- Japan

- /

- Electrical

- /

- TSE:6503

Mitsubishi Electric (TSE:6503): Valuation Insights Following Upgraded Guidance, Increased Dividend, and Share Buyback Completion

Reviewed by Simply Wall St

Mitsubishi Electric (TSE:6503) updated investors with a revised outlook for fiscal 2026, raising its revenue guidance due to currency tailwinds and stronger Infrastructure sales. The company kept its operating profit target steady.

The company also announced a higher interim dividend, up by ¥5 per share, signaling confidence in future earnings. Recent disclosures included the completion of a substantial share buyback program and detailed results from its latest quarterly earnings call.

See our latest analysis for Mitsubishi Electric.

Mitsubishi Electric has enjoyed a surge lately, with a 21% share price return over the last three months and an impressive year-to-date gain of nearly 63%. The momentum has clearly accelerated following the boost to revenue guidance, higher interim dividend, and a substantial share buyback. These developments have fueled renewed interest from investors who see a stronger long-term opportunity taking shape for the stock.

If Mitsubishi Electric’s recent upswing and strategic moves got your attention, it’s a good time to broaden your search and discover fast growing stocks with high insider ownership

After such a remarkable run, investors may be wondering whether Mitsubishi Electric is still trading at a bargain or if all the good news has already been reflected in the current share price, leaving little room for upside.

Most Popular Narrative: 19% Overvalued

Despite Mitsubishi Electric’s strong rally, the most popular narrative now pegs its fair value at ¥3,668, which is significantly below its last close of ¥4,374. As a result, the narrative positions the stock as notably overvalued at current levels, even as expectations for growth and margins tick higher.

Expansion in the Energy Systems and Public Utility segments is driven by ongoing investments in power distribution and the transition toward electrification and energy efficiency, supported by worldwide decarbonization initiatives. This is expected to result in higher recurring revenues and improved net margins as Mitsubishi Electric benefits from secular shifts to sustainable infrastructure.

Curious about the assumptions driving this bold fair value? The calculation hinges on forecasted profit margins and revenue gains from emerging trends. Want to know which projections fuel the debate over whether this price can be sustained? Click to see the full story behind these numbers.

Result: Fair Value of ¥3,668 (OVERVALUE)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating adoption of AI-based automation and intensifying competition from lower-cost rivals could undermine Mitsubishi Electric’s growth outlook and challenge current valuations.

Find out about the key risks to this Mitsubishi Electric narrative.

Another View: Peer Comparisons Shake Up the Outlook

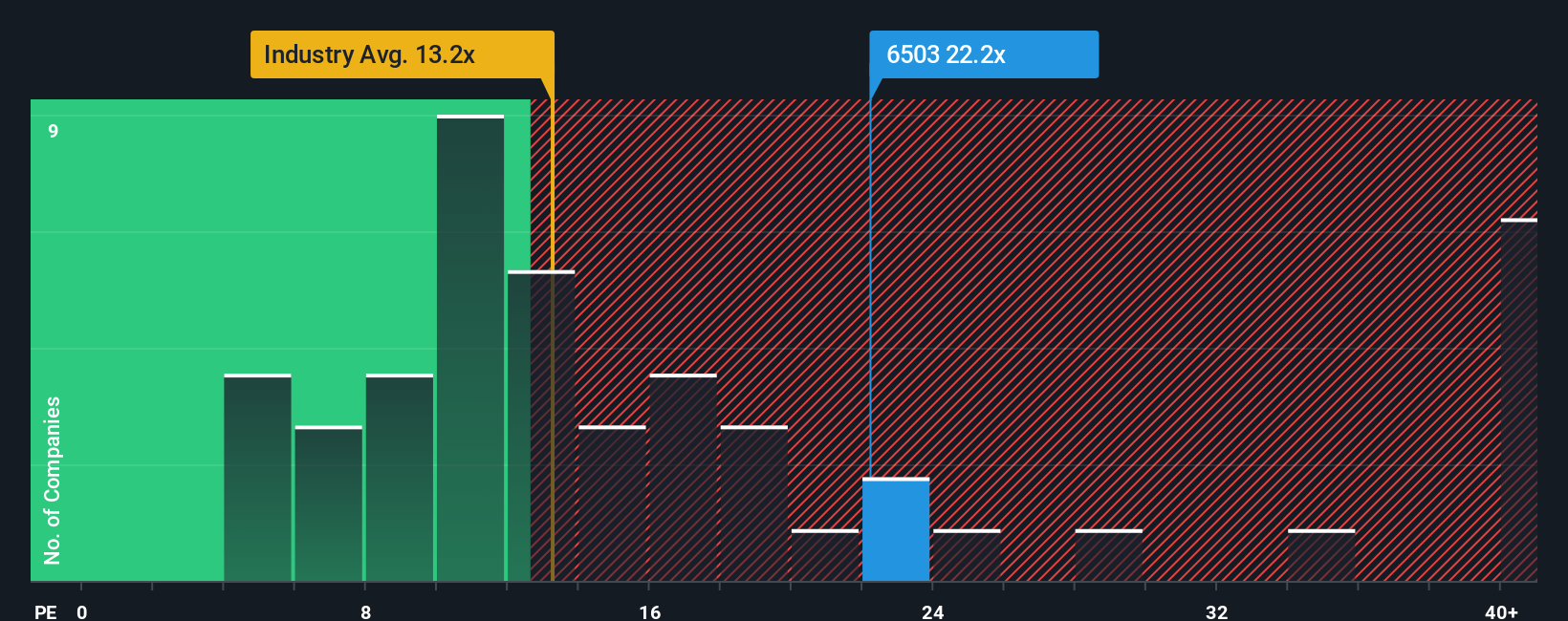

Looking at how Mitsubishi Electric stacks up on its price-to-earnings ratio reveals a more optimistic angle. While the company trades at 22.7x, this is below similar peers at 28.3x and remains under its fair ratio of 26.7x. However, it is notably pricier than the JP Electrical industry average of 13.2x. This mixed picture suggests some value, but also points to valuation risk if market sentiment changes. Which side will ultimately win out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mitsubishi Electric Narrative

If the current analysis does not reflect your perspective or you would rather check the numbers yourself, you can build your own narrative in under three minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mitsubishi Electric.

Looking for more investment ideas?

Make your next smart investing move by targeting stocks with the strongest upside, resilient income, and future-focused technology. Don’t let these opportunities slip by.

- Capture the momentum in artificial intelligence by tapping into these 25 AI penny stocks, which are poised for the next big breakthrough in automation and data-driven innovation.

- Unlock steady, inflation-beating payouts by zeroing in on these 17 dividend stocks with yields > 3% for reliable income streams and robust cash flow.

- Seize your edge in emerging technologies as you scan these 28 quantum computing stocks, which are blazing a trail toward advanced computation and tomorrow’s tech ecosystem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6503

Mitsubishi Electric

Develops, manufactures, sells, and distributes electrical and electronic equipment in Japan, North America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives