Maezawa Kasei Industries (TSE:7925) Profit Margin Beat Reinforces Bullish Narrative

Reviewed by Simply Wall St

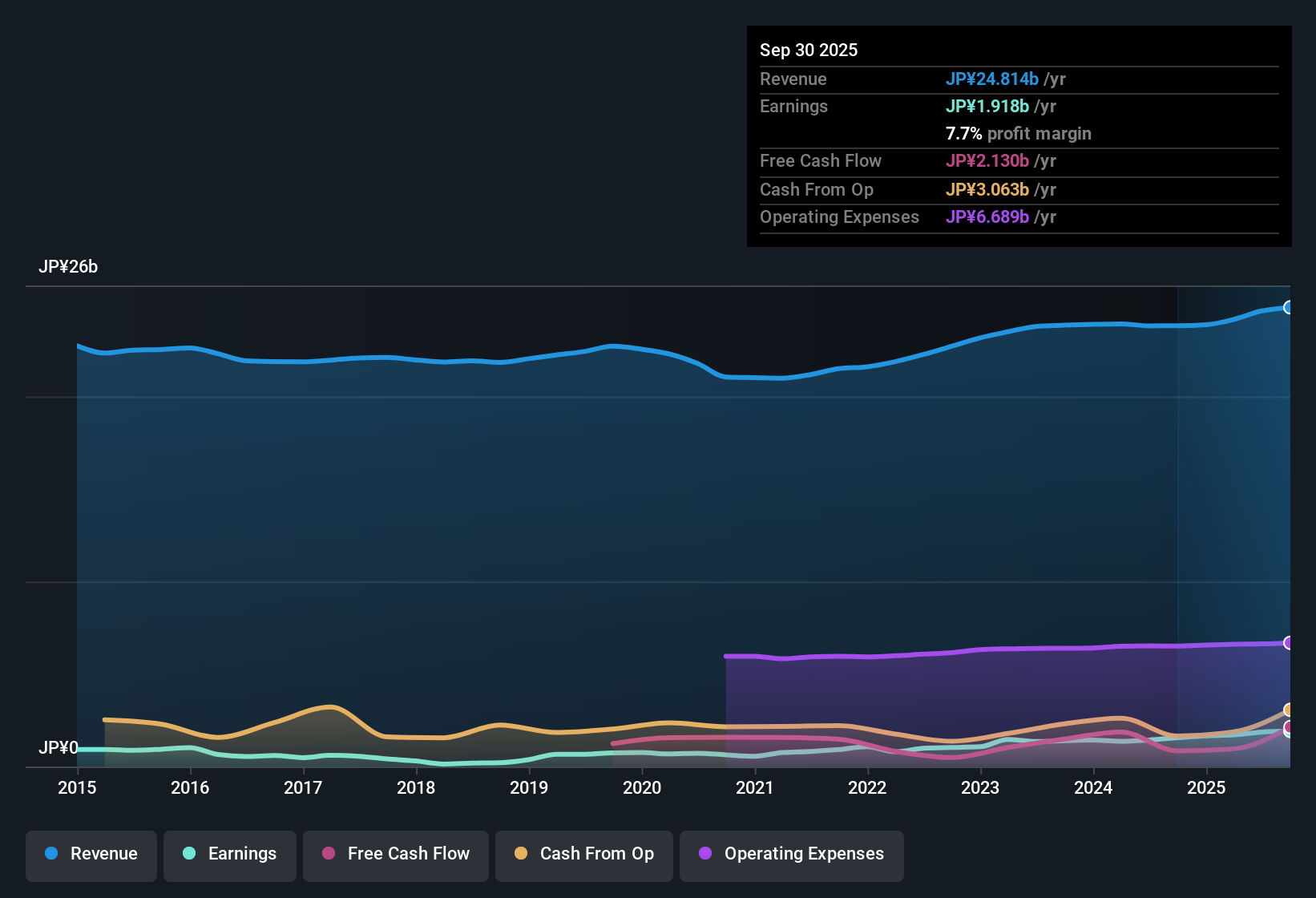

Maezawa Kasei Industries (TSE:7925) delivered a net profit margin of 7.7%, improving from 6.5% in the previous period, and achieved EPS growth of 23.3% year over year, significantly ahead of its five-year annual average of 20.5%. The company’s profits have expanded at a 20.5% annual rate over the past five years, and this period’s margin boost reinforces the quality of its earnings even as the shares trade above estimated fair value.

See our full analysis for Maezawa Kasei Industries.Next up, we’ll see how these headline results compare to the narratives that shape investor expectations. This will highlight which market views stand strong and which could get upended.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Growth Outpaces Five-Year Trend

- Profits have expanded at a 20.5% annual rate over the past five years, with the latest year’s earnings growth reaching 23.3% and comfortably ahead of the average pace.

- What is surprising is that, despite this consistency, the prevailing investment view remains sensitive to whether higher profit margins can be sustained beyond a single period. Structurally strong growth can sometimes mask volatility under the surface.

- Bears caution that a strong profit streak may not last if competitive pressures intensify or market conditions change abruptly.

- Supporters counter that beating the five-year growth average signals underlying operational efficiency, especially considering this year’s net margin improved by 1.2 percentage points.

P/E Ratio Flags Expensive Valuation

- The company's Price-To-Earnings Ratio stands at 16.1x, trading higher than both the peer average of 13.7x and the industry average of 15.1x. This suggests shares may be priced at a premium not entirely explained by growth rates alone.

- Critics highlight that paying above-industry multiples adds pressure for future results to keep outperforming, especially when the current share price of ¥2,086 is significantly above the DCF fair value of ¥1,363.58.

- Bulls may argue that premium multiples reflect quality earnings, but the upside narrows if the company’s performance reverts to the industry mean.

- Risk-oriented investors are quick to note that overpaying at these levels could blunt total return if any bumps emerge in earnings momentum or sector outlook.

Dividend Sustainability Poses Minor Risk

- While only a single minor risk is highlighted with a focus on dividend sustainability, the absence of more substantial red flags suggests earnings quality remains high for now.

- What is notable is that the prevailing narrative does not ignore this risk. Instead, it points out that companies showing rapid profit gains sometimes stretch dividend policies thin in pursuit of investor goodwill.

- Investors should weigh whether consistent margin improvements, like the lift to 7.7% this year, warrant confidence in future dividend payments.

- Even minor risks become relevant as valuation rises, making it worth monitoring payout ratios closely in the quarters ahead.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Maezawa Kasei Industries's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Although Maezawa Kasei Industries' profit margins have improved, its shares appear overvalued relative to peers. This puts pressure on future performance to justify the premium.

If you're wary of paying above fair value, use these 831 undervalued stocks based on cash flows to uncover attractively priced stocks where growth potential still outpaces the risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7925

Maezawa Kasei Industries

Produces and sells water and sewerage related products, and environmental equipment.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives