NTN Corporation (TSE:6472): Assessing Valuation After Revised Earnings Outlook and Dividend Confirmation

Reviewed by Simply Wall St

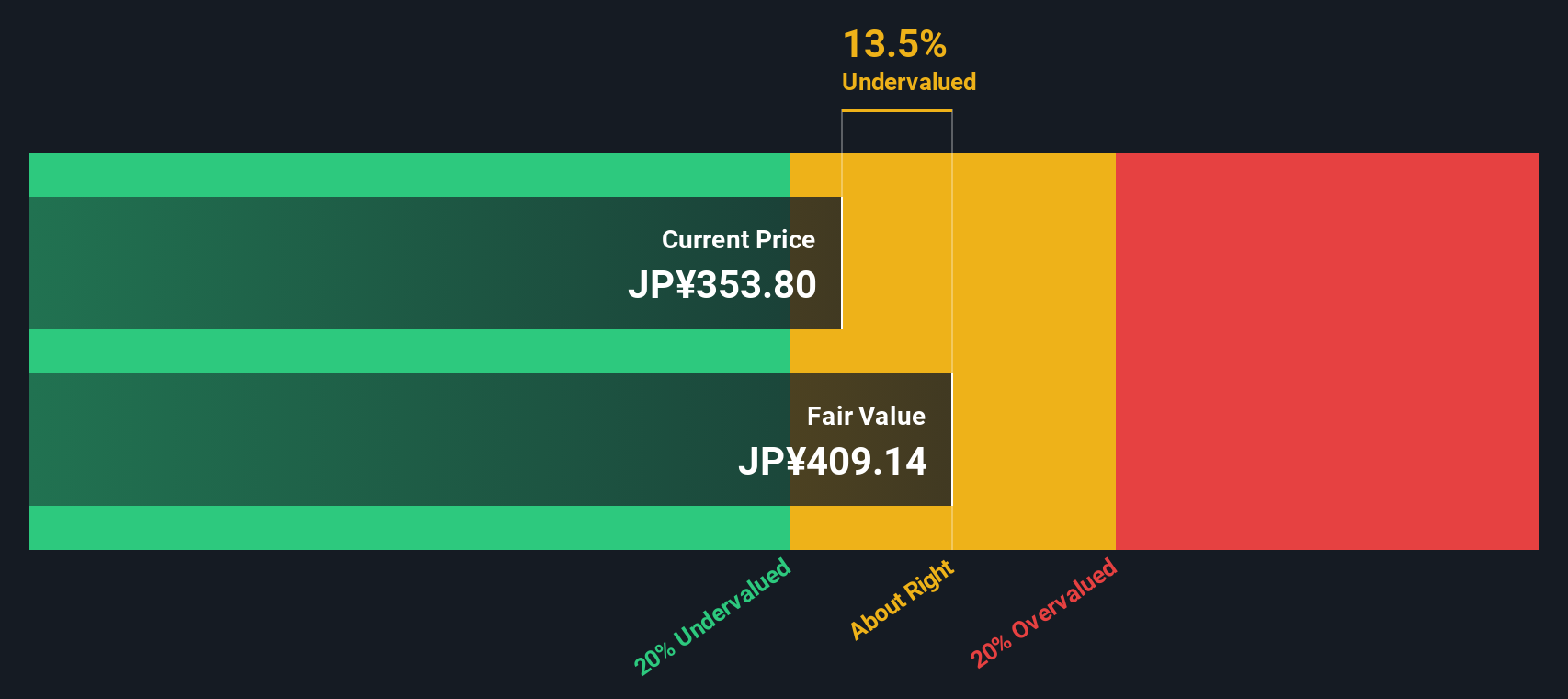

NTN (TSE:6472) has just updated investors with a lower full-year earnings outlook, citing currency changes and U.S. trade policy effects. At the same time, it reaffirmed guidance on interim and year-end dividends.

See our latest analysis for NTN.

Despite guiding for lower full-year earnings, NTN’s stock price has shown robust momentum this year, climbing over 45% year-to-date. Recent confirmation of stable dividends and clarity around guidance have sustained investor confidence, reflected in a 55% total return over the past year and a 74% gain over five years. The stock’s momentum appears to be building, with a 16.6% share price return across the last 90 days alone.

If you’re weighing fresh opportunities while momentum is on your mind, now is the perfect chance to discover fast growing stocks with high insider ownership.

With the shares trading at a noticeable premium to analyst targets but still offering a sizable long-term gain, the key question for investors is whether NTN remains undervalued or if the market has already priced in the company’s future prospects.

Price-to-Sales Ratio of 0.2x: Is it justified?

NTN is currently trading at a price-to-sales (P/S) ratio of just 0.2x, notably below both the JP Machinery industry average and peer group benchmarks. With the last close at ¥363.1, the stock appears attractively valued compared to its sector.

The price-to-sales ratio reflects how much investors are willing to pay for every yen of sales. In machinery and capital goods, the P/S ratio is an important gauge because profits can ebb and flow with economic cycles, while sales may be more stable. An unusually low ratio may signal the market expects ongoing challenges or sees limited profit conversion from revenue.

NTN's P/S of 0.2x stands sharply beneath the JP Machinery industry average of 0.8x and the peer average of 1x. This implies the market has discounted NTN relative to industry norms. Compared to the estimated 'fair' P/S ratio of 0.6x derived from regression analysis, NTN trades at a level the market could move up toward if company performance or sentiment turns. This discount suggests the valuation could re-rate if profit expectations improve or if the company returns to broader sector averages.

Explore the SWS fair ratio for NTN

Result: Price-to-Sales Ratio of 0.2x (UNDERVALUED)

However, slower revenue growth or persistent net losses could challenge the undervalued case and prompt further caution among investors.

Find out about the key risks to this NTN narrative.

Another View: SWS DCF Model Points to Deeper Value

Looking beyond sales ratios, our DCF model estimates NTN’s fair value at ¥412.62 in contrast to its current trading price of ¥365.3. This suggests the shares could be undervalued and challenges the logic behind the market’s discounted pricing. However, does this model capture future risks, or is it presenting an overly optimistic view?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NTN for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NTN Narrative

If you see the story differently or want to get hands-on with the data, building your own perspective takes just a few minutes, so why not Do it your way.

A great starting point for your NTN research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep fresh ideas within reach. Don’t limit your strategy when standout opportunities are waiting. These handpicked screens make it easy to spot your next winners with confidence.

- Unlock reliable income and steady growth by checking out these 16 dividend stocks with yields > 3%, which features impressive yields above 3% from established companies.

- Experience the forefront of artificial intelligence innovation when you browse these 25 AI penny stocks, focusing on breakthroughs in autonomous systems and advanced analytics.

- Gain early exposure to tomorrow’s leaders with these 868 undervalued stocks based on cash flows, a screen for stocks trading below intrinsic value and offering a rare shot at significant upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NTN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6472

NTN

Manufactures and sells bearings, drive shafts, and precision equipment and other products in Japan, the United States, Europe, Asia, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives