- Japan

- /

- Commercial Services

- /

- TSE:2353

Top Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets experience a mix of record highs and geopolitical uncertainties, investors are increasingly seeking stability through dividend stocks to bolster their portfolios. In this dynamic environment, selecting stocks that offer consistent dividend payouts can provide a reliable income stream and potential for growth amidst broader market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.58% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Hyundai Marine & Fire Insurance (KOSE:A001450)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai Marine & Fire Insurance Co., Ltd. operates as a major provider of insurance services, with a market cap of ₩2.20 trillion.

Operations: Hyundai Marine & Fire Insurance Co., Ltd. generates its revenue primarily from the Financial Industry segment, amounting to ₩1.58 trillion, and a smaller portion from the Non-Financial Industry segment at ₩14.89 billion.

Dividend Yield: 7.3%

Hyundai Marine & Fire Insurance offers a compelling dividend yield of 7.34%, placing it in the top tier within the Korean market. Despite its high-quality earnings and strong coverage by both earnings and cash flows, with payout ratios of 17.7% and 7.6% respectively, its dividend history is less stable due to volatility over the past five years. The stock trades at a good value relative to peers, enhancing its appeal for value-focused investors.

- Click here to discover the nuances of Hyundai Marine & Fire Insurance with our detailed analytical dividend report.

- Our valuation report unveils the possibility Hyundai Marine & Fire Insurance's shares may be trading at a discount.

NIPPON PARKING DEVELOPMENTLtd (TSE:2353)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NIPPON PARKING DEVELOPMENT Co., Ltd. offers consulting services for parking lots both in Japan and internationally, with a market cap of ¥71.86 billion.

Operations: NIPPON PARKING DEVELOPMENT Co., Ltd. generates its revenue from three main segments: the Parking Lot Business at ¥17.23 billion, the Ski Resort Business at ¥8.25 billion, and the Theme Park Business at ¥6.59 billion.

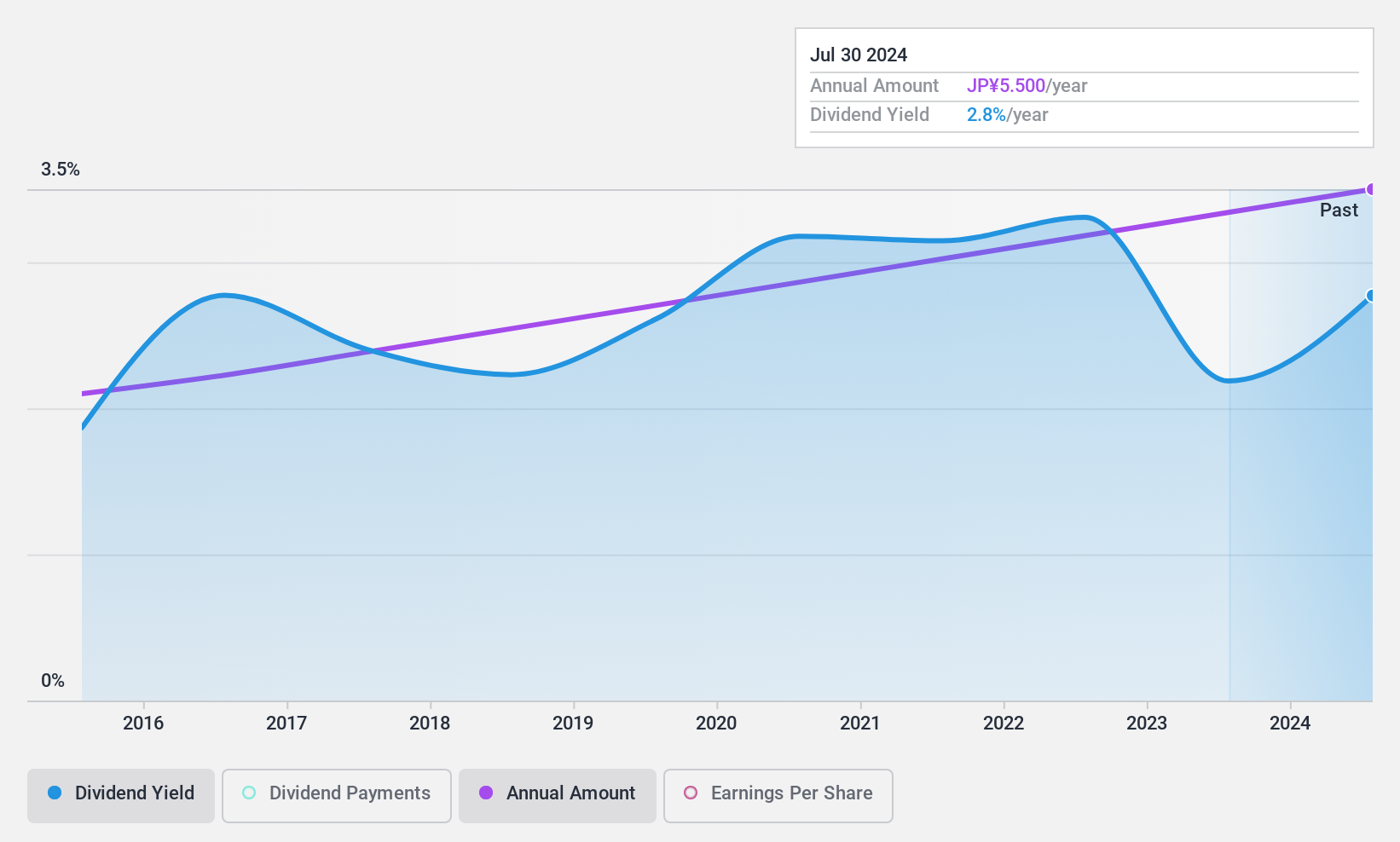

Dividend Yield: 3.1%

NIPPON PARKING DEVELOPMENT Ltd. has a stable dividend history over the past decade, with payments growing consistently and showing little volatility. However, its 3.1% yield is below the top 25% in Japan's market. Despite a low payout ratio of 34.2%, dividends are not well covered by free cash flows due to a high cash payout ratio of 342.9%. The company's earnings grew by ¥15 billion last year, but non-cash earnings remain significant.

- Unlock comprehensive insights into our analysis of NIPPON PARKING DEVELOPMENTLtd stock in this dividend report.

- According our valuation report, there's an indication that NIPPON PARKING DEVELOPMENTLtd's share price might be on the expensive side.

Obara Group (TSE:6877)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Obara Group Incorporated manufactures and sells resistance welders, arc welders, laser equipment, polishers, cleaners/washers, and related consumables in Japan and internationally with a market cap of ¥69.37 billion.

Operations: Revenue Segments (in millions of ¥): Resistance Welders: ¥45,000; Arc Welders: ¥12,500; Laser Equipment: ¥8,200; Polishers and Cleaners/Washers: ¥6,300; Consumables: ¥3,900.

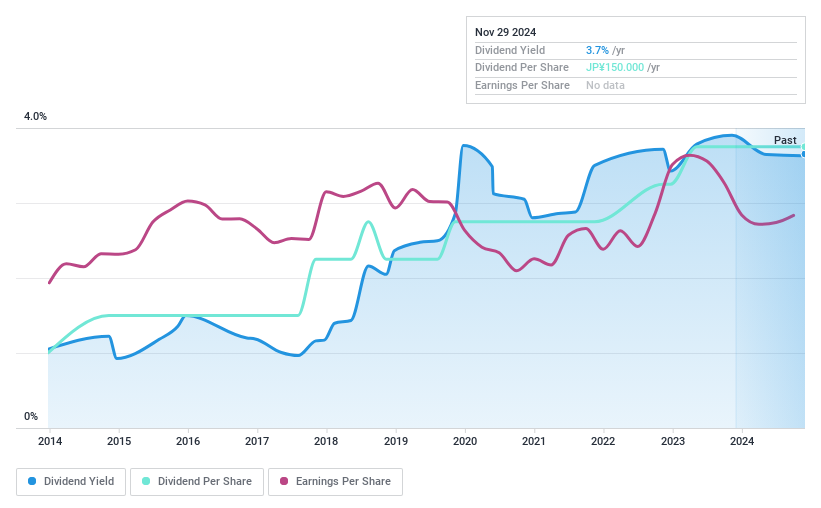

Dividend Yield: 3.6%

Obara Group's dividend yield of 3.58% is below the top quartile in Japan, and its dividend history is marked by volatility despite recent growth. Dividends are well-covered by earnings and cash flows, with payout ratios at 39.8% and 48.5%, respectively. Recent guidance confirms stable dividends for the upcoming fiscal year, maintaining JPY 90 per share annually. The company completed a significant share buyback, enhancing shareholder value through repurchasing shares worth ¥5.33 billion.

- Navigate through the intricacies of Obara Group with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Obara Group shares in the market.

Seize The Opportunity

- Unlock our comprehensive list of 1958 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIPPON PARKING DEVELOPMENTLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2353

NIPPON PARKING DEVELOPMENTLtd

Provides consulting services for parking lot in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.