- Japan

- /

- Industrials

- /

- TSE:6501

Does Hitachi’s 16% Surge Leave Further Room for Growth After Infrastructure Deals?

Reviewed by Bailey Pemberton

- Wondering if Hitachi is fairly valued right now? You are not alone. Plenty of investors are trying to figure out if the stock has room to run or if the current price already reflects its potential.

- Despite some choppy days recently, the stock is up 16.4% over the past month and a significant 29.4% year-to-date, following long-term gains of 268% over three years and 617.7% in five years.

- Much of the recent excitement comes following industry expansion and news around major infrastructure deals that have fueled optimism about Hitachi’s growth initiatives. Strategic moves in digital transformation and strengthened partnerships with global tech leaders have also contributed to changing investor sentiment.

- For now, Hitachi has a valuation score of 1 out of 6, meaning most valuation checks suggest the stock is not undervalued. However, there is more to consider regarding the approaches analysts use, and we will explore a different perspective on valuation by the end of this article.

Hitachi scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hitachi Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's values. This reflects the time value of money and accounts for uncertainty in long-term forecasts.

For Hitachi, the latest trailing twelve months Free Cash Flow is ¥1,202.3 Billion. Analyst estimates for future Free Cash Flow reach ¥819.0 Billion by the year ending March 2030. Most growth is expected over the next five years, followed by a period of slower increases extrapolated by Simply Wall St. The first five years of projections are based on analyst estimates. After this period, the DCF model uses reasonable assumptions to continue forecasting up to a decade ahead.

Based on these cash flow projections, the DCF model calculates an intrinsic value for Hitachi shares at ¥4,047.59. Compared to the current market price, the model implies Hitachi is roughly 27% overvalued at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hitachi may be overvalued by 26.9%. Discover 876 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hitachi Price vs Earnings

Price-to-Earnings (PE) is a widely used valuation metric for profitable companies like Hitachi because it directly links the company's share price to its earnings. This provides investors with a straightforward way to gauge how much the market is paying for each yen of current earnings.

When assessing what a "fair" PE ratio should be, expectations about future growth and the risks inherent in a business are key. Companies with stronger growth prospects and lower risks generally justify higher PE ratios, while those with slower growth or greater risk tend to trade at lower multiples.

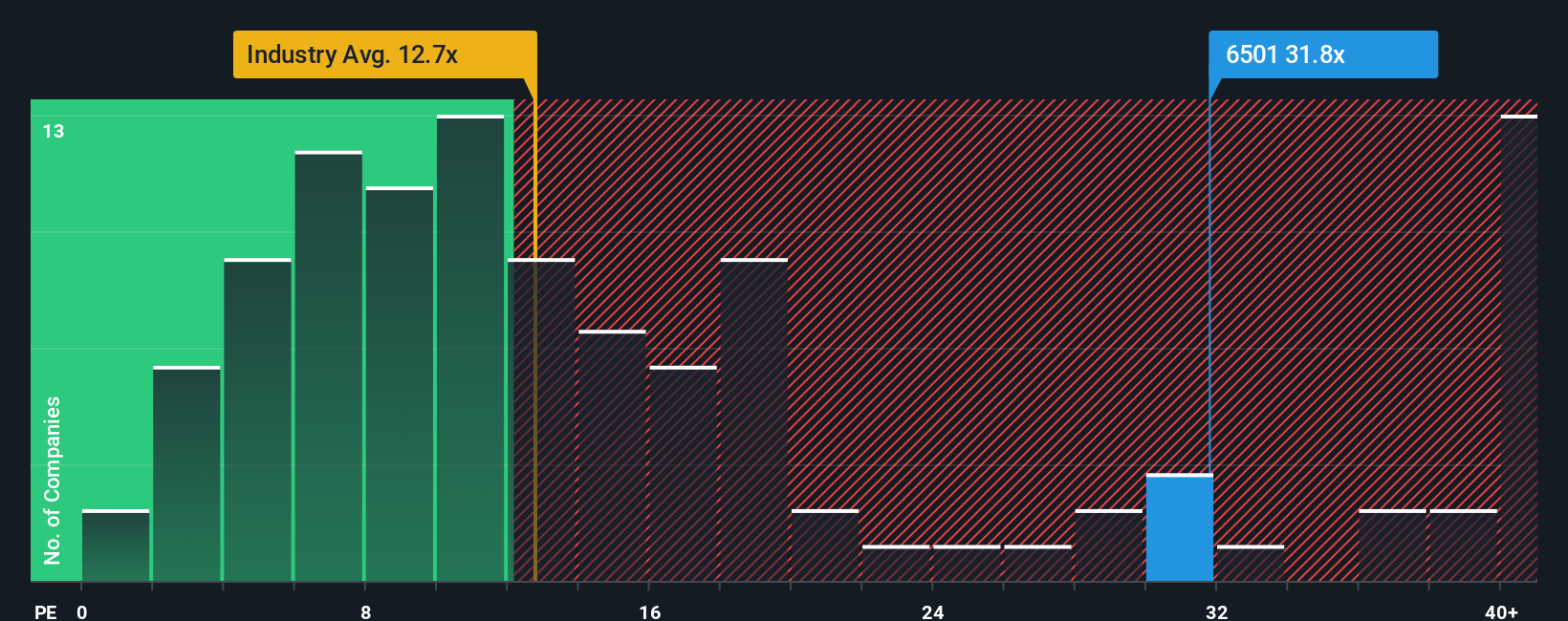

Currently, Hitachi is trading at a PE ratio of 29.3x. This is markedly higher than both the Industrials sector average PE of 13.3x and the peer average of 13.4x. At first glance, this suggests investors are willing to pay a premium for Hitachi’s earnings, likely due to its growth profile or perceived stability.

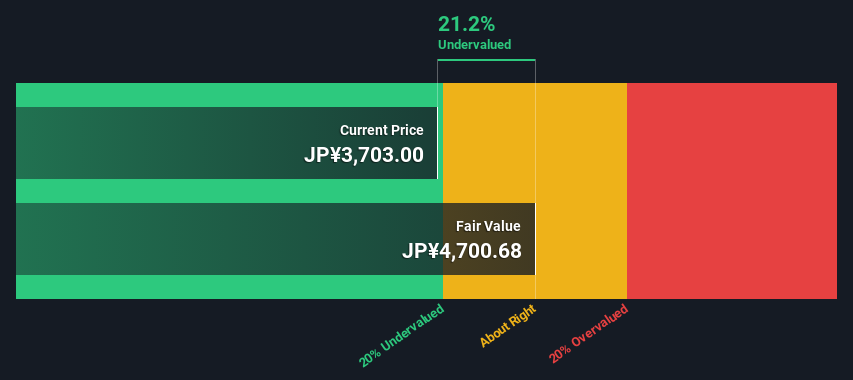

To capture a more tailored perspective, Simply Wall St's proprietary “Fair Ratio” model weighs factors including growth, profit margins, industry, market cap, and risk to estimate an appropriate multiple for Hitachi. The Fair Ratio for Hitachi stands at 37.0x, reflecting a comprehensive look at all these factors rather than just simple market averages. This makes the Fair Ratio a more reliable benchmark for valuation than industry or peer comparisons alone.

Since Hitachi’s actual PE multiple (29.3x) is notably below its Fair Ratio (37.0x), the stock appears undervalued based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hitachi Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story, a way to connect your perspective on Hitachi's future with quantitative forecasts like revenue, earnings, profit margins, and ultimately, fair value. Narratives make investing more intuitive by linking what you believe about a company’s opportunities or risks (for example, rapid digital transformation or geopolitical headwinds) directly to a financial forecast. This approach then reveals whether the stock is undervalued or overvalued.

On Simply Wall St’s Community page, Narratives are easy and accessible tools used by millions of investors. They help you decide when to buy, hold, or sell by constantly comparing your Fair Value to the market Price. As new information emerges, such as earnings reports or strategic updates, your Narrative and its fair value update dynamically so your investment thesis always stays relevant.

For example, right now among Hitachi investors, some see strong tailwinds from government projects and digital services, supporting a fair value as high as ¥5,300. Others focus on global competition and margin risks, citing fair values closer to ¥3,900. Narratives give you the power to invest based on the story you believe in, supported by actionable numbers and real-time insights.

Do you think there's more to the story for Hitachi? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hitachi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6501

Hitachi

Provides digital system and services, green energy and mobility, and connective industry solutions in Japan and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives