Did Welding Qualification Lapses Just Shift Kanadevia's (TSE:7004) Investment Narrative?

Reviewed by Sasha Jovanovic

- Kanadevia Corporation recently submitted an interim report to Japan's Ministry of Land, Infrastructure, Transport and Tourism about inappropriate conduct at its Mukaishima Works, admitting that welding was carried out by operators lacking necessary qualifications but assuring safety is not significantly compromised.

- This event underscores the potential impact that compliance issues and regulatory scrutiny can have on both company operations and stakeholder confidence.

- We’ll explore how Kanadevia’s efforts to address welding qualification breaches may affect its broader investment narrative and future prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Kanadevia Investment Narrative Recap

Kanadevia's investment narrative centers on the company's ability to deliver steady long-term growth while managing profitability challenges amid evolving market demand. The recent disclosure of welding qualification breaches at Mukaishima Works heightens scrutiny in the Marine Engine segment but does not appear to affect the most important short-term catalyst, which remains improving order intake across core business lines. Nonetheless, compliance issues are now a prominent risk, especially given ongoing cost and inspection headwinds in critical divisions.

In this context, the company's proposal to abolish the position of Counselors aims to strengthen corporate governance and aligns with investor focus on transparency and accountability. This announcement is particularly relevant, as enhanced oversight could help Kanadevia mitigate reputational and operational risks exposed by recent compliance events while supporting renewed trust from stakeholders and clients.

In contrast, there is more investors should consider about how regulatory scrutiny could affect Kanadevia’s future trajectories and...

Read the full narrative on Kanadevia (it's free!)

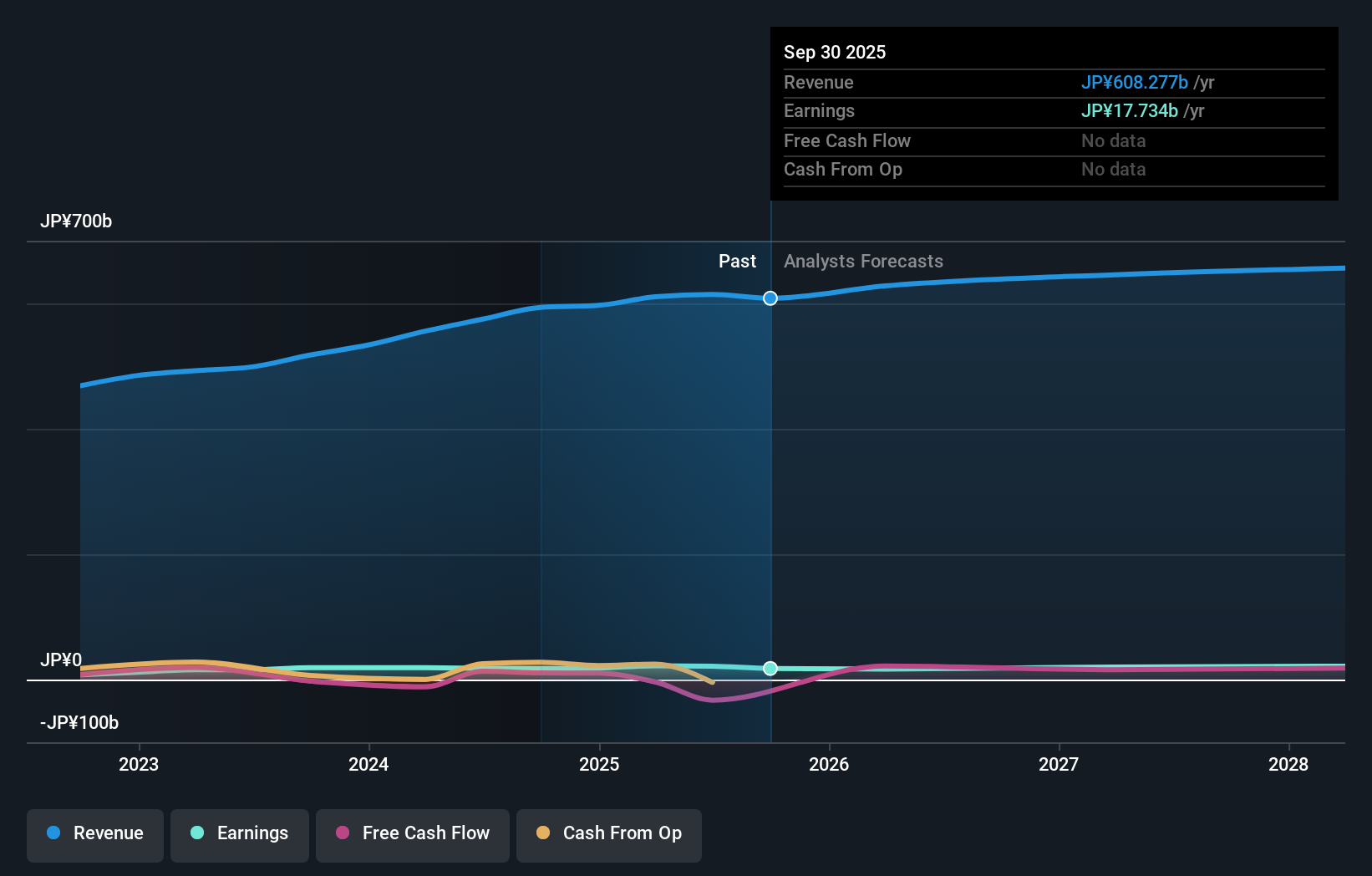

Kanadevia's outlook anticipates revenues reaching ¥695.0 billion and earnings of ¥24.6 billion by 2028. This reflects an annual revenue growth rate of 4.2% and a ¥3.3 billion increase in earnings from the current ¥21.3 billion level.

Uncover how Kanadevia's forecasts yield a ¥1050 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimated Kanadevia’s fair value to range from ¥1,050 up to ¥2,149, reflecting two distinct views. With compliance risks now in focus, your outlook might differ, consider how this could inform future performance and explore several perspectives.

Explore 2 other fair value estimates on Kanadevia - why the stock might be worth as much as 87% more than the current price!

Build Your Own Kanadevia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kanadevia research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kanadevia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kanadevia's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kanadevia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7004

Kanadevia

Engages in the design, manufacture, installation, sale, repair and maintenance of environmental equipment, plants, machinery, and infrastructure facilities in Japan, Europe, Asia, North America, Middle East, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives