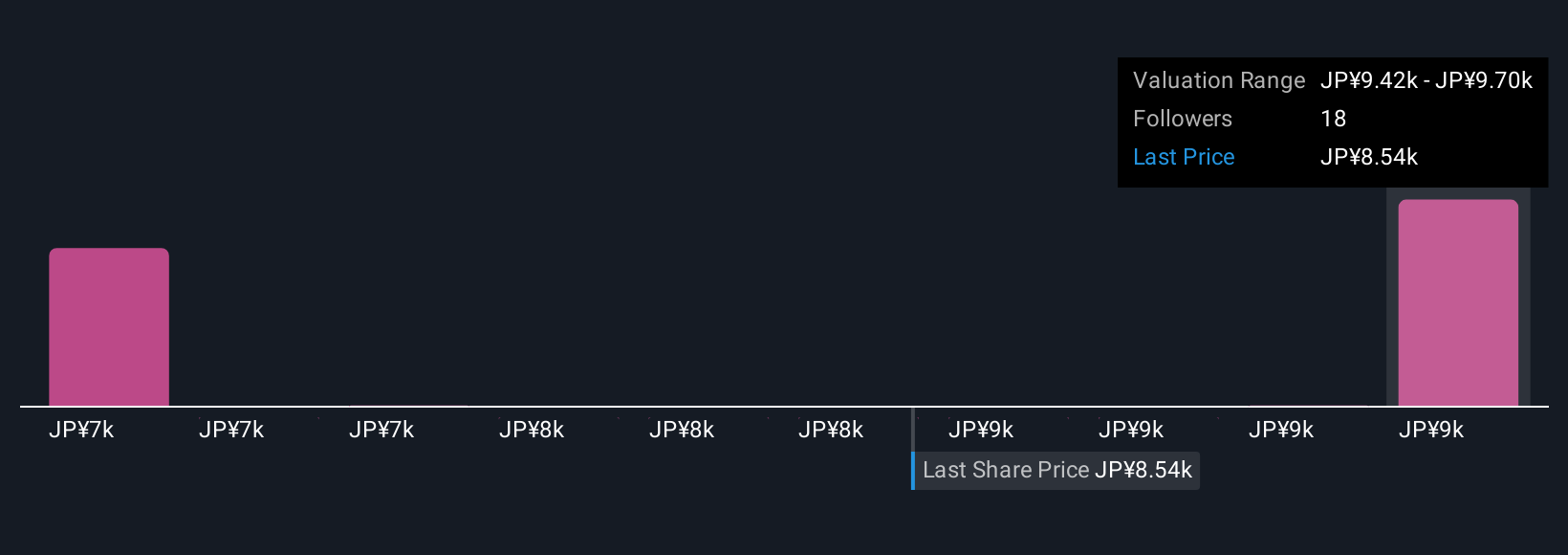

Three Simply Wall St Community valuations for ITOCHU range widely, from ¥7,251 to ¥9,696 per share. While many expect stability from its shift toward higher-margin businesses, you’ll find investors weighing this optimism against persistent commodity exposure and the implications for future returns.

Explore 3 other fair value estimates on ITOCHU - why the stock might be worth as much as ¥9696!

Build Your Own ITOCHU Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ITOCHU research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ITOCHU research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ITOCHU's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8001

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives