How Should Investors View Mitsubishi Heavy Industries After Its 121% Price Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Mitsubishi Heavy Industries is undervalued or could still have room to run? You are not alone, as many investors are taking a closer look after its significant share price rally.

- The stock has surged 121.2% in the past year, with particularly strong momentum recently. It is up 24.3% over the last month and 4.8% just this past week.

- Much of this enthusiasm follows a series of positive headlines, including Mitsubishi Heavy's progress on clean energy projects, contracts in aerospace, and renewed investor attention on Japanese large-caps. These developments have supported optimism around the company’s role in global industrial trends.

- However, here is the twist: Mitsubishi Heavy Industries scores just 0 out of 6 on our value checks, meaning it is not considered undervalued by conventional metrics. Next, we will break down what this means using different valuation approaches. At the end, we will discuss a more comprehensive way to assess a company's true worth.

Mitsubishi Heavy Industries scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mitsubishi Heavy Industries Discounted Cash Flow (DCF) Analysis

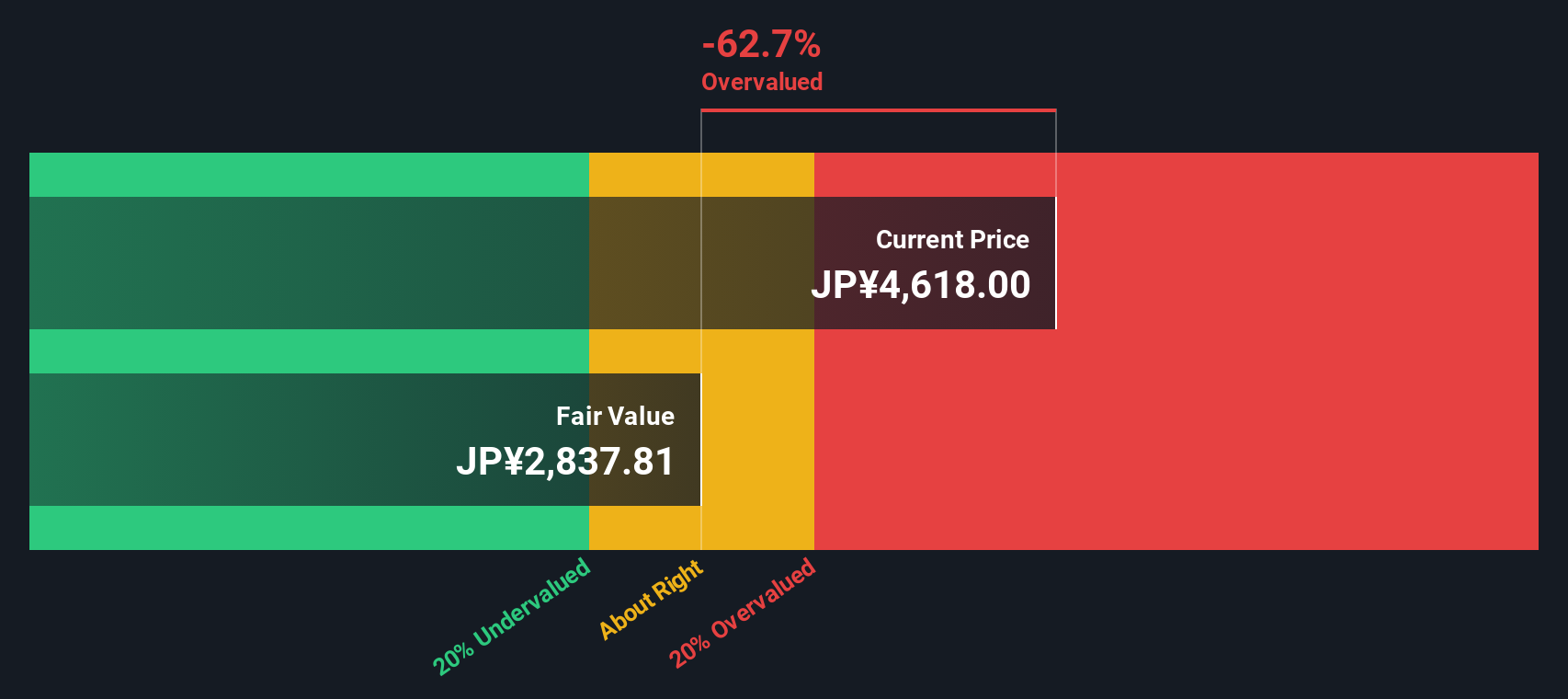

A Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and then discounting those figures back to their present value. The goal is to determine what Mitsubishi Heavy Industries is worth today, based on reasonable assumptions about its ability to generate cash in the years to come.

According to the latest data, Mitsubishi Heavy Industries generated free cash flow of ¥491.3 billion over the last twelve months. Analyst forecasts provide cash flow estimates for the next five years. Simply Wall St extrapolates continued growth into the following years, projecting free cash flow to reach about ¥514.3 billion by March 2030. These projections suggest steady, though not explosive, growth in the company’s ability to generate cash.

When all future cash flows are discounted back to today’s value using the 2 Stage Free Cash Flow to Equity model, the DCF model estimates Mitsubishi Heavy Industries’ fair value to be ¥2,871.49 per share.

However, based on the current share price, the DCF analysis indicates the stock is trading at a premium, roughly 61.6 percent above its projected intrinsic value. This suggests the shares are significantly overvalued by DCF standards.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mitsubishi Heavy Industries may be overvalued by 61.6%. Discover 834 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Mitsubishi Heavy Industries Price vs Earnings (PE Ratio)

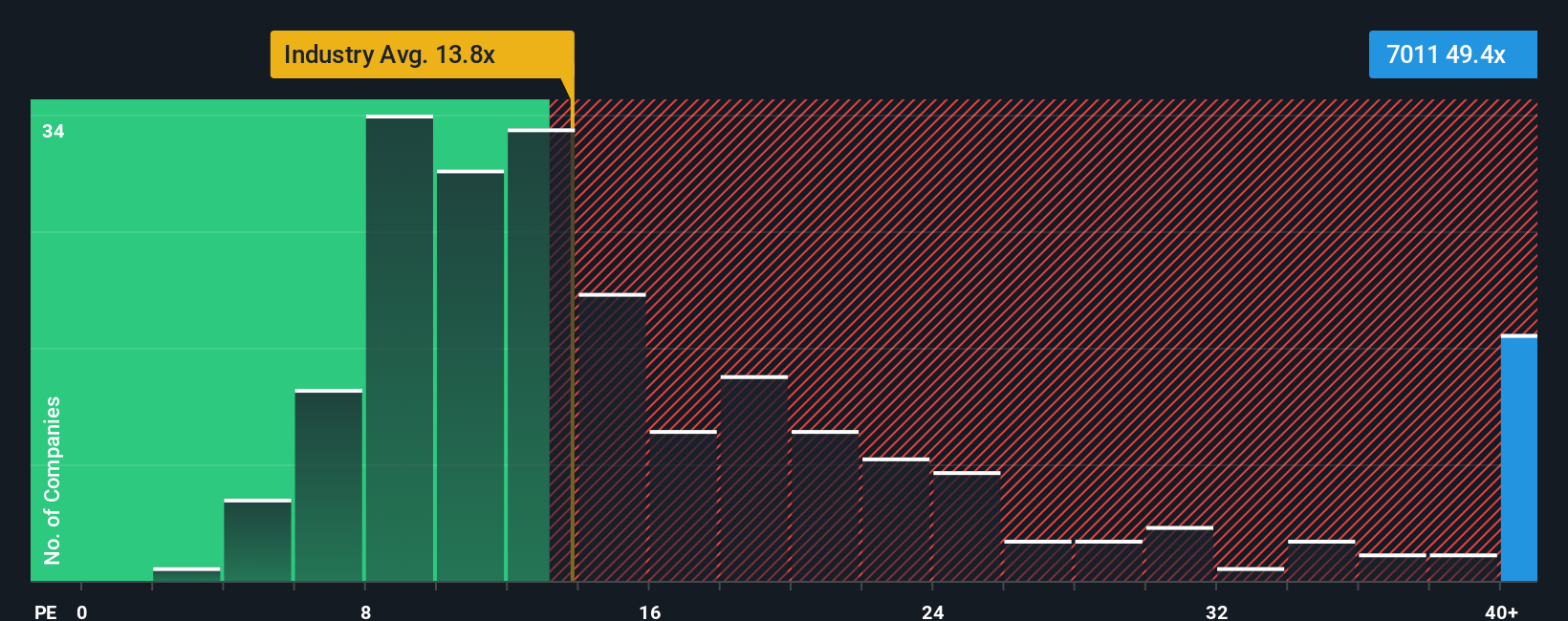

The Price-to-Earnings (PE) ratio is widely recognized as a reliable way to value established, profitable companies because it shows how much investors are willing to pay today for each yen of current earnings. A higher PE can reflect strong growth expectations or lower risk, while a lower PE could signal challenges or market skepticism.

Mitsubishi Heavy Industries currently trades at a PE ratio of 62x. For context, the average PE ratio for the Machinery industry sits at 13.5x, and the average among Mitsubishi Heavy's direct peers is approximately 28x. This means the stock is commanding a substantial premium to both its sector and its closest competitors.

To provide a more sophisticated benchmark, Simply Wall St calculates a “Fair Ratio”, which adjusts for not only industry trends and size but also company-specific factors like earnings growth, profit margins, and risks. For Mitsubishi Heavy Industries, this proprietary Fair Ratio stands at 41.3x. The Fair Ratio goes further than simple averages to help investors assess value in the context of what makes this company unique and how it is positioned within its industry.

Comparing the current PE (62x) to the Fair Ratio (41.3x), Mitsubishi Heavy Industries is trading well above what we would expect after accounting for its growth and market position. This suggests the stock remains overvalued using this approach as well.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1390 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mitsubishi Heavy Industries Narrative

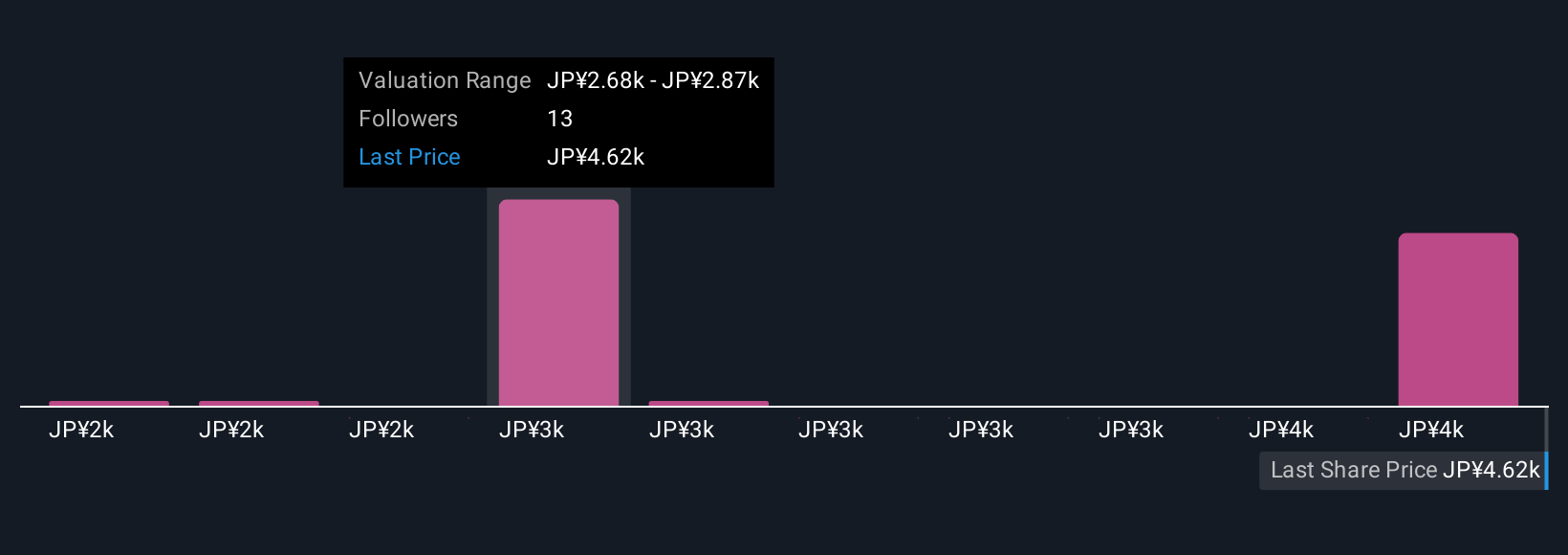

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your perspective or “story” about a company. You connect the dots between what you believe about Mitsubishi Heavy Industries’ future (like revenue growth, profit margins, or industry trends) and how that shapes its fair value.

Narratives make it easy to link your expectations and research directly to a financial forecast, leading you to a clear sense of what you think the company is worth. On Simply Wall St’s Community page, millions of investors use Narratives to give context to the numbers, sharing why they think the stock is undervalued or priced just right.

With Narratives, you can dynamically compare your fair value to the current share price to decide when to buy or sell. Your story is automatically updated whenever new news or financials come in. For example, one investor may be bullish, believing robust clean energy demand and margin expansion justify a fair value as high as ¥4,400. Another, focused on profit risks and market volatility, sees fair value closer to ¥2,500. Both perspectives are powered by their unique Narratives.

Do you think there's more to the story for Mitsubishi Heavy Industries? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7011

Mitsubishi Heavy Industries

Manufactures and sells heavy machinery worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives