- Japan

- /

- Industrials

- /

- TSE:6501

A Fresh Look at Hitachi (TSE:6501) Valuation Following Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Hitachi (TSE:6501) shares have caught the attention of investors lately, especially after posting steady gains over the past month. The company’s recent returns are prompting a closer look at what might be driving momentum in the stock.

See our latest analysis for Hitachi.

Looking beyond the recent rally, Hitachi has steadily added to its momentum, with a 7.2% 1-month share price return and an 11.2% gain year-to-date. Over the long run, the company’s total shareholder return stands out, highlighted by an impressive 13.3% for the past year and a substantial 255% over three years, underscoring sustained growth and renewed investor optimism.

If Hitachi’s rising performance has you thinking bigger, this is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading close to analyst price targets and strong returns already delivered, the real question is whether Hitachi is undervalued or if future growth has already been priced in by the market.

Most Popular Narrative: 8% Undervalued

Hitachi's most widely cited valuation narrative sets its fair value about 8% above the last close. This places the spotlight firmly on future growth expectations versus current market confidence.

Expansion of the Lumada digital platform and related digital services, including synergies from recent acquisitions like GlobalLogic and the increasing adoption of generative AI solutions, are accelerating high-margin recurring revenues in IT and modernization projects. This is enhancing overall profit margins and long-term earnings growth.

Curious why the market believes Hitachi deserves this premium? The valuation pivots on ambitious forecasts and future margin expansion powered by digital transformation and recurring revenue streams. Find out the core assumptions driving this bullish outlook. One key number might surprise you.

Result: Fair Value of ¥4,801 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing global competition and rising project costs could still challenge Hitachi’s expected margin expansion. This could potentially limit upside from its current trajectory.

Find out about the key risks to this Hitachi narrative.

Another View: Market Multiples Tell a Different Story

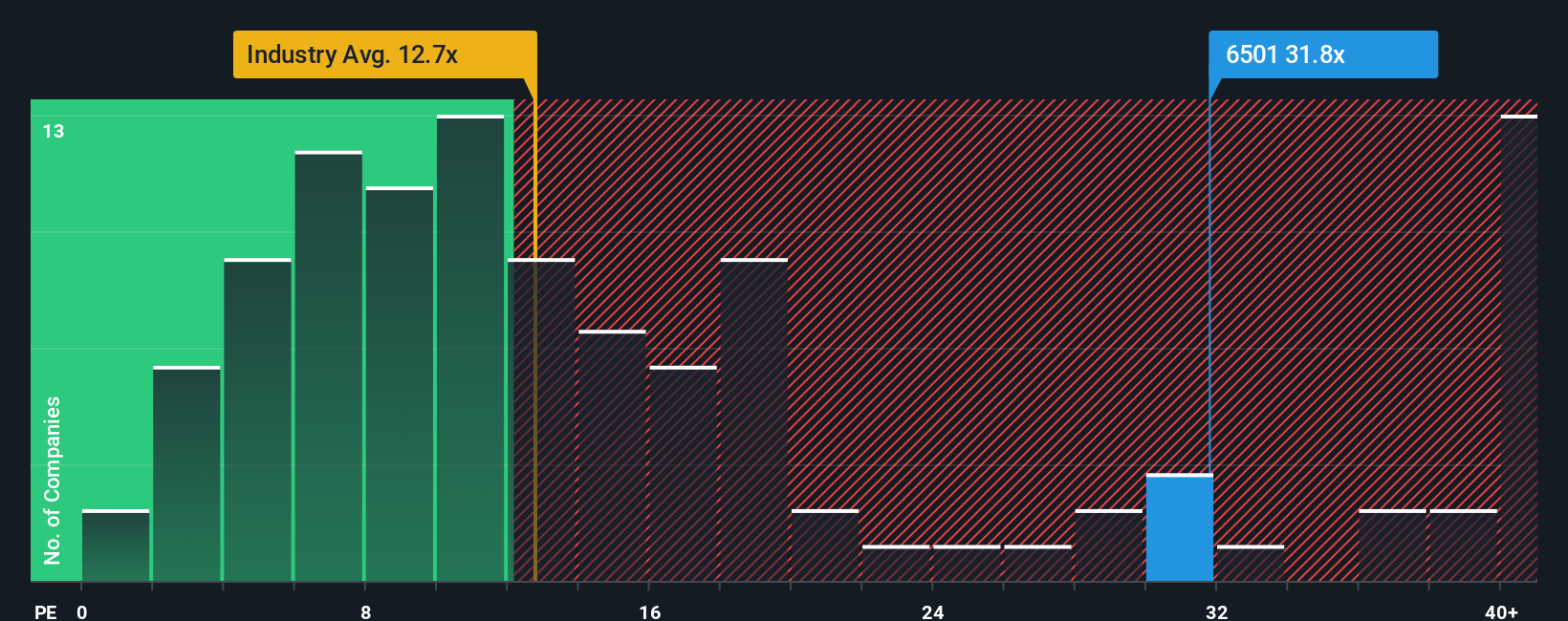

While analyst forecasts suggest Hitachi is undervalued, the current price-to-earnings ratio of 31.7x is well above the industry average of 12.8x and the peer average of 15x. However, this number is actually below the fair ratio of 37.9x, which highlights both valuation risk and potential upside if the market shifts toward premium multiples. Should investors trust that the premium will persist, or could expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hitachi Narrative

If you have a different perspective or want to dig into the numbers yourself, it’s easy to shape your own storyline in just a few minutes, and Do it your way.

A great starting point for your Hitachi research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Great opportunities are waiting beyond just one company. If you want to stay ahead and build a winning portfolio, check out these unique market trends and breakthrough investment angles. Missing them could mean missing out on your next big winner.

- Tap into tomorrow’s momentum by reviewing these 892 undervalued stocks based on cash flows, filled with companies the market may be overlooking right now.

- Unlock income potential and stability with these 19 dividend stocks with yields > 3%, focused on strong yields for your long-term strategy.

- Ride the wave of innovation and invest in breakthroughs with these 24 AI penny stocks, which are shaping the future of intelligent technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hitachi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6501

Hitachi

Provides digital system and services, green energy and mobility, and connective industry solutions in Japan and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives