Assessing Hino Motors (TSE:7205) Valuation Following Recent Share Price Swings

Reviewed by Simply Wall St

If you have been following Hino Motors (TSE:7205) lately, you might be pondering the stock’s next move. This year has seen some big swings, and while there is no dramatic event hitting headlines right now, the sheer movement in the share price is enough to make investors look twice. Sometimes, it is these quiet stretches after a choppy period that tell us more about what the market really expects for the months ahead.

For context, Hino Motors’ shares are down about 6% over the past year and have fallen roughly 29% since January. Despite this, there has been a bit of stability cropping up lately. Shares are up about 6% in the past month, suggesting short-term sentiment could be shifting even as the longer-term chart remains in the red. Zooming out, the three- and five-year returns are deeply negative, signaling that any bullishness now is a recent phenomenon rather than a sustained trend.

So, after this mixed stretch with a recent bounce but still bruised over the longer run, is the market underestimating Hino’s value, or are investors already banking on a turnaround?

Price-to-Sales of 0.1x: Is it justified?

Hino Motors is trading at a price-to-sales (P/S) ratio of 0.1x, which is significantly lower than both its industry average and that of its peer group. This suggests the market perceives the company's revenues to be less valuable than those of its competitors.

The price-to-sales ratio compares a company's market capitalization to its total sales. This metric is particularly relevant for unprofitable companies like Hino Motors. In the machinery sector, where cyclical swings and profitability headwinds are common, the P/S ratio can offer investors a benchmark to judge if shares are bargain-priced or reflect deeper business challenges.

In Hino's case, the market appears to be underpricing its current sales potential, either due to ongoing losses or skepticism about its ability to return to profitability. The low multiple may be justified if the company struggles to turn sales into sustainable profits. However, if Hino executes a turnaround or earnings recover, this valuation level could present an opportunity.

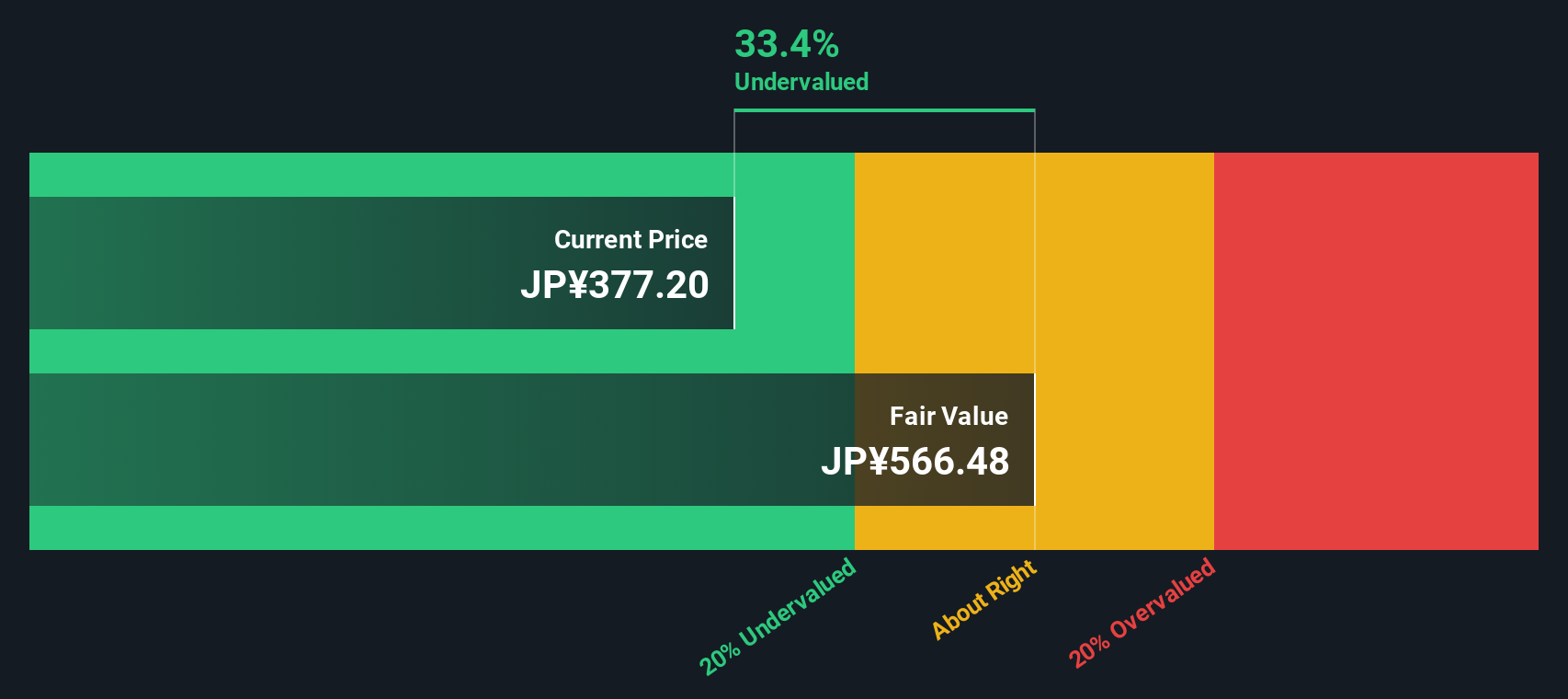

Result: Fair Value of ¥596.2 (UNDERVALUED)

See our latest analysis for Hino Motors.However, persistent losses and sluggish revenue growth could weigh on any recovery hopes. This could potentially limit upside if Hino fails to show sustainable progress.

Find out about the key risks to this Hino Motors narrative.Another View: Our DCF Model Perspective

Taking a different approach, the SWS DCF model also finds Hino Motors to be undervalued. Both methods point to a discount. However, could underlying risks or shifting market conditions still surprise investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hino Motors Narrative

Keep in mind, if you have a different perspective or want to dig into the details yourself, you can put together your own analysis in just a few minutes. Do it your way.

A great starting point for your Hino Motors research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at a single opportunity. Broaden your portfolio and spot potential winners right now with Simply Wall Street’s hand-picked screeners below. Your next great stock idea might just be a click away.

- Tap into the growth surge shaping artificial intelligence by checking out AI penny stocks making waves with groundbreaking technologies and innovation across industries.

- Unlock value opportunities. Use undervalued stocks based on cash flows to uncover companies trading well below their intrinsic worth based on robust cash flow metrics.

- Boost your passive income by finding dividend stocks with yields > 3% delivering steady yields above 3% and building wealth through reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hino Motors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:7205

Hino Motors

Manufactures and sells commercial vehicles under the Hino brand worldwide.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives