Glory (TSE:6457): Assessing Current Valuation After Recent Share Performance

Reviewed by Simply Wall St

See our latest analysis for Glory.

The past year has been a strong one for Glory, with a total shareholder return of nearly 58%, signaling growing confidence among investors. While momentum has slowed a bit over recent months, overall sentiment remains positive. The company’s fundamentals continue to attract attention.

If you’re on the lookout for what else is gaining traction, this could be the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

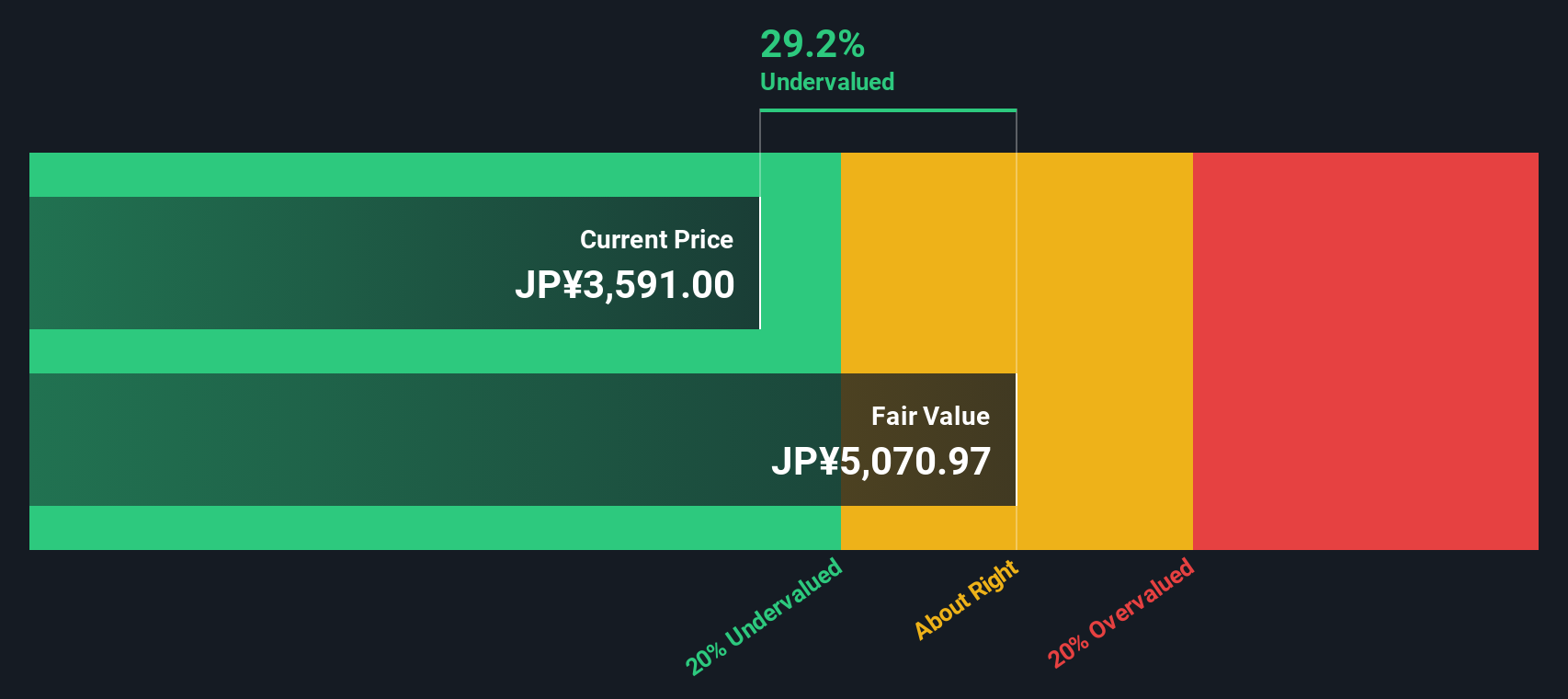

With shares still trading around 27% below intrinsic value estimates despite recent gains, investors are left wondering if Glory is a hidden value play ready for upside, or if the market has already accounted for the company’s growth prospects.

Price-to-Earnings of 19.4x: Is it justified?

Glory is currently trading at a price-to-earnings (P/E) ratio of 19.4x, which is well above both its industry and peer group averages. With the latest share price closing at ¥3,698, investors are paying a significant premium compared to similar machinery stocks.

The price-to-earnings ratio reflects how much investors are willing to pay today for a company's earnings. For industrial and machinery companies like Glory, it is a standard measure of valuation, showing whether the market is betting on stronger profit growth compared to peers.

Looking closer, Glory’s P/E of 19.4x is notably higher than the Japan Machinery industry average of 13.5x and the peer average of 14.4x. Compared to the estimated fair P/E ratio for the company, which is 17.9x, Glory still appears pricey. This suggests the stock would need to deliver robust earnings growth or improved profitability to justify its premium, or its valuation could eventually align more with industry norms if results fall short.

Explore the SWS fair ratio for Glory

Result: Price-to-Earnings of 19.4x (OVERVALUED)

However, slowing revenue growth or a dip in net income could challenge the optimistic outlook and potentially put pressure on Glory’s elevated valuation.

Find out about the key risks to this Glory narrative.

Another View: Discounted Cash Flow Model Calls Undervaluation

While the stock appears overvalued when considering its price-to-earnings ratio, our DCF model presents a different perspective. According to this approach, Glory’s shares are trading 27% below fair value estimates. This prompts the question: are investors overlooking a potential bargain, or do risks remain?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Glory for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Glory Narrative

If you’d rather draw your own conclusions or want to dig deeper into Glory’s numbers, you can craft your personal take in just a few minutes. Do it your way

A great starting point for your Glory research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Investment Opportunity?

Don’t let your research end here. Unlock new investing angles and spark your portfolio with handpicked opportunities from the Simply Wall Street Screener today.

- Capture market rebounds by targeting these 831 undervalued stocks based on cash flows that offer strong potential based on cash flows and solid underlying fundamentals.

- Find the latest innovations in healthcare by tracking these 34 healthcare AI stocks delivering breakthroughs in medical technology and AI-driven diagnostics.

- Accelerate your returns with these 24 dividend stocks with yields > 3% offering yields above 3%, perfect for those seeking reliable income and portfolio stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6457

Glory

Develops, manufactures and sells cash handling machines in Japan, the United States, Europe, and Asia.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives