- Japan

- /

- Electrical

- /

- TSE:6594

Nidec (TSE:6594) Valuation in Focus Following Removal From Nikkei 225 Index

Reviewed by Simply Wall St

Nidec (TSE:6594) has been removed from the Nikkei 225 Index, a change that often sparks shifts in investor sentiment and influences trading activity by funds that follow the index closely.

See our latest analysis for Nidec.

Nidec’s surprise removal from the Nikkei 225 sparked a flurry of activity, briefly boosting the share price by over 12% in the past week. Despite this bounce, longer-term momentum remains challenged, with the 1-year total shareholder return sitting at -19% and a 5-year total return of -58%. This highlights that sentiment is still mixed as the company navigates this transition.

If this shake-up has you scanning the market for new ideas, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares down sharply over the past year and trading at nearly a 25% discount to analyst targets, the question facing investors is clear: is Nidec an overlooked bargain, or is the market skeptical of its growth story?

Most Popular Narrative: 32% Undervalued

Compared to Nidec’s recent share price, the most widely followed narrative sees the company as significantly undervalued. This sets up a big disconnect between analyst assumptions and current market sentiment. This gap in valuation is driven by bold forecasts for growth and profitability, and hints at strong potential upside if the narrative plays out.

Nidec is positioned to capitalize on surging global demand for advanced motor solutions in data centers, particularly with its expanding water cooling module and nearline HDD motor businesses. The company highlighted strong order inquiry trends from major data center markets (U.S., China, Japan) and expects portfolio expansion and market penetration to further accelerate, supporting sustained revenue growth and margin expansion as the AI and cloud infrastructure cycle evolves.

What numbers justify this optimism? The narrative quietly bakes in aggressive profit expansion and ambitious market share gains. Could future earnings and margin leaps really transform Nidec’s valuation story? Only a deeper dive into their exact projections will reveal the true engine behind this price target.

Result: Fair Value of ¥3,363.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering questions around internal controls and the ongoing restructuring highlight real risks that could quickly derail Nidec’s turnaround narrative.

Find out about the key risks to this Nidec narrative.

Another View: How Does Market Valuation Stack Up?

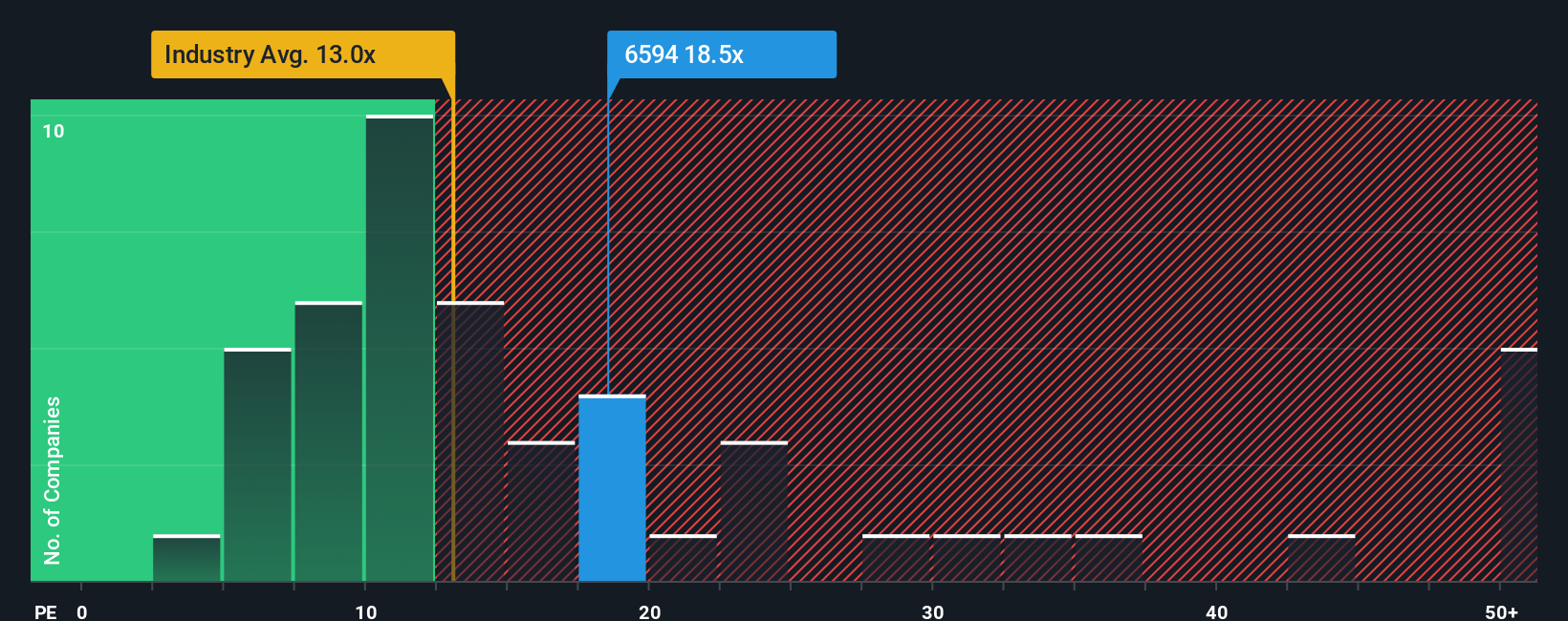

While fair value estimates point to Nidec’s shares being undervalued, the current price-to-earnings ratio of 16.6 is above the industry average of 14 but well below peer averages of 24.5 and the fair ratio of 30.8. This means that by one key pricing measure, the market sees some risk, or is ignoring potential upside. Could investor caution be holding the stock back, or is there hidden value waiting to be realized?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nidec Narrative

Whether you’re skeptical of these forecasts or want to dig deeper on your own terms, you can shape your own perspective on Nidec’s future in just a few minutes, and Do it your way

A great starting point for your Nidec research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your search to just one story. The market offers a wide range of compelling opportunities waiting for your next smart move. Jump in now and see where your curiosity could lead!

- Fuel your portfolio with strong income potential by checking out these 15 dividend stocks with yields > 3% delivering solid yields above 3%.

- Capture growth in cutting-edge fields when you tap into these 25 AI penny stocks powering the next wave of intelligent innovation.

- Get ahead of the curve by targeting value investments among these 858 undervalued stocks based on cash flows poised for upside based on their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nidec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6594

Nidec

Develops, manufactures, and sells motors, electronics and optical components, and other related products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives