THK (TSE:6481) Valuation in Focus After Downward Earnings Revision and Industrial Demand Challenges

Reviewed by Simply Wall St

THK (TSE:6481) just lowered its earnings forecast for the year ending December 2025. The company cited softer orders in the industrial machinery segment across Japan and Europe, as well as higher costs from U.S. tariffs and restructuring efforts.

See our latest analysis for THK.

THK’s share price has pulled back sharply over the past month, with a 13.0% decline reflecting more cautious sentiment after the lowered earnings outlook. Even so, the stock’s 14.5% total shareholder return over the past year and 57.1% three-year total return suggest that long-term momentum remains intact, despite some turbulence in the near term.

If this change in momentum has you considering other opportunities, now is a great time to broaden your scope and discover fast growing stocks with high insider ownership

With shares down and long-term gains still substantial, the real question for investors now is whether THK offers compelling value at current levels or if the market has already priced in the company’s future growth challenges.

Most Popular Narrative: 11.1% Undervalued

THK’s most widely followed narrative suggests the shares are trading about 11% below the calculated fair value of ¥4,322, based on a 6.6% discount rate. This places the latest close at ¥3,843 in a potential opportunity zone, according to analyst consensus on future earnings and business reforms.

Accelerated investment in automation, workforce optimization, and production system upgrades, including ¥91 billion in capex focused on automation, is expected to reduce fixed and variable costs. This would support higher margins and improved capital efficiency.

Curious how aggressive capital spending and sweeping reforms shape THK’s expected transformation? Guess which ambitious margin and growth targets are driving analysts’ optimistic fair value. Dive in to see why the story could be just getting started.

Result: Fair Value of ¥4,322 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue declines or failure to execute reforms could undermine THK’s transformation. This could potentially limit any upside from the current undervaluation narrative.

Find out about the key risks to this THK narrative.

Another View: Multiples Show a Different Picture

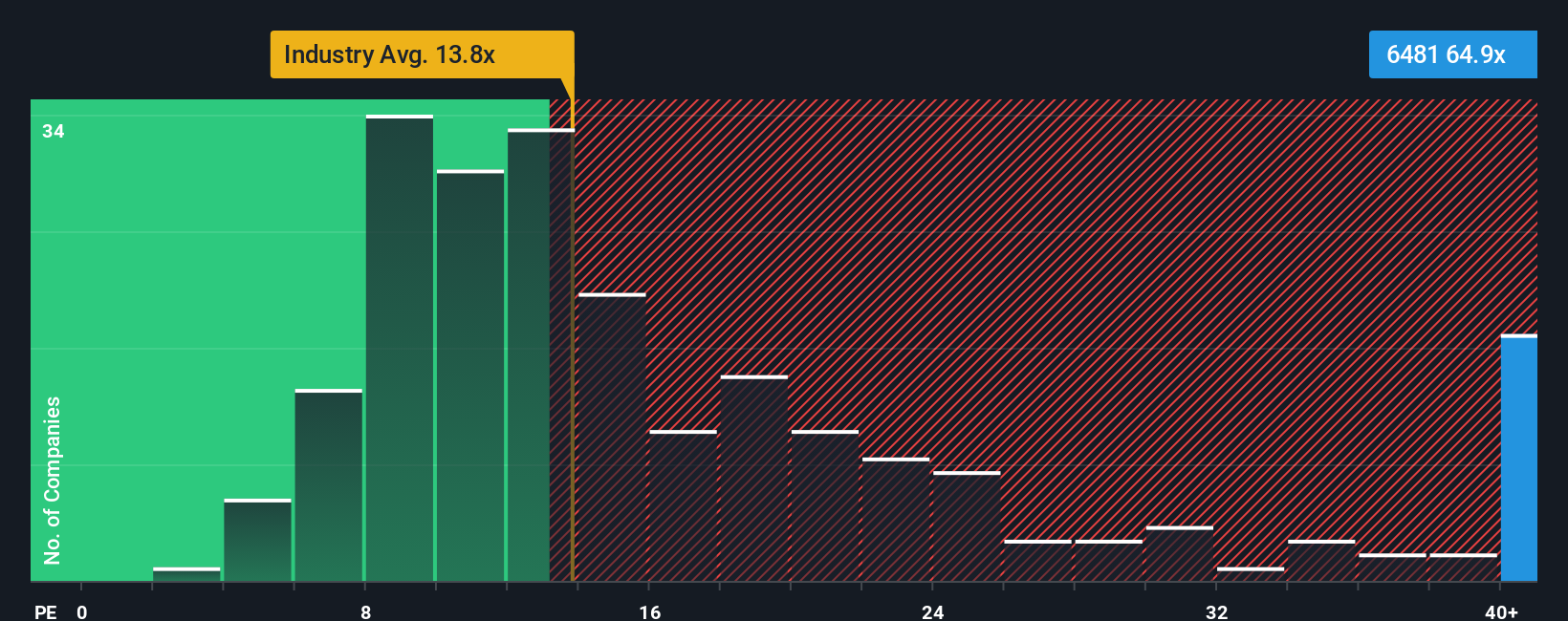

Looking beyond fair value estimates, THK’s price-to-earnings ratio stands at 66.2x, which is well above both the Machinery industry average of 12.3x and the peer average of 56x. This also exceeds the fair ratio of 29.1x, indicating a much steeper valuation risk than what growth stories might suggest. Is the market overly optimistic, or is a premium truly justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own THK Narrative

If you feel that this perspective does not align with your findings, or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes: Do it your way

A great starting point for your THK research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take control of your investment journey and get ahead of shifting market trends with these handpicked opportunities available now on Simply Wall Street.

- Supercharge your portfolio’s growth by tapping into these 25 AI penny stocks, which features companies harnessing artificial intelligence innovations for tomorrow’s breakthroughs.

- Secure reliable income streams as you scan these 16 dividend stocks with yields > 3% for stocks boasting standout dividend yields above 3% and steady fundamentals.

- Ride the wave of blockchain innovation by zeroing in on these 81 cryptocurrency and blockchain stocks, where companies are reshaping finance, security, and technology worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if THK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6481

THK

Engages in the manufacture and sale of mechanical components worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives